Staples And Utilities Relatively Close To Their Highs

One simple method or technique I use to determine relative strength in the stock market is what I term “Decline-Advance Ratio Analysis.” It can be applied to various categories of indexes such as broad market, sector, size and style.

The S&P 500 index declined 18.9% from its highest close on February 19th to its lowest close on April 8th. From that low, it is currently up 14.1%, so the decline-to-advance ratio stands at 0.75. We have yet to see if that April low is the bottom or not. The index is about 7.4% below its previous high level.

I performed the same calculations for the 11 sector indices that comprise the S&P 500 index by using their tracking Exchange Traded Funds (ETFs). They reached their peaks at very different times, but all made their lows on the same date as their mother index - except for health care (April 21st).

Materials, consumer discretionary and technology fell the most, but consumer staples and utilities fell the least during the decline. Technology and industrials are up the most, and health care and consumer staples are up the least from their lows in April. On a ratio basis, utilities, financials, industrials, consumer staples and technology are the best sector ETF performers.

Sometimes it turns out that the instruments that declined the least will advance the most and outperform the others. Here, consumer staples and utilities held up relatively well in the declining phase, but the former sector is the second worst performer in the advancing phase. Nevertheless, these two sectors are closest to their prior highs from February 25th and November 29th, or only 1.9% and 2.4% away respectively. Both are considered defensive or risk-off sectors. Technology, a true offensive or risk-on sector, has risen 20.5% after dropping 25.7%.

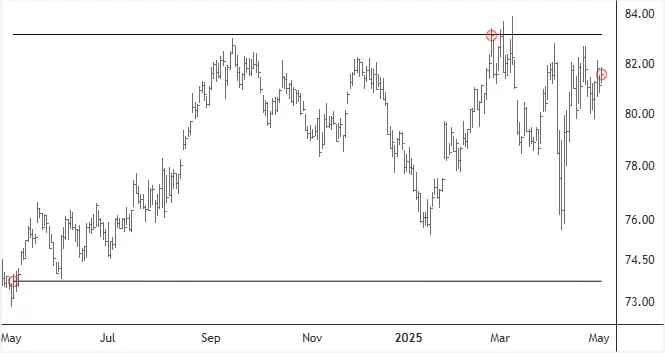

The two charts below show where the current prices of the consumer staples (XLP) and utilities (XLU) ETFs are located within their one-year ranges.

XLP - Daily Chart

XLU - Daily Chart

More By This Author:

S&P 500 Index At Juncture Point

Silver To Gold Price Ratio Near All-Time Low

U.S. Equity Markets Have Probably Entered Their Capitulation Phase

Disclosure: The author of the analysis presented does not own shares or have a position or other direct or indirect monetary interests in the financial instrument or product discussed in his ...

more