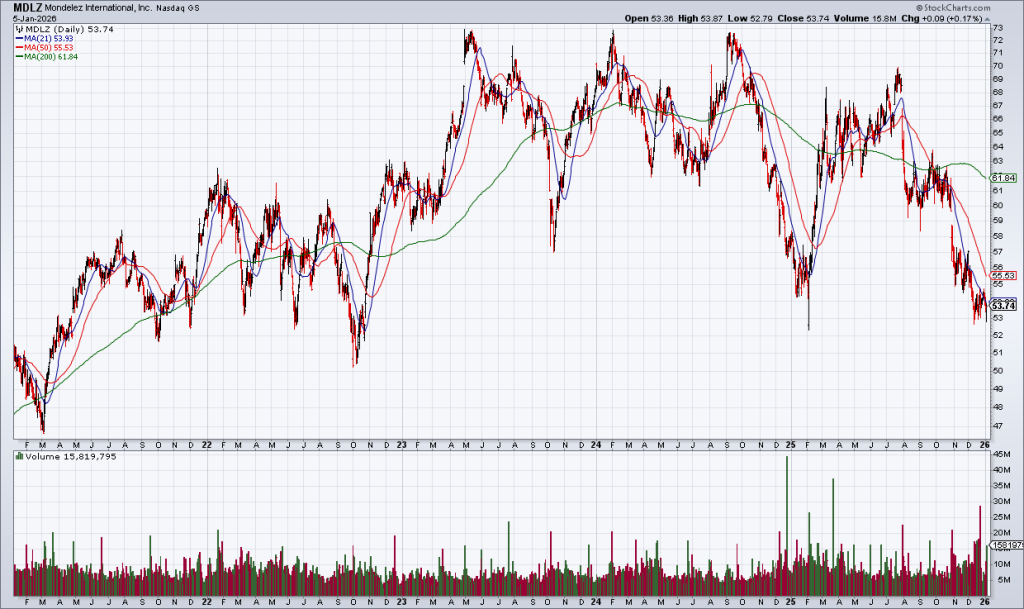

The Case For MDLZ

(Click on image to enlarge)

Mondelez (MDLZ) is a $70 billion food company with a number of popular brands like Chips Ahoy!, Cliff Bar, Ritz Crackers, Sour Patch Kids and Oreos, among many others. It is the 7th largest holding in the S&P Consumer Staples ETF (XLP).

The stock is down more than 20% over the last 6 months as high cocoa prices have decimated their margins. Adjusted Operating Margin for the first three quarters of 2025 is down 470 basis points to 13.7% from 18.4% in the comparable year ago period. The stock is essentially back to 2022 levels.

Adjusted EPS is expected to be down 15% this year from $3.36 in 2024. However, they expect it to return to their long term forecast of high single digit growth in 2026 as cocoa prices moderate. You can see the rise and expected moderation in cocoa prices on page 17 of their 3Q25 Earnings Presentation from October 28, 2025.

Applying a growth rate of -15% to 2025 Adjusted EPS and 7.5% to 2026 works out to $3.07 Adjusted EPS next year. At Monday’s closing price of $53.74, that’s 17.5x. MDLZ also pays a 50 cent quarterly dividend which is 3.72% annualized.

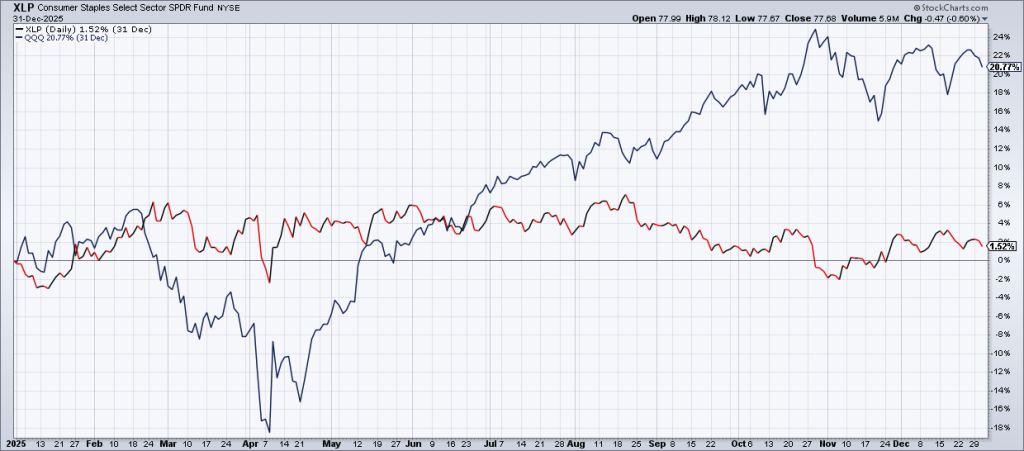

(Click on image to enlarge)

Consumer Staples (XLP) were essentially flat in 2025 but – along with healthcare – are generally the best defensive stocks in difficult markets. While Tech could well continue to run hot in 2026, I personally think it’s a good time to play a little more defense than last year.

MDLZ is a high quality food company with an excellent long term track record that can be had at a reasonable valuation. I think it will perform nicely in 2026 and I plan to pick up a few shares on Tuesday. The only problem I have with MDLZ is that analyzing it causes me to crave Oreos.

More By This Author:

Year-End Letter: Portfolio Returns 38% In 2025

The Roots Of Financial Nihilism

The NKE Quarter