The Fed Vs Trump: An Interest Rate Tango In 2025

As expected, falling in line with general market expectations, the Federal Reserve didn’t cut rates during their first FOMC meeting of 2025.

In the statement accompanying that decision, the Fed under Chairman Jerome Powell underscored that “inflation remains somewhat elevated.” It maintained that “in considering the extent and timing of additional adjustments” for its rates, leaders on the FOMC will continue to asses incoming data along with a balance of risks.

Notably, the Fed confirmed its intent to action just two rate cuts this year.

However, the Fed’s heavily monitored statement did remove language noting that labor market conditions have generally eased.

But that statement wasn’t the most interesting event for the financial media… it was the Q&A portion that set up what’s ahead.

Powell told reporters, “the committee is very much in the mode of waiting to see what policies are enacted… we need to let those policies be articulated before we can even begin to make a plausible assessment of what their implications for the economy will be.”

So, we turn to the real indicator – the financial world. The more compelling focus for the markets was what Trump might respond with. Indeed, following the Fed’s announcement to leave rates unchanged, Trump criticized the decision, accusing Powell of creating inflation by not cutting rates.

Trump’s view on rates is seemingly have been on a crash course with Powell and the Fed. That’s because, at a January 7th press conference in Mar-a-Lago, Trump declared, "Inflation is still raging, and interest rates are far too high."

Last week, during a video address, he also told a gathering at the World Economic Forum in Davos, Switzerland that, "With oil prices going down, I'll demand that interest rates drop immediately, and likewise, they should be dropping all over the world."

Last year, the Fed cut rates a total of 100 basis points, including. by 25 basis points on its last meeting of 2024, on December 17, to between 4.25% and 4.5%.

Plus, the central bank reduced its 2025 rate cut projections for 2025 to two from a previous four. That was due to expectations of higher inflation levels, uncertainty over the impact of Trump's tariff policies and slightly better growth estimates.

Trump Won’t Fire Powell

Let’s cut to the chase. Chairman Powell’s term expires in May 2026. There have been rumors about Trump firing Powell if he doesn’t promote a more rapid rate-cutting cycle.

President Trump told NBC’s Meet the Press, when asked if he had plans to replace Powell, “No, I don’t think so. I don’t see it.”

Powell has made it clear he won’t leave his post even if Trump asks him to resign, which is available to him.

Trump first appointed Powell, a Republican and a former private equity executive, as chairman of the Board of Governors of the Federal Reserve System in February 2018.

By March 2018, Trump had enacted extensive tariffs on Mexico, Canada, the European Union, the UK, China and more.

During his first term, Trump threatened to fire Powell on repeated occasions. The reasons hinged on disagreements over cutting rates and Powell’s fears that tariffs would be inflationary. But Trump would eventually come to terms with the fact that Powell was legally in place.

By the time President Biden took the White House, he was faced with the opportunity to either keep or replace Powell. In 2022, President Joe Biden reappointed Powell to a second four-year term.

Inflation and Rates Were Lower at the End of Trump 1.0

Now, let’s compare the financial landscape under Trump’s first term in office and what his current term might deliver.

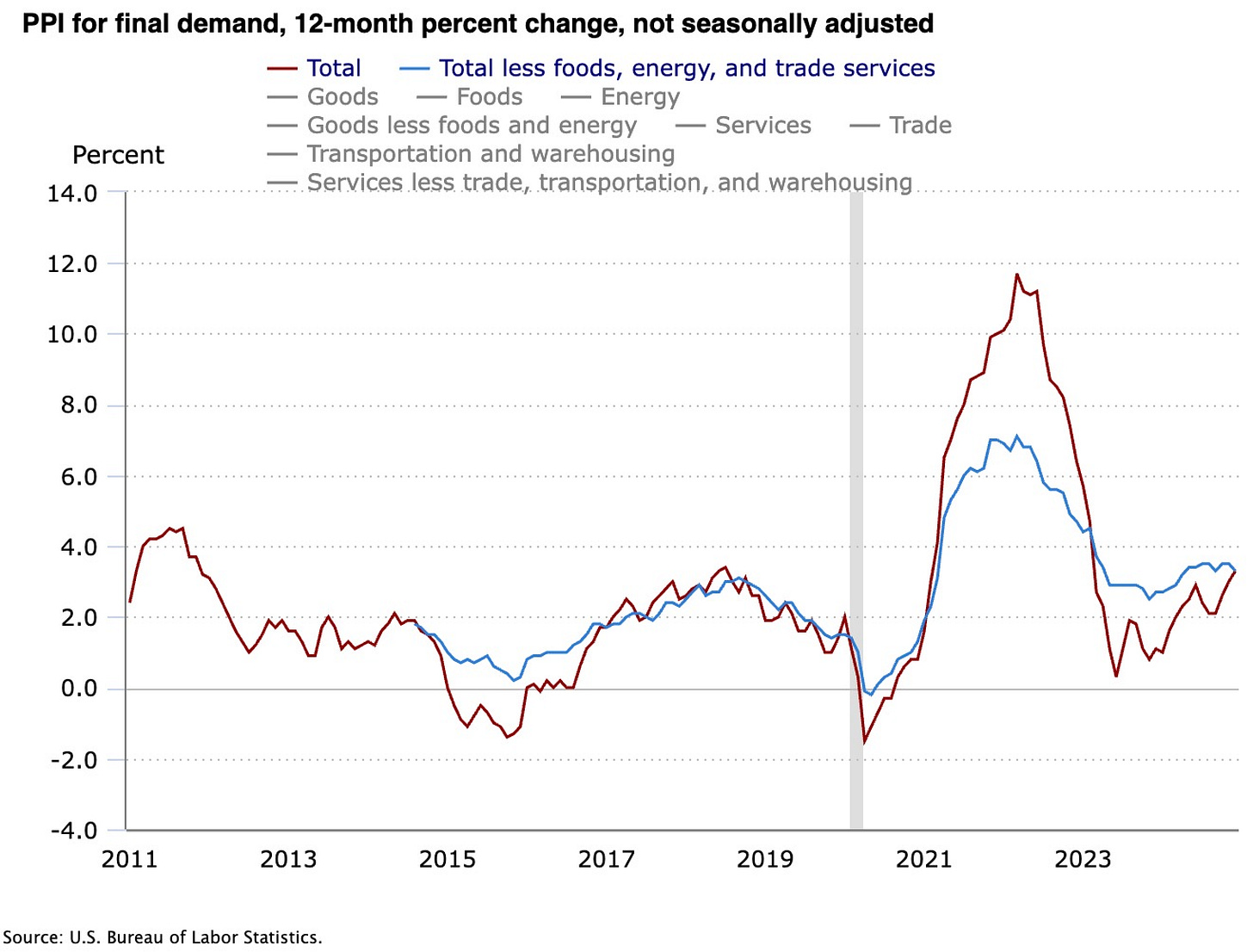

First, we should consider that the annal producer price index (PPI) for 2024 is the same as it was when Trump was in office (and pressing Powell to lower rates), as you can see detailed below.

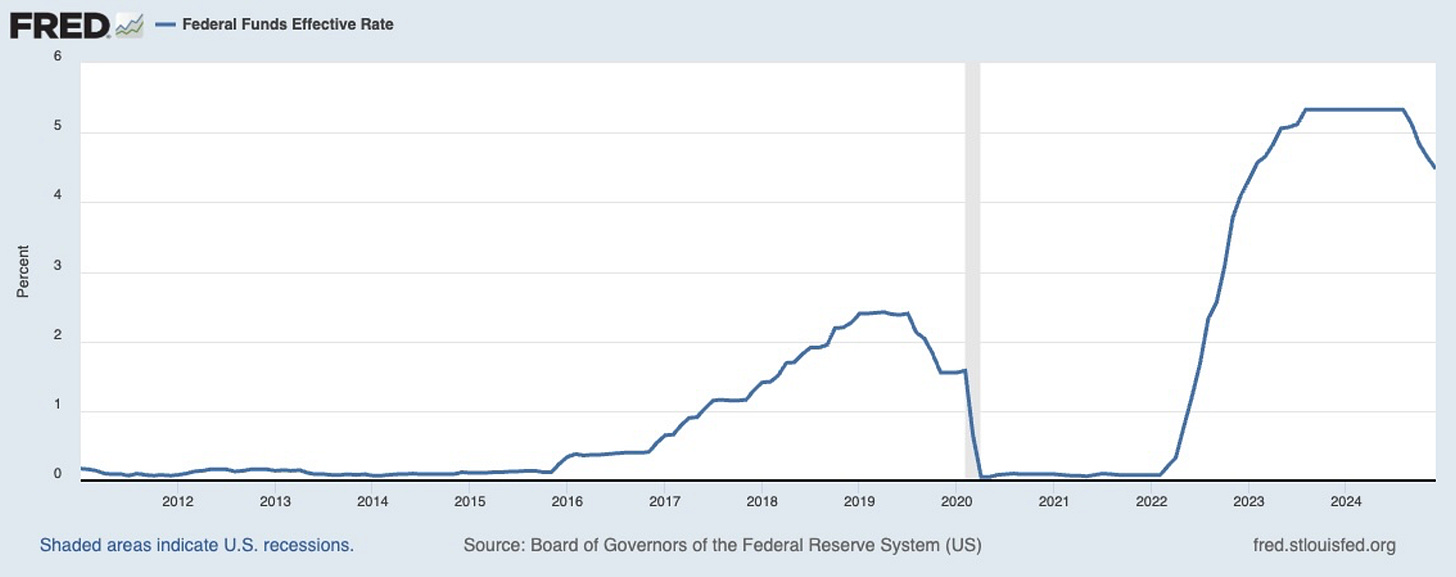

Second, recent history shows us that rates hit a then post-financial crisis high of 2.25-2.50% by mid-2019.

The Fed would then cut rates to 1.5% by November 2019. Rates would remain at those levels until the end of Trump’s first term. As you might recall, that was all before the Fed dropped them to zero at the onset of the COVID-19 pandemic and the financial shocks that would follow.

(Click on image to enlarge)

These two graphs indicate that, if anything, the Fed’s actions lag real-asset inflation. That signals that the Fed’s rate actions are more incidental and not influential over real asset and commodity inflation. Yes, the cost of money does indeed have an impact on financial inflation in areas like mortgage rates and real estate prices – but the Fed’s influence can only go so far. That means the Fed can do little to lower the price of eggs in grocery stores, just like it has no influence over tariffs and trade wars.

Now, regardless of what Trump says, Powell is in a position to flex the Fed’s independence muscle. However, the Fed must eventually realize it can’t truly finetune real asset price inflation to stick to 2% levels.

So, where does this leave us?

The Fed will ultimately need to consider whether economic growth is slowing. And if it is, whether they will require a pivot to more accommodate policies quickly. We saw this just last year with the softening labor market triggering an extra push for the Fed to cut rates.

Expect the Fed to Cut Rates by 100 Basis Points – Not 50 This Year

As we’ve told you in our Money Trends and recent AI Prinsights analysis, we expect market volatility to remain pertinent for the foreseeable future. The battle over rate cuts will only add fuel to that fire.

One of the best ways to accumulate long-term wealth and ride out volatility is by considering allocating a segment of your portfolio to gold. Gold has proven relatively stable during periods of volatility, geopolitical tension, inflation, trade wars and general market disruptions.

That’s why we’re looking forward to sharing an exclusive interview with one of my favorite gold miner CEOs, who sits right at the center of this situation next week. It is a can’t miss!

More By This Author:

Elon’s Next Big Bet On The Future

3 Ways AI Is Sending The Energy Sector Into Overdrive

Interview: Ana Kasparian On Economic Policy, The Working Class And More

Disclosure: None.