The Reliability Of Employment Measures From CES

Alternate measures of conceptually similar to NFP and private NFP continue to rise.

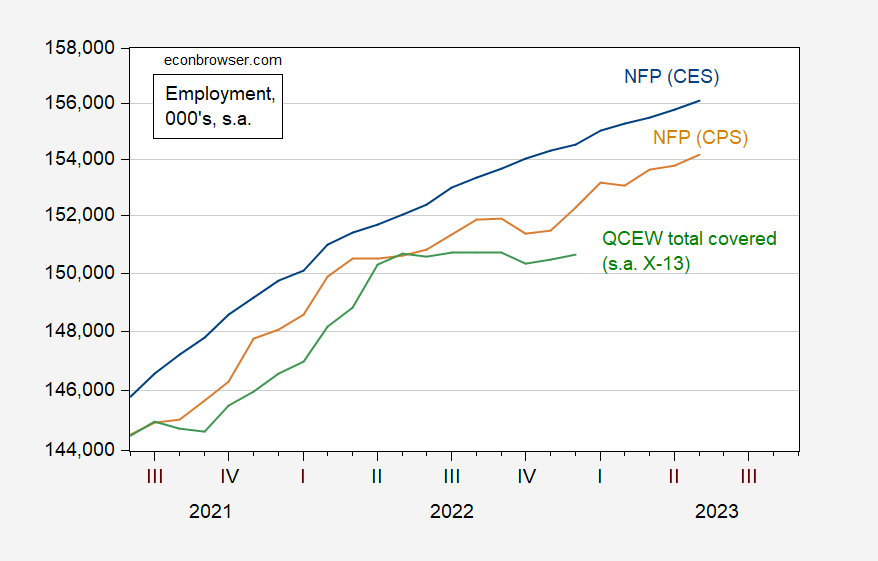

Figure 1: Nonfarm payroll employment from CES (blue), from CPS, adjusted to NFP concept (tan), and total covered employment from Quarterly Census of Employment and Wages, seasonally adjusted by author using X-13 (green), all in 000’s, s.a. Source: BLS via FRED, BLS, BLS (QCEW).

Note the CES NFP trend is matched in recent months by the research series drawn from the CPS (tan line). While the QCEW based series plateaued over the last half of 2022, the Philadelphia Fed’s Early Benchmark estimates through 2023Q1 indicate continued growth.

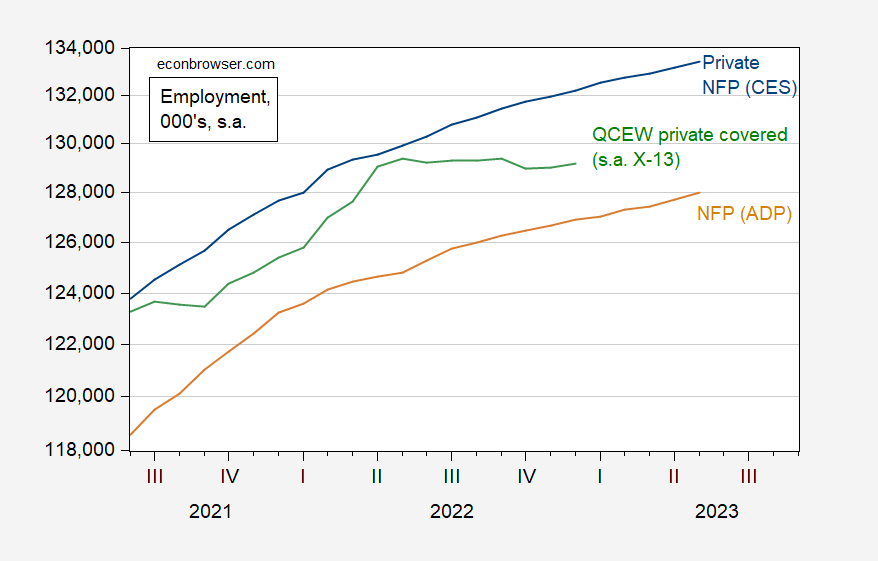

Figure 2: Private nonfarm payroll employment from BLS CES (blue), from ADP (tan), and total covered employment from Quarterly Census of Employment and Wages, seasonally adjusted by author using X-13 (green), all in 000’s, s.a. Source: BLS, ADP via FRED, BLS (QCEW).

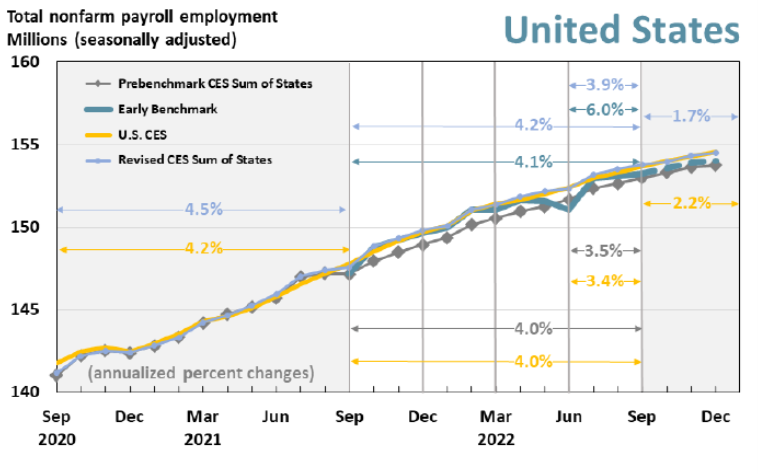

There has been substantial debate regarding whether the Philadelphia Fed’s early benchmark using QCEW data would yield a different picture of matters (reader Steven Kopits hinged an entire argument for recession in 2022H1 on this series). The latest reading indicates continued growth in 2023Q1.

Source: Philadelphia Fed (March 16, 2023).

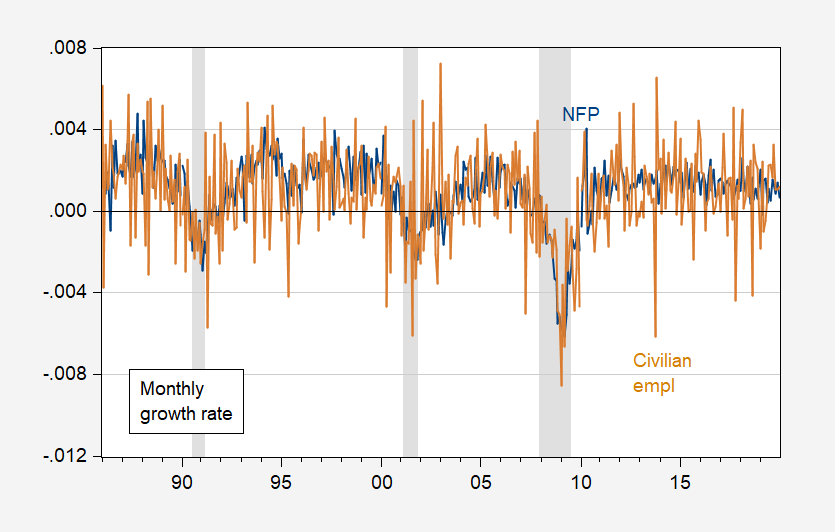

Why not pay more attention to the CPS civilian employment series? Because the variability of that series, relative to the CES NFP, as shown in Figure 3.

Figure 3: First log difference of NFP (blue), and civilian employment (tan). New population control months excluded. NBER defined peak-to-trough recession dates shaded gray. Source: BLS, NBER and author’s calculations.

The standard deviation is 0.0015 for NFP and 0.0023 for civilian employment.

While there is a folk wisdom that the civilian series turns down before the establishment, there is mixed evidence for this in real time (as noted in this post). Civilian employment has declined in May, while NFP has continued to rise. But civilian employment also declined in April, June and October of last year…

More By This Author:

Business Cycle Indicators At June’s Start: Where’s The Recession?

Capture and Ideology, Debt Ceiling Edition

Aggregate Demand Vs. Income: Sometimes An Important Distinction