The Un(der)employment Rate Leads Wage Growth: 2023 Update

I had already planned on taking an updated look at wage growth today, but there was a little flutter on Twitter about job openings and last week’s Q1 wage and benefits data, so that sealed the deal.

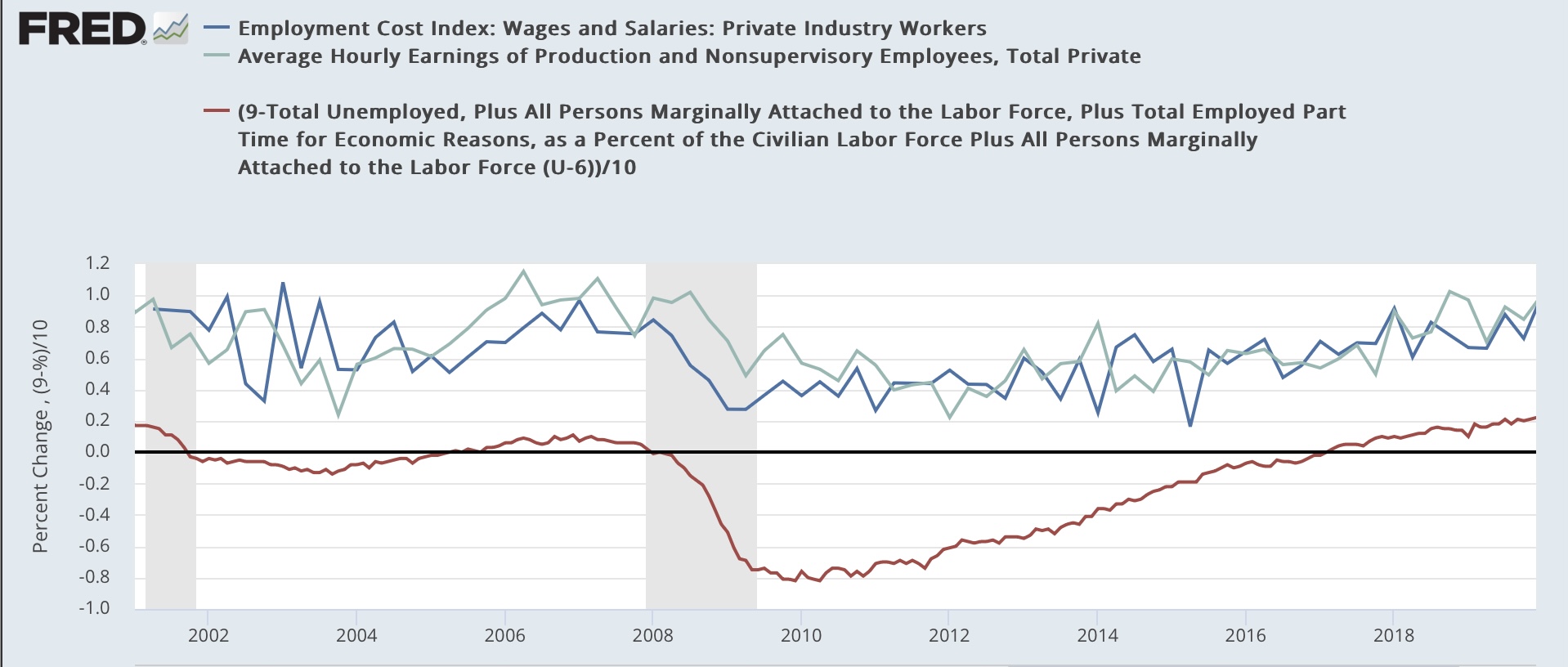

To wit: as I used to write many times during the last expansion, wage growth is a long-lagging indicator. It tends to increase only after unemployment (or even better, underemployment) falls to a level where labor begins to have some bargaining power. For the underemployment rate, this was about 9%. It took over half a decade after the Great Recession for the U6 rate to hit that marker:

(Click on image to enlarge)

So the below graph subtracts the U6 rate from 9% (red), so that any rate lower than 9% shows as a positive, compared with the YoY% change in average nonsupervisory wages (light blue) and wages measured by the quarterly employment cost index (dark blue):

(Click on image to enlarge)

Because the underemployment rate went to over 20% in the first few months of the pandemic, the below continuation graph eliminates those months and picks up in the last quarter of 2020:

(Click on image to enlarge)

As the labor market got tighter, wage growth continued to accelerate.

Economist Jason Furman made a similar point several days ago comparing the job openings rate with wage growth. Here’s his graph:

A graph of the quarterly % changes in wage growth in nonsupervisory wages and the employment cost index does not particularly correlate with the quarterly % change in job openings:

(Click on image to enlarge)

But the YoY% change in wages does correlate with the absolute level of job openings:

(Click on image to enlarge)

As the level of employment continues to reach post-pandemic equilibrium, the level of job openings will continue to decline, and the underemployment rate will likely increase. This will cause wage growth to decelerate as well.

More By This Author:

March JOLTS Report Shows Labor Market About Halfway To Pre-Pandemic NormalizationManufacturing And Construction Start Out The Month’s Data To The Negative Side

A Mixed Picture On Real Personal Income, Savings, And Spending In March, And Real Total Sales In February

Disclaimer: This blog contains opinions and observations. It is not professional advice in any way, shape or form and should not be construed that way. In other words, buyer beware.