Stocks Rally On Labor Deceleration

Investors are heading into the Independence Day holiday in stride despite this morning’s weaker-than-expected economic data. News from ADP and ISM depicting decelerating hiring amidst a contracting services sector is sending yields to the basement while stocks gain modestly. Additional fuel was supplied from the Labor Department, which reported the loftiest level of continuing unemployment claims in 32 months.

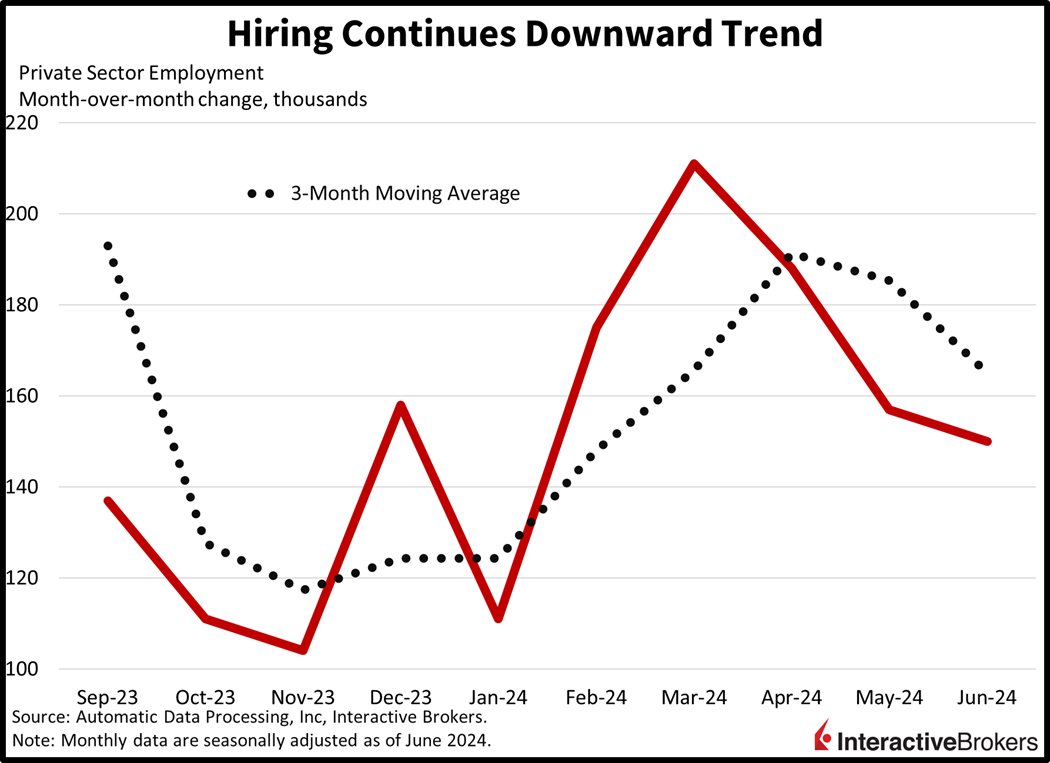

Hiring Misses Expectations

Private sector employers continued to add jobs in June but at a pace that fell short of analysts’ expectations. The private sector increased employment by 150,000 jobs, missing the expectation of 163,000 new positions and down slightly from May, when 157,000 jobs were added, according to the ADP National Employment Report. The leisure and hospitality sector accounted for the lion’s share of the job growth with 63,000 added positions. Other sectors that expanded and the number of jobs they added were as follows:

- Construction, 27,000

- Professional and business services, 25,000

- Trade, transportation and utilities, 15,000

- Financial activities, 11,000

- Other services, 16,000

- Education and health services, 9,000

Among decliners, natural resources and mining lost the largest number of positions with a decline of 8,000, followed by the manufacturing and information sectors, which lost 5,000 and 3,000 jobs respectively.

Mid-sized companies, or those with 50 to 499 workers, led the expansion with the addition of 87,000 positions while larger companies added 58,000 workers. Companies with fewer than 20 workers added 13,000 positions while companies with 20 to 49 employees experienced an 8,000 decline. ADP also found that annual pay in June was up 4.9% for job stayers and 7.7% for job changers, down 10 basis points (bps) from May on both fronts.

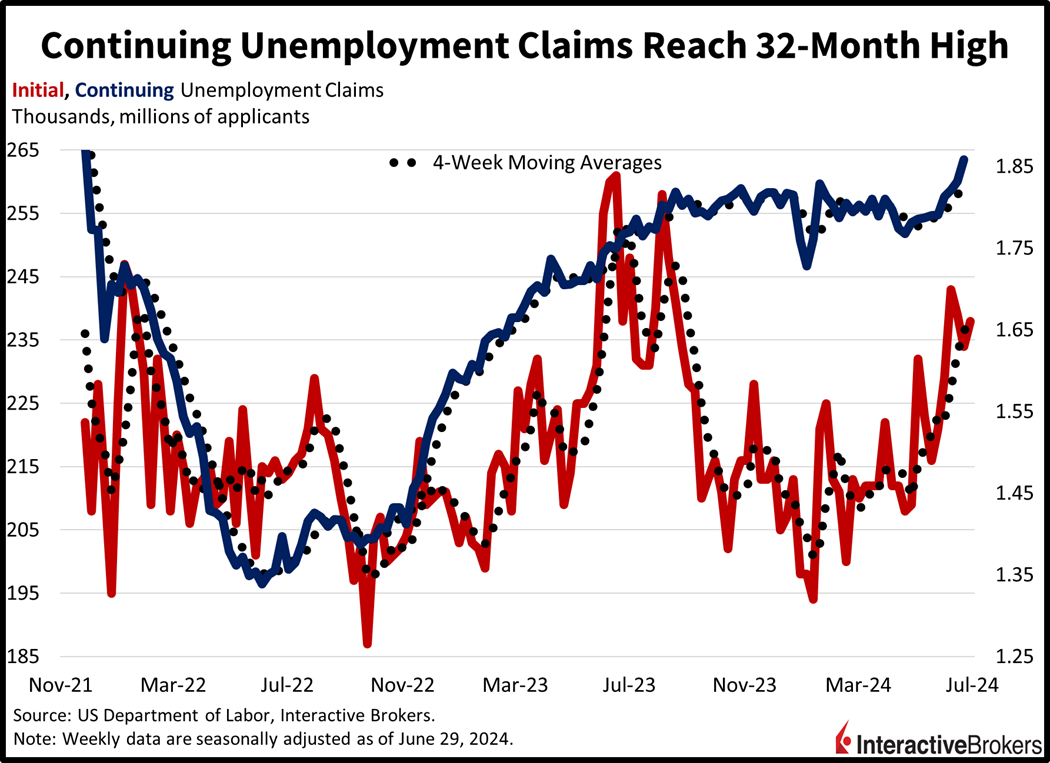

Continuing Claims Mark a 32-Month High

The streak of softening labor conditions hasn’t abated with initial and continuing unemployment claims increasing for both one-week periods and four-week moving averages. Of particular significance, continuing unemployment claims, a proxy for the ability of individuals to find work, reached a 32-month high of 1.85 million for the seven-day period ended June 22, up 26,000 from the preceding period. The number also exceeded the analyst consensus expectation for 1.84 million. The four-week average, which smooths out volatility that is common with shorter periods, increased by 16,750 to 1.83 million. Initial claims increased from 235,000 to 238,000 week over week as of June 29, exceeding expectations for 234,000 individuals seeking benefits, and the moving average climbed to 238,500, up by 2,250. Today’s data release marks four and seven consecutive weeks of increases in the moving averages of initial and continuing unemployment claims.

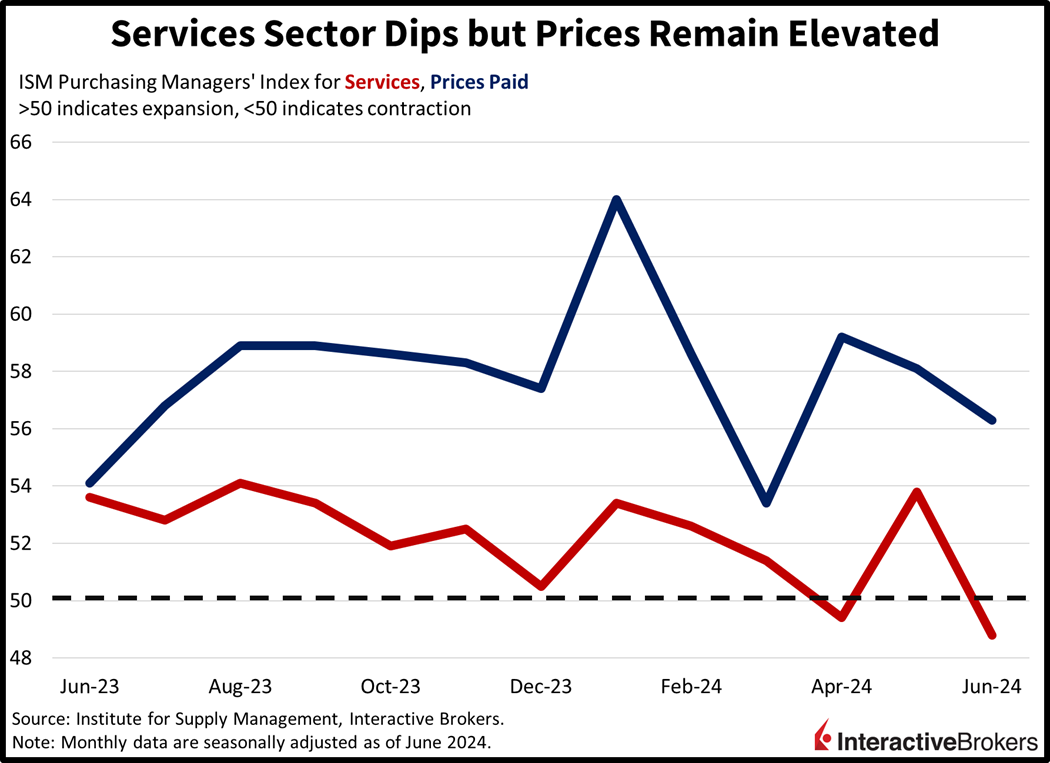

After One Month of Expansion, Services Sector Contracts

The June Institute for Supply Management Purchasing Managers Index for services also dished out disappointing results with an overall level of 48.8, landing below the 50 contraction/expansion threshold and falling from 53.8 in the preceding month. It also missed the analyst consensus forecast of 52.5. Employment and new orders contracted, reaching scores of 46.1 and 47.3, but the lack of customers didn’t weigh much on inflationary pressures. The prices paid component declined to just 56.3, remaining firmly in expansion territory.

Bad News is Good News Today

The view that bad news is good news is dominating today’s session as most major US equity indices point north while bond yields and the dollar plunge. The Russell 2000, Nasdaq Composite and S&P 500 benchmarks are leading the bulls, gaining 0.4%, 0.2% and 0.1%. Meanwhile, the Dow Jones Industrial Average is unchanged. Sectoral participation is positive with consumer discretionary, utilities, and materials driving the wheel; they’re up 1%, 0.9% and 0.8%. The greatest laggards consist of the healthcare, consumer staples and financials segments, which are losing 0.5%, 0.2% and 0.1%. Treasurys are changing hands at 4.68% and 4.35%, 7 and 9 bps lighter on the session. The Dollar Index is down 51 bps to 105.12 as the US currency loses ground relative to all of its major developed counterparts except for the yuan. The greenback is down against the euro, pound sterling, franc, yen, and Aussie and Canadian dollars. Commodities are gaining on the back of improved demand prospects, a result of lighter borrowing costs, with silver, copper, gold, lumber and crude oil gaining 3.7%, 2.9%, 1.5% and 0.2%.

More Bad News Could Be Good News

Strong economic growth is often viewed as the driver behind corporations rewarding investors with earnings growth, but at times, a decelerating economy is warmly received by market participants, especially during the final phases of the Fed marching across the monetary policy bridge towards rate reductions. At such times, the Fed’s act of balancing the taming of inflation and employment growth becomes increasingly difficult and investors often worry that restrictive monetary policy and its accompanying higher financing costs will tip the country into recession and cause corporate earnings to tank. From that perspective, a weakening economy can build optimism that the Fed is inching closer to implementing incremental accommodations, helping to alleviate fears that the central bank will tip the country into a downturn.

More By This Author:

Some Brutal Roaring Kitty Math

Nice Quarter, Guys?

A Quarter-End Check-In

Disclosure: The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the ...

more