The Vision Of The Anointed And The Betrayal Of Value Investing

Image Source: Pexels

The massive success of Amazon (AMZN) has created a paradigm shift in value investing. It was very hard to understand how AMZN could be a value stock based on traditional valuation measures for a very long time. Nick Sleep and Qais Zakaria of The Nomad Investment Partnership (2001-2014) seem to be the ones who saw earliest and most clearly what Jeff Bezos was up to.

From the beginning, Bezos had a very long term vision. He followed the Costco (COST) model of returning economies of scale to consumers in the form of lower prices, faster delivery, better selection, etc… – instead of taking margin now. Here is a quote from Bezos in AMZN’s 2005 Annual Report quoted by Sleep and Zakaria in their 2006 Annual Letter (pg. 105 of the PDF):

As our shareholders know, we have made a decision to continuously and significantly lower prices for customers year after year as our efficiency and scale make it possible. This is an example of a very important decision that cannot be made in a math-based way. In fact, when we lower prices, we go against the math that we can do, which always says that the smart move is to raise prices. We have significant data related to price elasticity. With fair accuracy, we can predict that a price reduction of a certain percentage will result in an increase in units sold of a certain percentage. With rare exceptions, the volume increase in the short-term is never enough to pay for the price decease. However, our quantitative understanding of elasticity is short-term. We can estimate what a price reduction will do

this week and this quarter. But we cannot numerically estimate the effect that consistently lowering prices will have on our business over five years or ten years. Our judgment is that relentlessly returning efficiency improvements and scale economies to customers in the form of lower prices creates a virtuous cycle that leads over the long-term to a much larger dollar amount of free cash flow, and thereby to a much more valuable Amazon.com. We have made similar judgments around Free Super Saver Shipping and Amazon Prime, both of which are expensive in the short term and – we believe – important and valuable in the long term.

As AMZN grew to dominate the market for many consumer goods, Sleep and Zakaria reasoned that they would be able to expand their margins. Even low margins over huge volume is a good business model. Consider Costco or Walmart, for example.

But it must be said that Sleep and Zakaria got lucky too. That’s because the major driver of AMZN’s growth and profitability over the last decade has NOT been the retail business – it’s been Amazon Web Services (AWS). AWS wasn’t a part of Sleep and Zakaria’s thesis because nobody knew much about it until 2015.

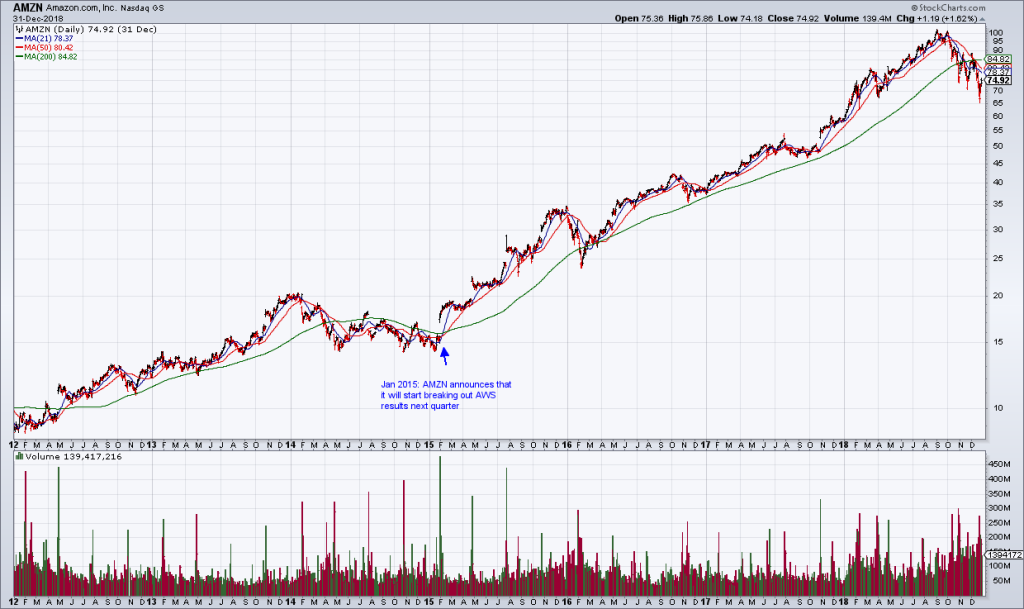

(Click on image to enlarge)

The stock really started to move in January 2015 when AMZN announced that it would start breaking out AWS results the following quarter. The stock surged and when the business proved to be better than expected, the stock surged again. AMZN stock went from $15 to $35 in 2015 – and has never looked back.

AWS accounted for 60% of AMZN’s operating income in the first three quarters of 2025 and I believe it accounts for ~70% of AMZN’s intrinsic value.

In other words, AMZN never would have reached its current proportions without AWS – and nobody could have invested on that basis before 2015. Those who invested before 2015 and held on through AWS benefitted from a stroke of good luck. Only those who understood the massive inflection point that was AWS and invested after 2015 – or increased their position then – profited from real insight and understanding. The story of AMZN as a value stock is a little more complicated than the traditional narrative would have it.

Some value investors today use the case of AMZN to justify investing in Tesla (TSLA). TSLA’s valuation can’t be justified based on electric vehicles (EV) business and current results. The stock is trading at 100x trailing twelve month (TTM) Adjusted EBITDA. The EV business is worth ~1/5 of the current stock price.

The case they make for TSLA is that robotics, autonomous vehicles (AVs) and AI will be huge winners in the future, justifying the current stock price – and much more. One claim is that TSLA’s AVs will own ride hailing, essentially putting UBER out of business. But TSLA has not had its AWS moment yet. These businesses generate very little money at the moment. If and when it does, I will be an investor.

But for now, TSLA is a story stock that depends on very uncertain outcomes in the distant future. It may end up being a roaring success story. Based on the information we have right now, however, I don’t think an investment can be made in it on the basis of value investing methodology.

More By This Author:

Investment Philosophies: Value Vs. Momentum

The State Of The Market: Can The S&P Keep Going Up Without Tech Participation?

The Case For MDLZ