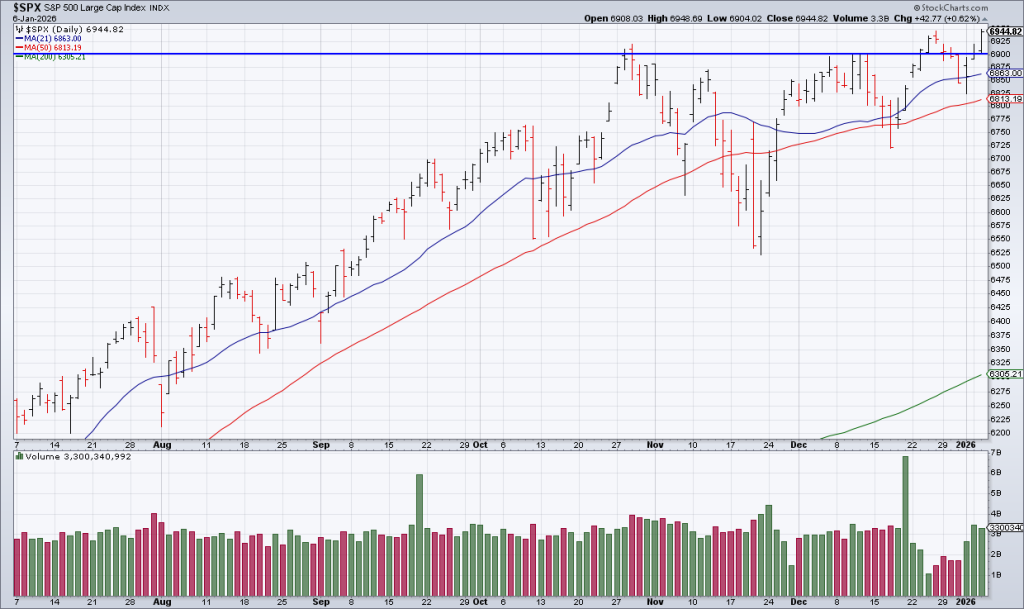

The State Of The Market: Can The S&P Keep Going Up Without Tech Participation?

(Click on image to enlarge)

There’s something interesting happening in the market that I don’t hear many people talking about. While the S&P 500 has broken out to new highs in recent days, it is being driven by the “soldiers” not the mega cap tech “generals” that have led for this almost three year bull market.

The S&P struggled at 6900 in late October before correcting in November. In recent days – with a strong move on Tuesday – it broke out above 6900. However, it is being driven by the smaller stocks in the rest of the S&P, not the mega cap tech stocks that have led for the last three years.

(Click on image to enlarge)

The S&P Equal Weight ETF (RSP) has been quite strong and is driving the move higher in the overall index at the moment. It struggled to get through $191.50 in late October but is now decisively through that level, closing Tuesday at $197.00.

(Click on image to enlarge)

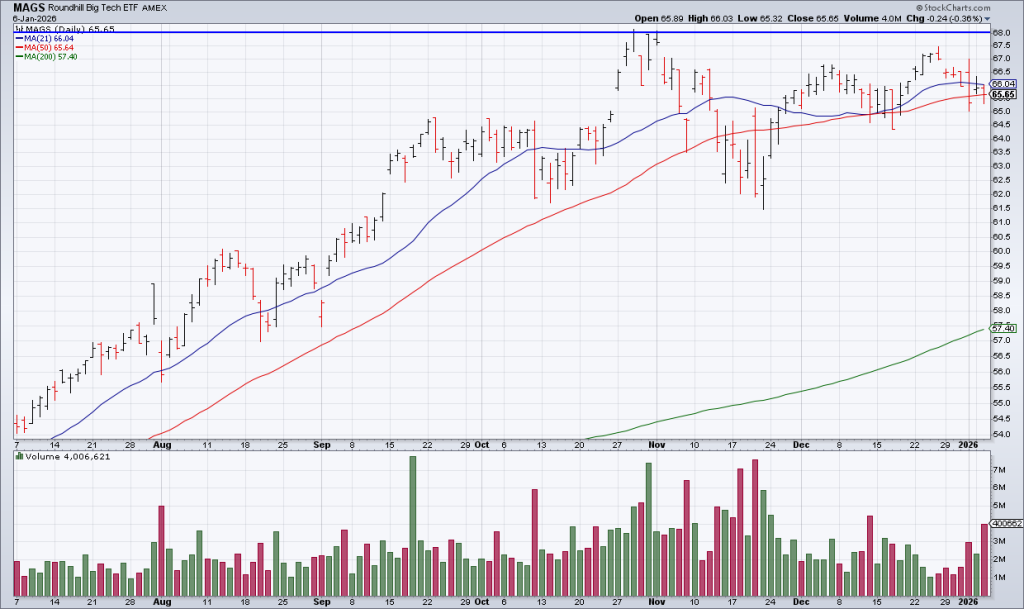

What’s interesting is that tech – including the Mag 7 – have been lagging of late. You can see this in the charts of the Nasdaq 100 ETF (QQQ), the Mag 7 ETF (MAGS) and the S&P Tech Sector ETF (XLK). QQQ closed Tuesday ~2% below its October 2025 highs while MAGS is ~3% below its October 2025 highs. (Note: Stockcharts.com MAGS candles for late October are wrong as MAGS closed at $69.06 on October 29 – not just above $68 – before falling back. It’s frustrating and I will tag them on Twitter to try to get this fixed). XLK is almost 4% below its October 2025 highs.

There are two ways to look at this. The bulls will say it’s healthy rotation. Other sectors are starting to participate in a big way, the market is broadening out, etc… Bears will say that the market can’t run much higher without mega cap tech participation because the Mag 7 make up something like 30% of the S&P’s market cap and tech stocks in general are more than 40%.

(Click on image to enlarge)

In my opinion, the bears are right. The S&P can get to 7,000 or maybe a little higher with QQQ and MAGS continuing to go sideways – but not much higher. For the bull to continue to roll, mega cap tech is going to need to start moving again.

Based on this analysis, I initiated a starter short position in MAGS on Monday at $66.14. I will cover this short at $66.20 and add to it below $65. I am focused on the big candle with a range of $65-$67 from the first trading day of the year (Friday January 2, 2026). (Please use very tight risk management when shorting or don’t do it at all as it is generally a losing strategy).

(Click on image to enlarge)

More By This Author:

The Case For MDLZ

Year-End Letter: Portfolio Returns 38% In 2025

The Roots Of Financial Nihilism

Disclosure: Top Gun initiated a starter short position in MAGS on Monday at $66.14.