SPY May Pull Back

Image Source: Pexels

SPX Monitoring purposes; Sold long 6/5/25 at 5936.30 = gain .033%; long SPX on 5/15/58 at 5916.93

Our gain 1/1/24 to 12/31/24 = 29.28%; SPX gain 23.67%

Our Gain 1/1/23 to 12/31/23 SPX= 28.12%; SPX gain 23.38%

Monitoring purposes GOLD:Sold long GDX 4/11/25 at 49.66 = gain 21.33%.

We ended up 29.28% for 2024; SPX up 23.67% for the year. SPY not giving a clear sign as volume studies lean bearish and TRIN and Tick closes lean bullish (noted in shaded blue). We noted in red that the SPY may pull back to in the coming days which is also where a gap lies which is near the 570 level. Not see a good setup for now; however the bigger trend remains up and new highs may be seen later this year.

(Click on image to enlarge)

Above is the weekly SPY. Last week the SPY broke above its previous high of two weeks ago on 8% lighter volume, suggesting a false break to the upside. If a market can’t break above a previous high on equal or greater volume, it will reverse and attempt to take out its previous low. The previous low in this case is also the low of two weeks ago which is near 575 SPY and a possible down side target. The pattern forming appears to be a Head and Shoulders pattern that has a measured target near 740 range which is over 23% higher than current levels. May see a decent bullish setup near 570 SPY.

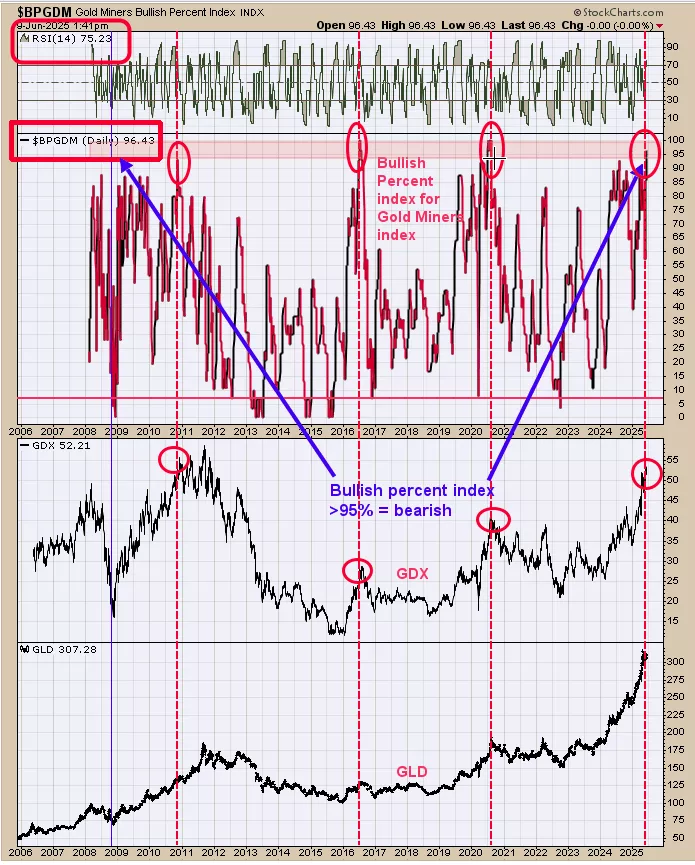

The bottom window is the GLD and next higher window is the GDX and next higher is the Bullish percent index for the Gold miners index (BPGDM).This chart goes back to 2006.The Bullish percent index measures the percent of stocks in that index that are on “point and figure” buy signals. The BPGDM is at 96.43% showing that 96.43% of the stocks in the Gold miner’s index are on “point and figure”buy signals.You would think that is bullish for the Gold Miners index?We noted with red dotted lines the times when the BPGDM reached 95% and higher; and all occasion produced at least a pull backThe evidence suggests a pull back is likely and possible target is still the 39.00 range on GDX.

More By This Author:

SPY Forming A Head And Shoulders Pattern

New High In The Stock Market

SPY Momentum Builds As RSI Approaches Key Level

Signals are provided as general information only and are not investment recommendations. You are responsible for your own investment decisions. Past performance does not guarantee future performance. ...

more