The Fed Is Planning To Send Money Directly To Americans In The Next Crisis

Over the past decade, the one common theme despite the political upheaval and growing social and geopolitical instability was that the market would keep marching higher and the Fed would continue injecting liquidity into the system.

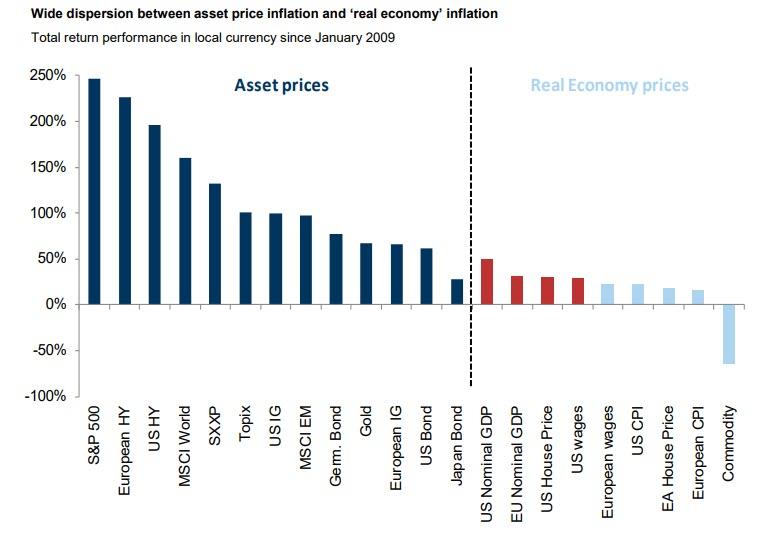

The second common theme was that despite sparking unprecedented asset price inflation, price as measured across the broader economy (at least using the flawed CPI metric) would remain subdued (as a reminder, the Fed is desperate to ignite broad inflation as that is the only way the countless trillions of excess debt can be eliminated, and yet it has so far failed to do so).

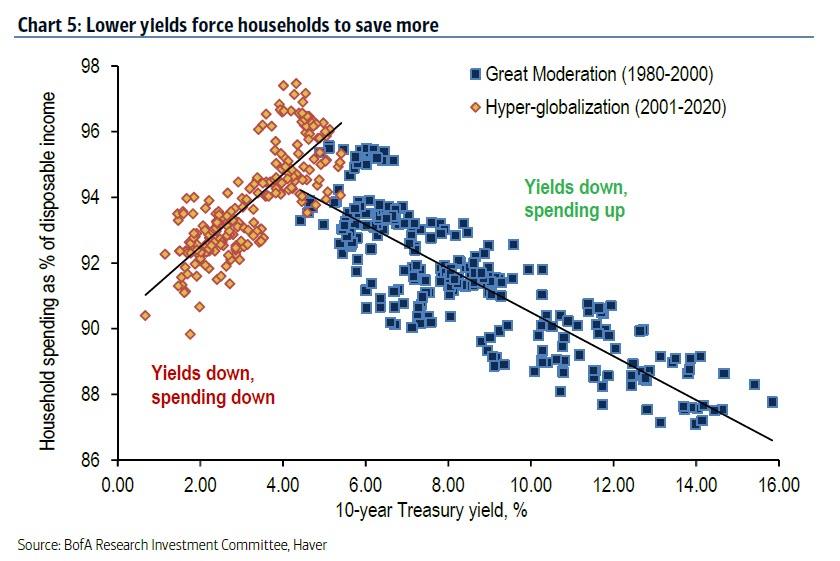

The Fed's failure to reach its inflation target has sparked broad criticism from the economic establishment, even though, as we showed in June, deflation is now a direct function of the Fed's unconventional monetary policies as the lower yields slide, the lower the propensity to spend.

In other words, the harder the Fed fights to stimulate inflation, the more deflation and more saving it spurs as a result (incidentally this is not the first time this "discovery" was made, in December we wrote "One Bank Makes A Stunning Discovery - The Fed's Rate Cuts Are Now Deflationary").

In short, ever since the Fed launched QE and NIRP, it has been making the situation it has been trying to "fix" even worse, all the while blowing a massive asset price bubble.

And having recently accepted that its preferred stimulus pathway has failed to boost the broader economy, the blame has fallen on how monetary policy is intermediated; specifically the way the Fed creates excess reserves which end up at commercial banks instead of "tricking down" all the way to the consumer level.

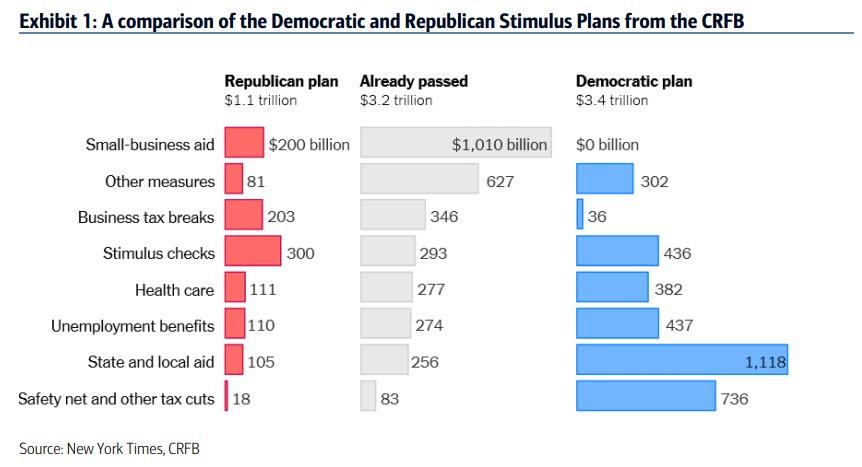

To be sure, the Fed has tried to short-circuit this process, and, in conjunction with the Treasury, it has launched "helicopter money," which has resulted in a direct transfer of funds to US corporations (via PPP loans) as well as to consumers, via the emergency $600 weekly unemployment benefits. Which, however, are set to expire unless renewed by Congress as explained last week, as Democrats and Republicans feud over which fiscal stimulus will be implemented next.

And yet, the lament is that even as the economy was desperately in need of a massive liquidity tsunami, the funds created by the Fed and Treasury (now that the US operates under a quasi-MMT regime) did not make their way to those who need them the most: end consumers.

Which is why we read with great interest a Bloomberg interview published on Saturday, August 1, with two former central bank officials: Simon Potter, who led the Federal Reserve Bank of New York’s markets group i.e., he was the head of the Fed's Plunge Protection Team for years, and Julia Coronado, who spent eight years as an economist for the Fed’s Board of Governors, who are among the innovators brainstorming solutions to what has emerged as the most crucial and difficult problem facing the Fed: get money swiftly to people who need it most in a crisis.

The response was striking: the two propose creating a monetary tool that they call recession insurance bonds, which draw on some of the advances in digital payments, which would be wired instantly to Americans.

As Coronado explains the details, Congress would grant the Federal Reserve an additional tool for providing support — say, a percent of GDP [in a lump sum that would be divided equally and distributed] to households in a recession. Recession insurance bonds would be zero-coupon securities, a contingent asset of households that would basically lie in wait.

The trigger could be reaching the zero lower bound on interest rates or, as economist Claudia Sahm has proposed, a 0.5 percentage point increase in the unemployment rate. The Fed would then activate the securities and deposit the funds digitally in households’ apps.

As Potter then elucidates:

"it took Congress too long to get money to people, and it’s too clunky. We need a separate infrastructure. The Fed could buy the bonds quickly without going to the private market. On March 15 they could have said interest rates are now at zero, we’re activating X amount of the bonds, and we’ll be tracking the unemployment rate—if it increases above this level, we’ll buy more. The bonds will be on the asset side of the Fed’s balance sheet; the digital dollars in people’s accounts will be on the liability side."

And that, in a nutshell, is how the Fed will stimulate the economy in the next crisis in hopes of circumventing the reserve creation process: it will use digital money apps (which explains the Fed's recent fascination with cryptocurrency and digital money) to transfer money directly to US consumers.

To be sure, the narrative is already set for how the Fed will "sell" this direct transfer of money to the rest of the world and the broader US population: as Coronado explains "it’s the most efficient from a macroeconomic standpoint in supporting spending and confidence. The fear of unemployment acts as an accelerant on a recession. There’s a shock — people are losing their jobs or worry about losing their jobs. They get very risk-averse. [By] getting money to consumers you can limit the depth and duration of a recession."

And the kicker:

"you could actually generate real inflation. It could be beneficial for not only avoiding negative rates but creating a more healthy interest-rate market, a more healthy yield curve."

So there you have it: the one thing that was missing from a decade of monetary tinkering by the Fed, the spark of inflation, will finally arrive as the Fed gives money to those most likely to spend it: the lower and middle classes of society.

But wait, there's more: now that the Fed is implicitly focusing on racial inequality, and soon explicitly with Joe Biden going so far as to urge the Fed to fight "racial economic inequality," and former Minneapolis Fed president Kocherlakota writing an op-ed in which he said the Fed "should have a third mandate on racial inquality," the stage is now set for the Fed to specifically release funds for those who have suffered from inequality, and once the time comes when the narrative allows to deploy reparations or direct funding to minorities, the Fed will be ready.

Disclaimer: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more