Year-End Letter: Portfolio Returns 38% In 2025

Image Source: Unsplash

"It takes a man a long time to learn all the lessons of all his mistakes" – Jesse Livermore

"The test of a first rate intelligence is the ability to hold two opposing ideas in mind at the same time and still retain the ability to function" – F. Scott Fitzgerald

In November of 2024, I read a line in Jack Schwager’s Little Green Book of Market Wizards that woke me from my dogmatic bearish slumber: “Do more of what’s working and less of what’s not.” For too long, my bearishness had held back Top Gun’s performance. It had cost me clients, and the business had been stagnant for a long time. As a result, I was despondent.

After reading that quote in Schwager, I did a thorough review of what was working and what wasn’t. One graphic in Interactive Brokers Portfolio Analyst tool with three lines told me everything I needed to know: Long performance, short performance, and total performance. The performance of my longs was just fine. The performance of my shorts was obviously the problem. The conclusion was that the latter mostly canceled out the former, resulting in a middling total performance.

I finally realized that shorting the hottest tech stocks based on valuation metrics of limited relevance, like the Price to Earnings ratio, without adequate risk management wasn’t working – and it didn’t make any sense, either. I covered them all and thereby ended the first phase of my investment career. At long last, I entered my maturity as an investor. It only took 25 years.

Not too long after I read Lawrence Cunningham’s thematically organized excerpts from Buffett’s Annual Letters The Essays Of Warren Buffett. I summarized Buffett’s investing philosophy in a blog in January 2025.

Later that year I stumbled across a William Green podcast with Chris Begg and discovered the concept of Value Investing 3.0. I outlined the evolution of value investing from Ben Graham (1.0) to Warren Buffett (2.0) and beyond (3.0) in a blog in May 2025. I also wrote one of my most important blogs of the year on “Why You Should Have A Bullish Bias” around the same time.

I had now internalized the importance of quality. Most of the big gains in the market come from simply buying and holding compounders who can grow earnings over long periods of time.

Having overcome the bearish prism through which I had always viewed the market now, instead of waiting for the next market crash, I wanted to buy stocks. And, boy, did I. I was like a kid in a candy store. So many great companies, so little cash. I loaded up the margin accounts with stock. At one point, I had more than 100 long positions. I couldn’t help myself.

The defining moment for investors in 2025 was in April, when Trump launched his tariffs. It was clear to everyone that the tariffs announced on Liberation Day were going to be a disaster. Having only recently converted from permabear to cautious bull, it was a scary moment for me. Had I changed my tune at exactly the wrong time?

One precedent that helped me hang on was the Covid Crash of March 2020. That time I panic-sold when, in retrospect, it was a great buying opportunity. The Fed rushed in to support the market, which shortly bottomed and then ripped higher for the remainder of the year.

This time I held on, wagering that Trump would heed the market reaction and back off – which he did. Ultimately the market followed the same script as it did in 2020 – bottoming in early April and ripping higher for the rest of the year. Investors who panic-sold the bottom missed out, while those who held on had another excellent year.

At the same time, as the market continued to roar higher in the latter half of the year, propelled by the AI trade, my old bearishness started to reassert itself. Many of the reasons I had been bearish for so long were valid concerns – though the market had long ignored them.

But with the price of gold and silver soaring, ultimately hitting $4500 and nearly $80, respectively, in late December, I began to feel that an inflection point was near at hand. I sold down all the stock I had bought on margin, selling the ones I had the least conviction in and trimming my position size in the ones I wanted to hold onto. I summarized my concerns in a blog on Dec. 22.

(Click on image to enlarge)

The dilemma I faced was how to balance my newfound appreciation for the enduring legacy of Warren Buffett with the macro concerns I had come to as a young man from my reading of Ayn Rand’s Atlas Shrugged, Ludwig von Mises’s Human Action, and other similar works. It was the macro framework acquired from them that had led to my dropping out of the Phd Philosophy Program at UC Davis in 2006 to start Top Gun to profit from the collapse of the housing bubble in the first place.

Having lost so much money shorting over the years, I knew that wasn’t a viable strategy. But how to protect our gains, as well profit, from an environment in which macro concerns were becoming impossible to ignore?

The integration that worked was to complement our portfolio of high quality stocks with a large position in the precious metals and other commodity miners as an inflation hedge. In addition, commodities have been underinvested in for too long as most investors have crowded into tech stocks. That portfolio construction worked beautifully in 2025, and I have no reason to think it won’t continue to in 2026.

(Click on image to enlarge)

That was the intellectual trajectory of our portfolio's year. Now, let’s dig into some specifics.

(Click on image to enlarge)

The biggest contributor to Top Gun’s year were the gold and silver miners, which I own through the following four ETFs: GDX, GDXJ, SIL, and SILJ. I am not a geological expert, so me trying to pick individual mining stocks would add no value. Therefore, I play this theme – and many others where the same logic applies – through ETFs.

I have been quite bullish on the precious metals and their miners since March 30, 2024, and the ETFs massively outperformed the S&P in 2025. They are up an average of ~200% over the last two years.

While this kind of price action usually suggests euphoria, in this case, I think it is warranted as concerns about the dollar and the entire fiat money based global monetary system rise to the forefront.

There will be nasty shakeouts like there was in October, which I correctly said was a buying opportunity and used to significantly add to our positions. But I continue to see corrections in the precious metals and their miners as buying opportunities. Those four ETFs contributed ~34% of our portfolio's total return for 2025.

Three other commodity miner ETFs – COPX, PICK, and URA – contributed ~7% of the portfolio's total return for 2025. While our oil, natural gas, and agricultural stock ETFs – XOP, XLE, FCG, and MOO – mostly flat-lined in 2025, I am optimistic about their potential for 2026.

(Click on image to enlarge)

(Click on image to enlarge)

The individual stocks I picked also worked superbly. UBER was Top Gun’s largest individual stock holding, and it delivered another solid year (+35%). I picked the turn in UBER three years ago, and I have ridden it since. It is a multi-bagger for us, and I think we are only in the middle innings.

While there is a big debate about whether autonomous vehicles are an existential threat to UBER, that debate depends on speculation about how things will be many years in the future. A lot can change between now and then, and I’m not as good at predicting precise outcomes in the distant future as the rest of financial media.

In the meantime, UBER continues to crush, producing solid quarter after solid quarter. Should AVs start to impinge on UBER’s business, it will show up in their results, and I will adjust. UBER contributed almost 3% of our portfolio's total return for 2025.

(Click on image to enlarge)

Another excellent individual stock pick was Centene (CNC), which I went big on in the wake of the disclosure that Buffett had acquired a stake in United Health (UNH). I wrote about that on Aug. 19, 2025. The stock is up by more than 1/3 since then. Centene contributed 0.8% of our portfolio's total return for 2025.

(Click on image to enlarge)

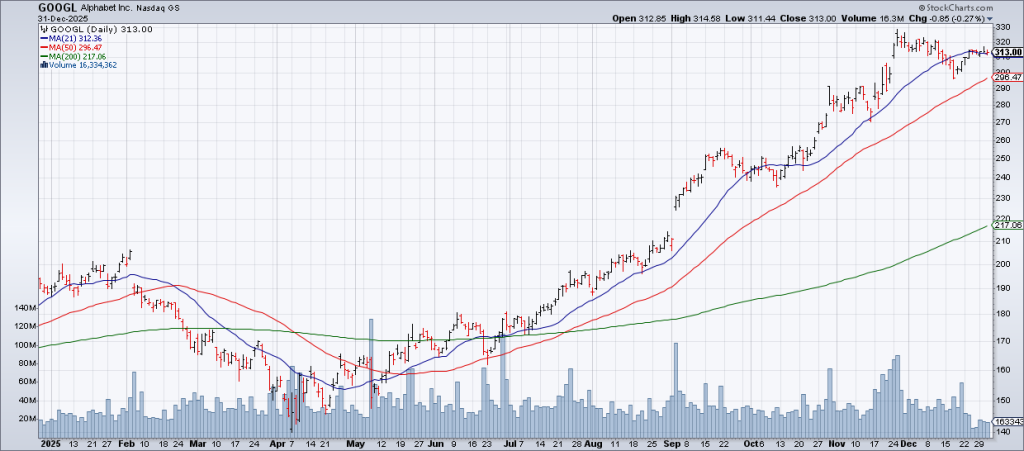

The one layup the market served up in 2025 was the big selloff in Google (GOOGL) in the first part of the year on concerns that search was moving to ChatGPT, which therefore posed an existential threat to its business. I bought that dip, and the stock doubled as Google’s results showed ChatGPT wasn’t as big of a threat as thought – at least for now.

I recently cut the position in half because the stock went from being undervalued to overvalued in six months. Like Ben Graham said, Mr. Market is a Manic Depressive: In the short run it’s a voting machine, in the long run a weighing machine. Alphabet contributed ~1.5% of the portfolio's total return in 2025.

Many other individual stocks picks were up and contributed to the portfolio's year, including Caterpillar (CAT), Ulta Beauty (ULTA), Brookfield (BN), Interactive Brokers (IBKR), Dutch Bros (BROS), Prologis (PLD), Welltower (WELL), and Ventas (VTR).

(Click on image to enlarge)

The biggest loser in the individual stock portfolio was Snapchat (SNAP), which I bailed on in August when I realized that my thesis had been invalidated. Snapchat simply hasn’t been able to monetize its significant base of Daily Active Users (DAUs), and I see few signs of progress on that front. I can always revisit it in the future if things change, but for now, I decided to cut my losses and redeploy capital. Snapchat's contribution to the total return for 2025 was -0.82%.

A few other notable laggards were Nike (NKE), Constellation Brands (STZ), and Comcast (CMCSA), each of which I continue to see a lot of value in and am holding onto.

The most frustrating thing for me was my continued losses attempting to short some of the market’s favorite mega-cap tech names – though I mostly employed solid risk management this time. While all of those have been covered, my shorts in Apple (AAPL), Tesla (TSLA), Netflix (NFLX), Palantir (PLTR), and The Magnificent 7 ETF (MAGS) were ~3% drag in terms of their contribution to our portfolio's total return in 2025. I also tried unsuccessfully to short long-term treasuries via TLT, which was an ~1.5% negative in terms of contribution to total return.

In addition, my appetite for action caused me to sometimes trade stocks and options ahead of earnings, or even occasionally to bet on big intraday reversals in the indexes. While I did get some of these trades right, my guess is that overall they were a loser – but I just couldn’t help myself.

I suspect many others are guilty of the same problem. Everything in the current market environment encourages investors to “Don’t just sit there. Do something,” as Warren Buffett once put it in one of his annual letters. But the opposite is usually the best policy.

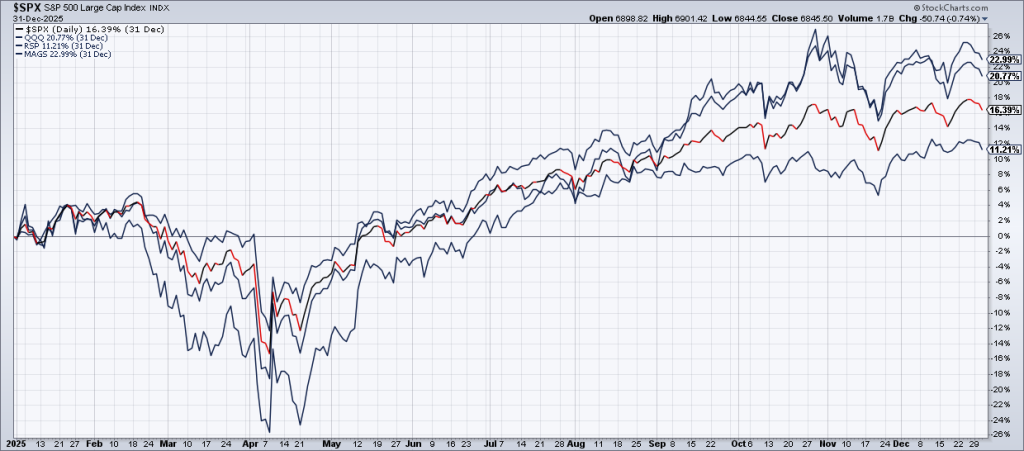

Overall, Top Gun returned 38% in Margin Accounts and 20% in IRA Accounts in 2025, compared to 16% for the S&P 500. It should be noted that the Equal Weight S&P (RSP) was up only 11% as the Magnificent 7 (+23%) drove most of the gains.

Portfolio 2025 returns by account type:

- Margin Accounts: +38%

- IRAs: +20%

(Click on image to enlarge)

More By This Author:

The Roots Of Financial NihilismThe NKE Quarter

Is CHWY The AMZN Of Pets?