The U.S. Consumer Is Hitting A Brick Wall, Negatively Impacting Discretionary Stocks

In numerous recent articles, I have stated that there are a growing number of signs that the U.S. consumer may be reaching a breaking point. When we consider that consumer spending currently comprises approximately 70% of the American gross domestic product, that could be a very big problem for the economy. This is particularly true for those companies whose revenue is derived from discretionary spending. For example, it is difficult to believe that people will rush out to the store and buy the newest Apple (AAPL) iPhone when they are trying to figure out how to fit food and energy bills into their budgets.

Background Of The Problem

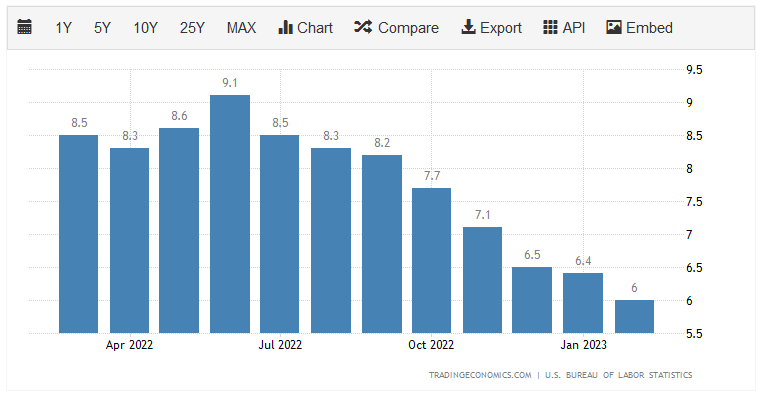

It is unlikely to come as a surprise to anyone reading this that inflation in the United States is currently incredibly high. We can see this by looking at the consumer price index, which is the usual measurement of price levels used by economists. As we can see here, the index has increased by at least 6% year-over-year in each of the past twelve months:

Source: Trading Economics

This has put a great deal of pressure on many American households, particularly those of lesser means. After all, food and energy, which are both necessities, are some of the things that have seen the greatest increase in prices. As pointed out by investment advisor Mish Shedlock in a recent blog post, the latest Prudential Pulse survey states that roughly 77% of Millennials and 81% of Generation Z members are now seeking out second jobs or opportunities in the gig economy just to earn the extra income that they need to pay their bills and feed their families. I suppose that this is to be expected when we consider that real wage growth has been negative for 23 straight months and approximately 63% of Americans live paycheck-to-paycheck. Thus, clearly, Americans do not have sufficient space in their budget to handle rising food prices without having to sacrifice discretionary spending.

So, how do we explain the fact that over much of last year, the economy still appeared to be strong and consumer spending was robust? After all, prices were significantly rising last year and reducing everyone’s disposable income. There were two factors that allowed Americans to maintain their spending in such an environment:

- Government pandemic assistance bolstered Americans’ savings. During the pandemic, there were three stimulus checks sent out to most households that totaled $3,200 per person in most cases. As the economy was largely shut down, this money wound up going into savings because there was nothing to spend it on. Once the economy re-opened fully in late 2021, people started spending the money that they had saved during the lockdowns, including all of the newly-printed government stimulus funds.

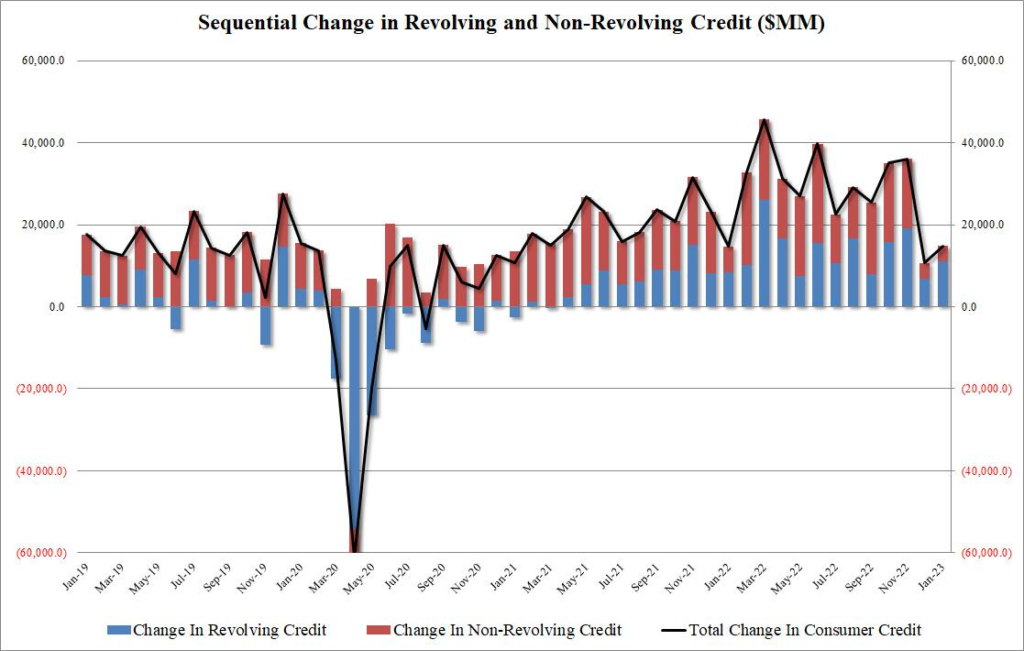

- Credit cards and debt growth. This became the biggest thing that allowed Americans to maintain their spending levels once their savings ran out. As I explained in a few previous articles, revolving credit card balances grew to set new record levels late last year as Americans relied on debt to maintain their standard of living in an environment where their paychecks cover less and less of their needs, let alone wants.

The End Is Near

We have now begun to see signs that Americans can no longer maintain their discretionary spending levels. Earlier this month, Zero Hedge reported that revolving consumer debt growth has begun to collapse. We can see that quite clearly here:

(Click on image to enlarge)

Source: Zero Hedge

In December 2022, consumer credit rose by a modest $10.7 billion. In January 2023, consumer credit rose by $14.8 billion. Those figures are both well below the numbers that were expected by analysts. In fact, they are almost record-setters in how far below estimates they came in at! To put the size of these misses into perspective, analysts expected that January 2023 would see an increase of $25.4 billion in total consumer credit balances. As we can see from the chart above, over the past two years, consumer credit has generally increased by $20 billion to $30 billion month-over-month. Clearly then, these two months bucked the trend in a pretty big negative way.

Conclusion

We have not seen an increase in wages that will allow consumers to maintain their spending levels without having to rely on their credit cards. In fact, real wage growth was negative in every month year-to-date. Thus, consumers are clearly cutting back on their spending. It is highly unlikely that they are cutting back substantially on food in order to pay for iPhones and trips to Disney World (DIS). It is more likely that those companies that are highly dependent on consumer discretionary spending are going to be taking some pretty serious hits. Invest accordingly.

More By This Author:

Solar Power: Not A Cheap Source Of Energy

Further Evidence Casts Doubt On Economic Strength And Employment Data

The Jobs Data Continues To Get Worse

Disclosure: I have no positions in any stocks mentioned in this article.

Disclaimer: All information provided in this article is for entertainment purposes only. Powerhedge LLC is not a licensed ...

more