The Roots Of Financial Nihilism

When the capital development of a country becomes a by-product of the activities of a casino the job is likely to be ill done – John Maynard Keynes

There can be few fields of human endeavor in which history counts for so little as in the field of finance – John Kenneth Galbraith

Kyla Scanlon – a 20-something financial influencer – wrote a fascinating column in the WSJ the other day on the “Financial Nihilism” of Generation Z. Whereas previous generations of Americans believed in education, hard work and saving, many of Generation Z have come to believe that these values no longer work.

In investing, many have gravitated from stocks to options, cryptocurrencies and even sports betting in an attempt to make a lot of money fast. While older generations lived by the rules of The American Dream, Scanlon defends her peers by saying that circumstances have changed – and she’s right.

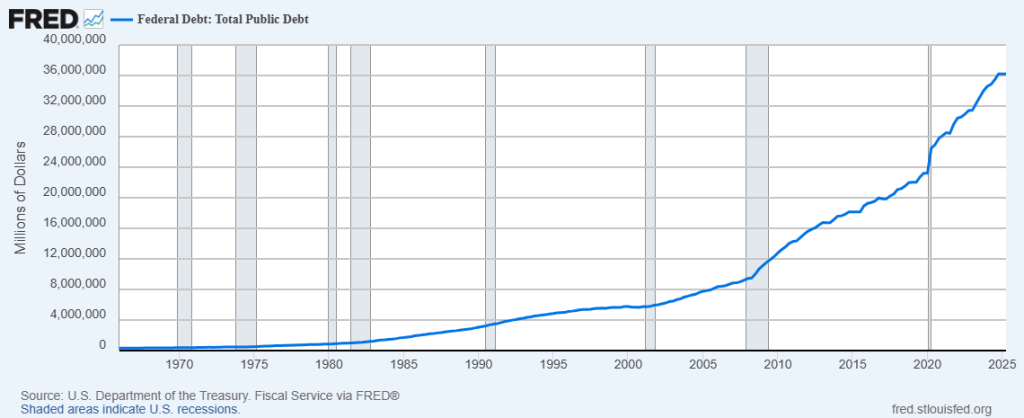

When the Federal Debt is $36 trillion (not counting the unfunded liabilities for Medicare and Social Security), when the Fed keeps interest rates below the rate of inflation blowing bubble after bubble, when the price of gold approaches $4500 – I think most of us can sense that something isn’t quite right.

What is going on?

While this is a complex issue with multiple lines of causation, the biggest issue is the degradation of money. David Stockman called it The Great Deformation in his book on the history of its evolution. The best concise, contemporary account of what has happened is Ruchir Sharma’s What Went Wrong With Capitalism? But the intellectual genealogy runs back through the Austrian Economists like Ludwig von Mises and Wilhelm Ropke to David Hume in the 18th century who pioneered The Quantity Theory of Money.

For most of human history money was gold. The 19th century was an economic Golden Age and its foundation was sound money. The gold standard came under attack during The Great Depression. After World War II until August 1971, most leading currencies were linked to the dollar and $35 could be exchanged for 1 ounce of gold. Known as The Bretton Woods Era (see Benn Steil The Battle of Bretton Woods), this monetary arrangement worked relatively well and resulted in the post-war boom. Nixon completely severed the dollar’s link to gold when he closed the gold window in August 1971 (see Jeff Garten Three Days At Camp David).

Alan Greenspan cut interest rates every time the stock market sneezed and Ben Bernanke cut them all the way to 0% and initiated Quantitative Easing in which the Fed flooded the market with money by buying trillions of dollars of Treasuries and Mortgage Backed Securities.

What we have now is fiat money: paper currency backed by nothing. Central banks can create it out of thin air without constraint – until prices start to spiral out of control as they did in Weimar Germany when people had to use wheelbarrows to carry all the money they needed to buy their groceries. Eventually the currency becomes as worthless as toiler paper.

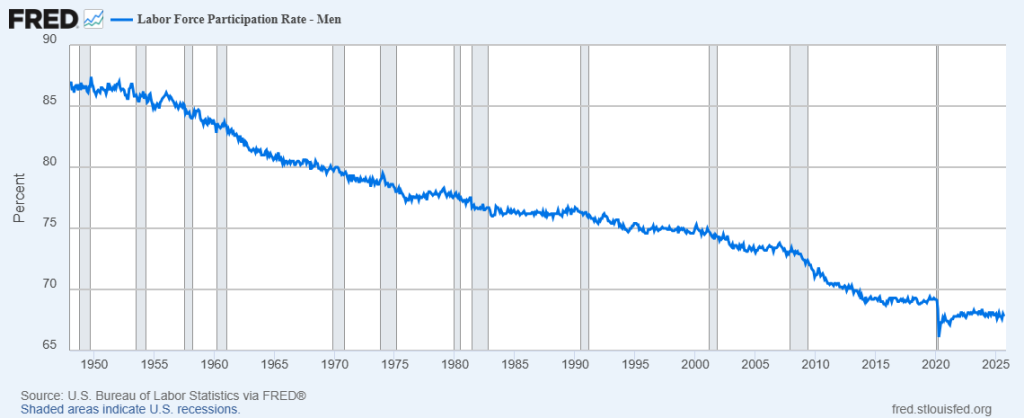

Our modern, highly specialized, division of labor economy depends on a medium of exchange. But when the money becomes funny money, it results in all sorts of distortions. The economy becomes financialized as people focus more on financial engineering and speculation rather than production, innovation and investment. The economy – and especially the financial markets – come to resemble a casino. At a certain point the money becomes so worthless that the system can no longer function and the economy completely breaks down as Adam Ferguson and Frederick Taylor documented in their accounts of Weimar Germany, When Money Dies and The Downfall of Money, respectively.

I don’t know what the endgame is this time around but the price of gold suggests to me that we are on the verge of another crisis. (For a more conventional but nonetheless concerned perspective, see Kenneth Rogoff Our Dollar, Your Problem).

More By This Author:

The NKE Quarter

Is CHWY The AMZN Of Pets?

Yields Front And Center Ahead Of Fed Decision