Further Evidence Casts Doubt On Economic Strength And Employment Data

Earlier this week, we published an article that expressed some concerns about the official narratives of a strong employment market. Most notably, we mentioned the large layoffs that have been occurring in the technology sector, among others. This is rather important because the technology sector was by far the biggest source of strength in the stock market over the past decade.

The Raw Data

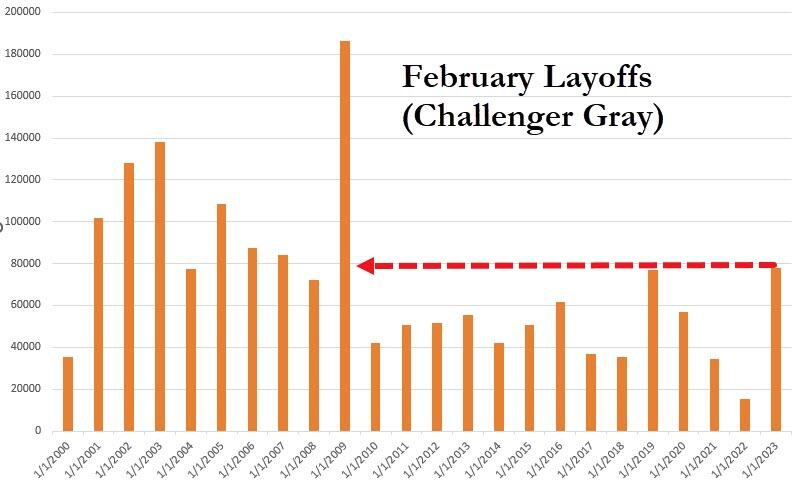

Earlier today, Challenger, Gray, & Christmas, one of the largest executive outplacement firms in the United States, announced that there were 77,770 job cuts during the month of February. When added to the January numbers, that is the highest level of job cuts in the first two months of any year since 2009:

Source: Zero Hedge

Those of us that are old enough to remember 2009 likely remember the financial collapse that gripped the nation at the end of 2008, which ultimately resulted in the “worst recession since the Great Depression,” to quote a few politicians and media personalities.

Challenger Gray also reports that layoffs primarily occurred in the technology, retail, and financial sectors, however, the outplacement firm noted that layoffs occurred in every sector that its analysis tracked. From the report:

“Certainly, employers are paying attention to rate increase plans from the Fed (Federal Reserve). Many have been planning for a downturn for months, cutting costs elsewhere. If things continue to cool, layoffs are typically the last piece in company cost-cutting strategies.

Right now, the overwhelming bulk of cuts are occurring in Technology. Retail and Financial are also cutting right now, as consumer spending matches economic conditions. In February, job cuts occurred in all thirty industries Challenger tracks.”

Andrew Challenger

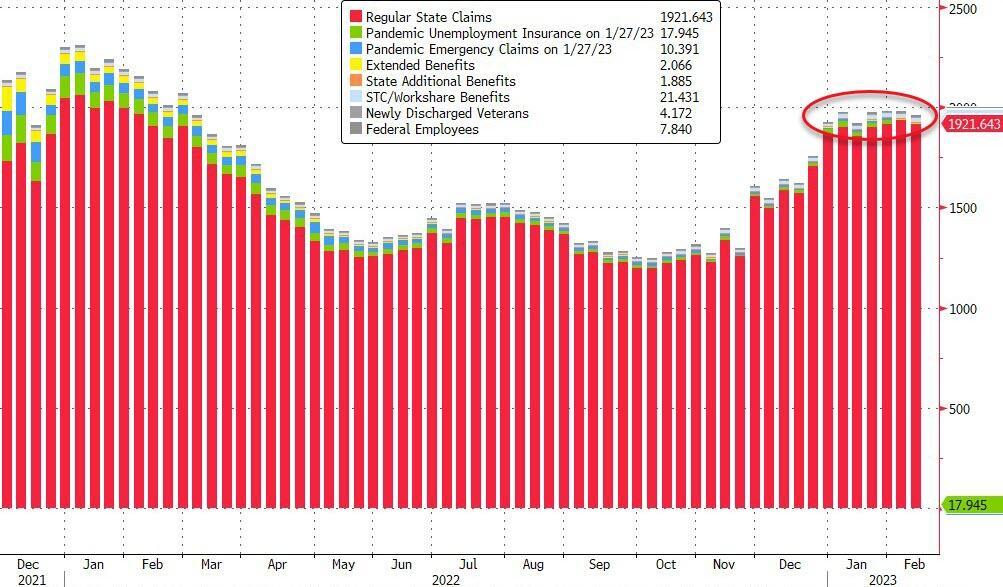

This is, to put it mildly, not in line with the narrative that we have been getting from the Bureau of Labor Statistics, which shows that initial jobless claims are at historically low levels:

Source: Zero Hedge

In fact, as we can see above, the Bureau of Labor Statistics is claiming that initial jobless claims are lower than in the second half of 2021. However, that does not appear to be true. In fact, the data from Challenger Gray says that layoffs are currently higher than they were at any time during the COVID-19 pandemic!

There are other signs that Challenger Gray’s data is more apt to be accurate than the data from the Bureau of Labor Statistics. For example, the total number of Americans that are collecting some sort of unemployment assistance hovers near one-year highs:

Source: Zero Hedge

If the labor market were really as strong as politicians and Federal officials are claiming, this would not be the case. In addition to this, there were 28,830 new job opportunities in February 2023. That is down from the 32,764 job openings in January and down substantially from the 215,127 new job openings in February of 2023.

Takeaway

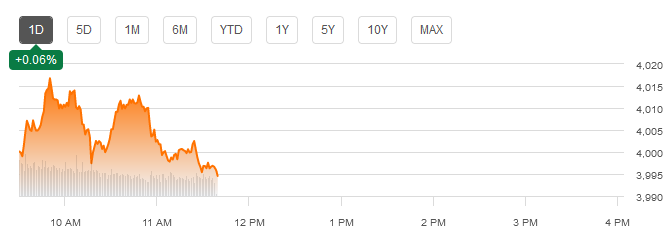

The question that this leads us to ask is how this could all impact the capital markets. As of the time of writing, the S&P 500 (SPX) is up 0.06% on the day:

Source: Seeking Alpha

As the market has been open for about two hours so far, we can consider it relatively flat. It is down by about 1.5% over the past five days, which is also relatively flat. It thus appears that the market is pricing in a rate hike of about 0.25%, which is reasonable if the Federal Reserve looks at this employment information and other data that indicates that a recession may be imminent. That is the most likely outcome in our minds right now. However, it is not completely out of the question that we will see the Federal Reserve hike rates by 0.5% given the still high inflation rate and the strength from some of the establishment surveys.

Invest accordingly.

More By This Author:

The Jobs Data Continues To Get Worse

No, The U.S. Market Is Not Cheap

A Look At Offshore Drilling Day Rates

Disclosure: I/We have no positions in any stock mentioned in this article.

Disclaimer: All information provided in this article is for entertainment purposes only. Powerhedge LLC is not a licensed ...

more