Solar Power: Not A Cheap Source Of Energy

Image Source: Unsplash

A few weeks ago, Zero Hedge published a rather insightful article written by Isaac Orr at RealClearPolicy.com. While that site is reviled among some commentators in the broader media, fact-checkers and media bias sites do rank it fairly respectably:

Source: MediaBiasFactCheck.com

With that said, I personally have no particular bias as I limit my analysis to economics and finance, not politics. The article in question is simply an analysis of the oft-provided claim by environmental activists that sunlight is free and therefore solar power is an affordable way to generate energy for the needs of society. Mr. Orr concludes in his article that this is not the case. For the most part, he is correct but he excludes a few points that are important to include in the discussion.

As is usual when I write a piece like this, I will begin by providing a summary and comments about Mr. Orr’s original article.

Analysis Of Solar Costs

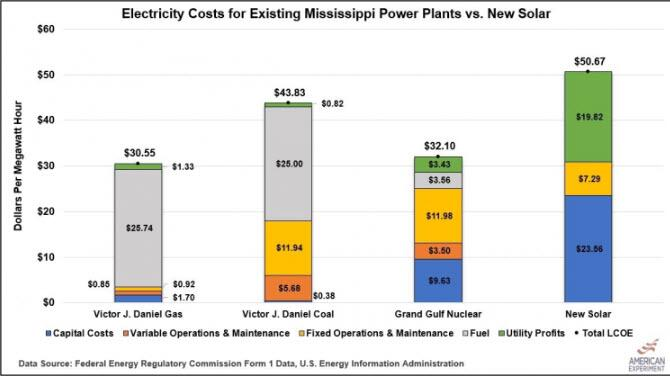

Mr. Orr’s original article looks at the experience of the state of Mississippi, which like most states has been providing various incentives for electric utilities operating in its territory to expand the use of solar power generation. He ultimately concludes that solar power is much more expensive than the state’s existing coal, natural gas, and nuclear power plants.

One of the best and most common ways to analyze the costs of generating power from a given power plant is the Levelized Cost of Energy or LCOE. This value is determined by taking the costs of the plant, such as the costs of constructing and operating it, buying fuel for the generators, and costs of any debt incurred to finance the upfront costs of building the plant. This figure is divided by the amount of energy (measured as megawatt-hours) that is produced by the plant over its lifetime. This metric works very well to compare power plants that may use different fuel sources, which is the primary objective of our analysis today.

The LCOE of solar power for the state of Mississippi works out to about $50.67 per megawatt-hour generated:

Source: Center of The American Experiment/Data from FERC

As we can clearly see, that is significantly higher than the LCOE for the state’s existing natural gas, coal, and nuclear power plants. These are all real-world values pulled directly from the Federal Energy Regulatory Commission, which is usually considered to be the most reliable and apolitical source of data for utilities (much as the Energy Information Administration is for crude oil and natural gas data and projections).

It is important to note though that these are the unsubsidized costs of solar power. The Inflation Reduction Act of 2022 creates massive subsidies from the government that are intended to reduce the cost of constructing and operating solar power plants. These reduce the effective costs to the utilities involved in the construction of these plants, but the real costs do not change. All these subsidies do is transfer some of the high costs of solar relative to fossil fuels from the actual producers and consumers of solar power onto the American taxpayer. These subsidies do not magically make solar power economical compared to fossil fuels.

In addition to the LCOE costs involved, there is another major factor that swings the economics further against solar power. This is the fact that solar power is intermittent, which I have pointed out in numerous other articles. This should be pretty easy for anyone to understand since it is obvious that solar power does not work when the sun is not shining. It also functions less well on cloudy days, which limits its potential in most areas of the United States since most areas in which humans live experience significant cloud cover over an average year. We can see this problem in the fact that Mississippi’s existing solar power plants only generated 22% of their nameplate output during 2021, which is the most recent year in which data is available. This gives utilities several options, all of which cost money:

- Install more capacity than is needed. For example, if 100 megawatts of capacity is needed, the utility instead constructs a 450-megawatt plant in order to deliver 100 megawatts at 22% efficiency. This is obviously an enormous waste of resources that increases the cost of solar far beyond the LCOE provided above.

- Use battery storage to deliver electricity during times when the plant is not generating enough power to satisfy the needs. This is, to put it mildly, a very, very poor decision from an economic perspective. As I pointed out in a previous article, the most powerful battery pack in the world, the 350-megawatt bank in Australia, can only deliver enough power to handle a half-million homes for about an hour. That is nowhere near enough to supply power to even a modest-sized town overnight. Thus, batteries are an incredibly poor choice for maintaining the “always-on performance” that we expect from a modern electric grid.

- Supplement the solar facility with natural gas turbines that can reliably generate power when the solar facility cannot. This solution works fine and it is the one that utilities usually employ. However, it is rather wasteful since it would be much cheaper to simply construct the natural gas generation plant and forget about the solar power facility.

Thus, no matter how we look at it, the economics of solar power does not work out in its favor. Ultimately, attempting to increase the use of solar power will simply increase the cost of electricity for everybody in some way or another.

Solar Power And Silver

The above analysis does not even take into account the rare materials that are required to construct a solar power plant. One of these is silver, which has been commonly used in jewelry and as money throughout history due to its rarity. In fact, there is less above-ground silver than gold, although silver is more prevalent in Earth’s crust.

As I have discussed in various previous articles, it takes a substantial amount of silver in order to make a solar panel. According to Casey Research, one solar panel requires about twenty grams of silver to manufacture. This is substantially more than a cell phone (200 to 300 milligrams) or a laptop computer (about 1 gram). Thus, the growth of solar will substantially increase the demand for silver.

We have in fact already seen surging silver demand. In 2022, the demand for silver hit record levels and this is not expected to change anytime soon. After all, silver is used by many investors as a store of wealth similar to gold. Thus, it is being purchased as an inflation hedge. However, a recent research study from Australia’s University of New South Wales states that solar panel production alone will use up 20% of the current silver production by 2027. By 2050, it is expected that solar panels alone will absorb 85% to 98% of all the above-ground silver currently in existence. This will obviously substantially drive up silver prices and make solar power even less economical than it currently is.

Of course, as policymakers, environmental activists, and others that are currently pushing for the widespread expansion of solar power are unlikely to change their mindset any time soon, this makes a great investment case for silver. Wheaton Precious Metals (WPM) could be one way to bet on this trend and earn a dividend along the way.

Good investing!

More By This Author:

Further Evidence Casts Doubt On Economic Strength And Employment Data

The Jobs Data Continues To Get Worse

No, The U.S. Market Is Not Cheap

Disclosure: I have no positions in any stocks mentioned in this article and no intention of taking a position within the next 72 hours.

Disclaimer: All information provided in this article is for ...

more