The NKE Quarter

(Click on image to enlarge)

I have been stalking Nike (NKE) for 27 months now and have written four blogs on it over that period, biding my time for the right spots to increase my position while lightening up at times. I added a few shares and sold some NKE $62.50 Dec19 Puts Thursday ahead of earnings. The puts are going to be deeply in the money based on the premarket – down ~10% – and my small stock position will be red as well. While value investors always say they love it when their stocks go down, it’s mostly posturing as we all want our stocks to go up. Nevertheless it does provide an opportunity to add to a position if you think it makes sense.

After a number of hours reviewing the report and listening to the Conference Call (CC), I remain constructive on NKE. Indeed, despite the market reaction I consider this quarter to be continued evidence that the turnaround is working. Currency Neutral Revenue Growth hit 0% after 5 quarters of being negative – four of which were high single digit declines or worse. Gross Margin declined 300 basis points year over year – but we knew that was coming as they guided to a 300-375 basis point decrease last quarter.

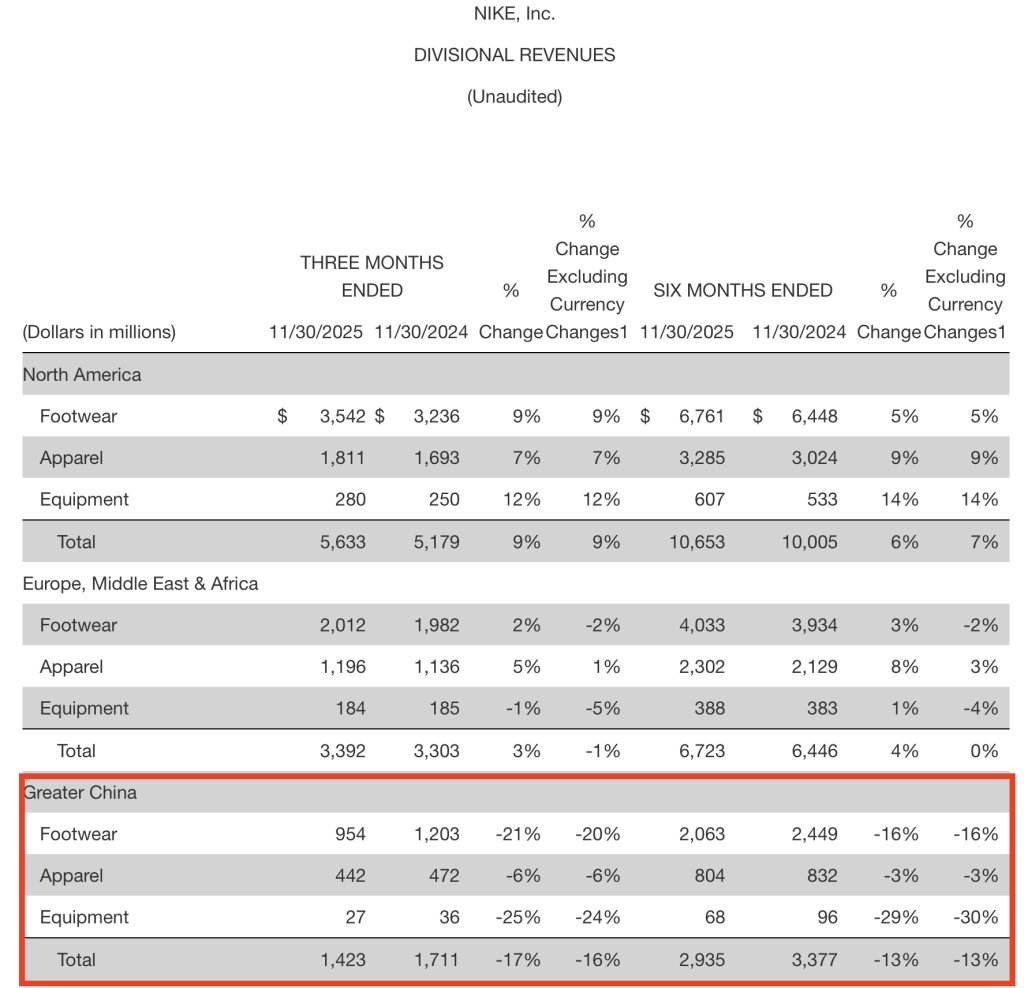

The real issue is China which @ConvexDispatch put his finger on in a number of tweets. Greater China Revenue declined by 17% in the quarter and EBIT by 49%. CEO Elliot Hill and CFO Matt Friend spent a lot of time on China on the CC. Unfortunately – in the guidance – Friend said that Q3 “performance in Greater China similar to Q2” (p. 12). In other words, the turnaround in China is going to take a long time. I think this is why the stock is down so much this morning.

On the other hand, North America was a bright spot with Revenue +9%. They appear to getting some traction here in what is by far their largest geographic segment. North American Revenue is 4x Greater China’s.

FY26 – which has two more quarter remaining – is going to be a difficult year of righting the ship and the financial results are not going to be pretty. The stock won’t really move until there is clear evidence that the turnaround is working. However, by that time it will be priced in and the opportunity missed. As @ConvexDispatch tweeted before the report: “Turnarounds are bought when risks are still obvious, not when everyone turns bullish.”

I think the management team is doing the right things and the long term prospects of a comeback for NKE remain high. The difficult part is being patient. We all want our stocks to work right after we buy them. This is one of those situations where it’s going to take time. I’m personally taking today’s selloff in stride and will probably add a few more shares to my position.

More By This Author:

Is CHWY The AMZN Of Pets?

Yields Front And Center Ahead Of Fed Decision

The Forgotten Tech Stock