March JOLTS Report Shows Labor Market About Halfway To Pre-Pandemic Normalization

The title of this piece is important to clue the relative nature of this morning’s Job Openings and Labor Turnover report for March.

For the last several years, the jobs market has been a game of “reverse musical chairs,” where there are always more chairs than participants. Those employers whose chairs weren’t filled had to increase their wages and/or benefits offerings or go without. This was good for labor but certainly put pressure on prices as well.

Because the jobs market has remained so strong, it has been unlikely that a recession would start unless the situation with job openings returned to at least close to its pre-pandemic levels. Only then could there be enough layoffs to actually be consistent with a negative monthly jobs number?

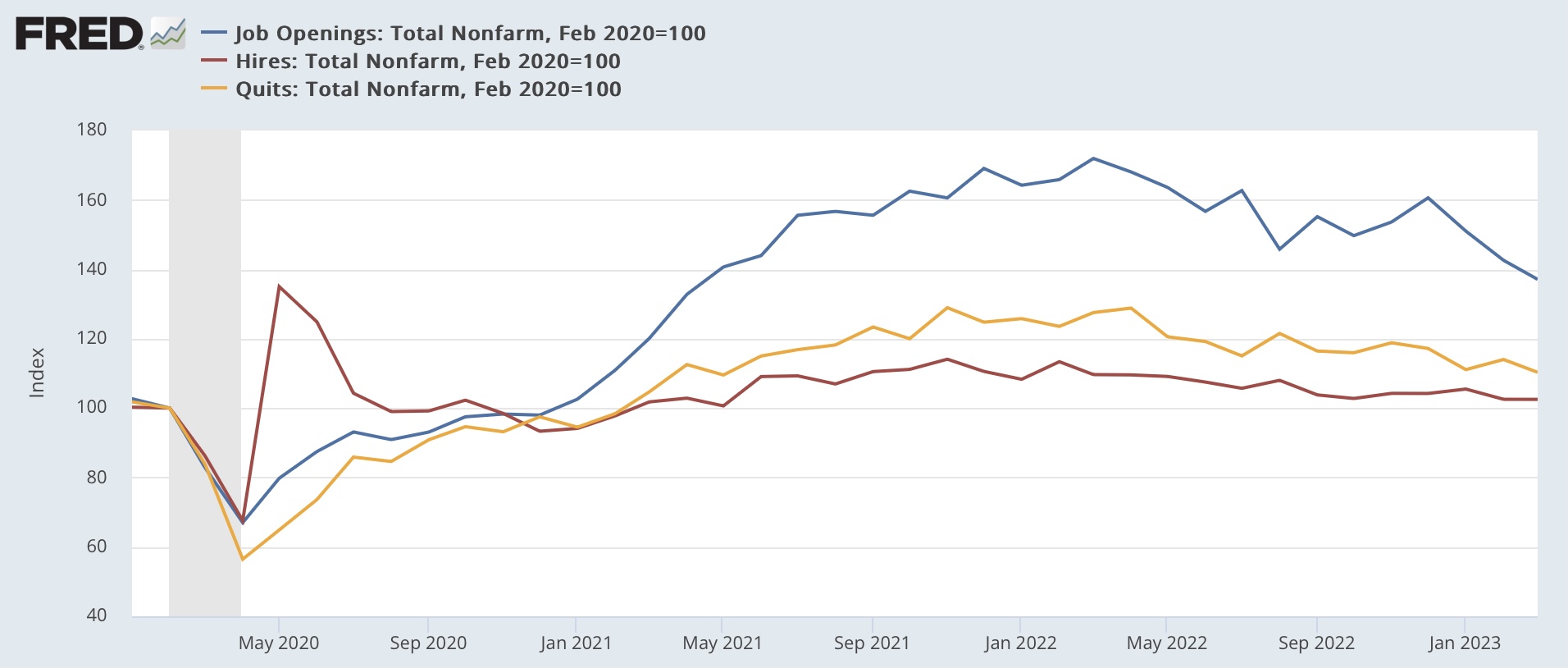

This morning’s report, as indicated in the title, indicates we are about half the way there. Job openings (blue in the graphs below) declined -384,000 to 9.590 million annualized (from a peak of 12.027 million 12 months ago, vs. 7 million just before the pandemic), while actual hires (red) declined a whopping -1,000 to 6.149 million (vs. a peak of 6.843 million in November 2021 and 6 million just before the pandemic), and voluntary quits (gold) declined -129,000 to 3.851 million (vs. a peak of 4.501 million in November 2021 and 3.5 million just before the pandemic:

(Click on image to enlarge)

All of the above are at roughly 2-year lows.

Here is the longer-term view of all 3 metrics from the series inception, better to show the current situation with the historical one before the pandemic hit:

(Click on image to enlarge)

All three remain at levels higher than at any time before the pandemic hit.

Additionally, layoffs and discharges increased 248,000 to 1.805 million annualized, also roughly a 2-year high):

(Click on image to enlarge)

Here is the longer-term historical record for layoffs. Note that before the pandemic, the current level would be quite low:

(Click on image to enlarge)

It would be wrong to simply project this month’s declines forward, but the overall trend is very clear.

All of the above remains consistent with a positive, even strong jobs report this coming Friday by historical standards. But, together with the increase in initial jobless claims (which are a leading indicator for the unemployment rate), it is likely that the report will be weak by the standards of the past 12 months, and the unemployment rate is more likely than not to increase.

More By This Author:

Manufacturing And Construction Start Out The Month’s Data To The Negative SideA Mixed Picture On Real Personal Income, Savings, And Spending In March, And Real Total Sales In February

The Deflators

Disclaimer: This blog contains opinions and observations. It is not professional advice in any way, shape or form and should not be construed that way. In other words, buyer beware.