Silver To Gold Price Ratio Near All-Time Low

Image Source: Pixabay

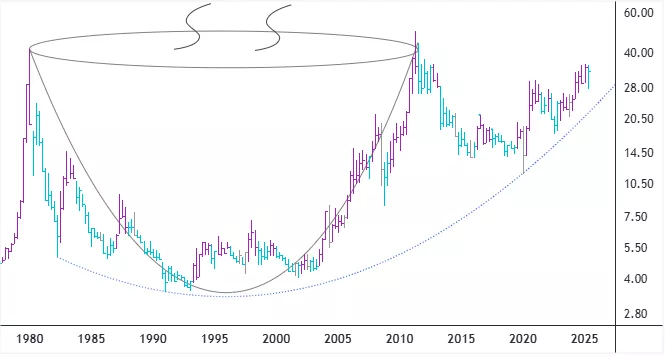

In nominal terms, the price of silver has formed a very large, multi-decade type of cup and handle pattern. I think it is the longest such formation in a duration that I have ever witnessed in my lifetime. It seems like the handle has been made and the price is setting itself up for a vertical launch or thrust to the upside.

At the moment, as with most other price chart formations, this is only a potential cup and handle pattern. In other words, now it is just a condition - not a signal yet. Price action must confirm it by rising convincingly through the $36 per ounce level and, preferably, stay there above going forward. Bear in mind that the prices of gold and silver can be very volatile.

Currently, the price ratio between silver and gold stands at 1.0 – meaning the price of silver is only 1% of the price of gold. Historically, that is a very low percent value; in fact, the all-time ratio low was set at about 0.9 in early 2020. If silver´s price begins to accelerate to the upside, then I expect it to outperform gold´s price on a relative basis in the forthcoming months.

Price of Silver - Quarterly Chart

Price of Silver and Silver to Gold Ratio – Monthly Chart

More By This Author:

U.S. Equity Markets Have Probably Entered Their Capitulation Phase

Housing Related Stock Prices Seeking A Bottom

XAU Has Likely Broken Out To The Upside

Disclosure: The author of the analysis presented does not own shares or have a position or other direct or indirect monetary interests in the financial instrument or product discussed in his ...

more