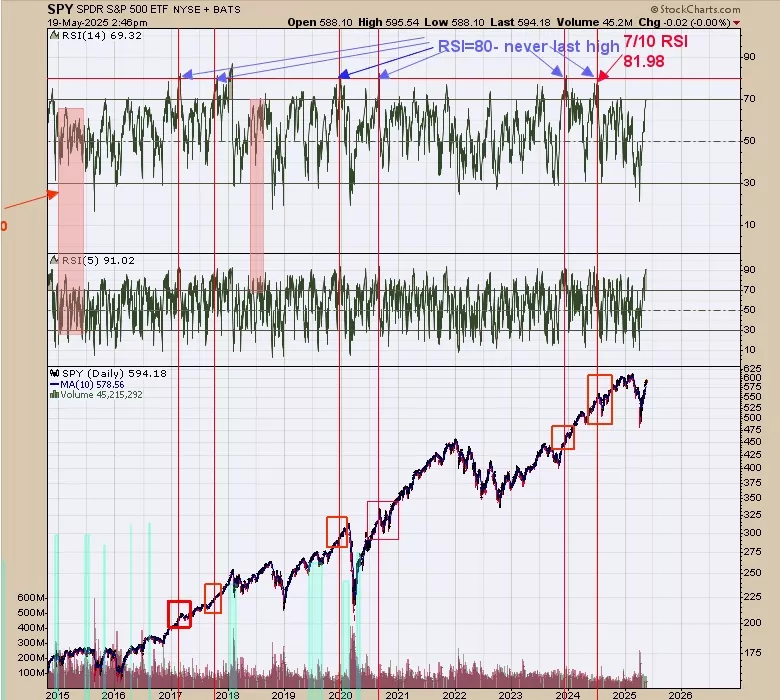

SPY Momentum Builds As RSI Approaches Key Level

Image Source: Unsplash

- SPX Monitoring purposes; long SPX on 5/15/58 at 5916.93

- Our gain 1/1/24 to 12/31/24 = 29.28%; SPX gain 23.67%

- Our Gain 1/1/23 to 12/31/23 SPX= 28.12%; SPX gain 23.38%

- Monitoring purposes GOLD: Sold long GDX 4/11/25 at 49.66 = gain 21.33%.

We ended up 29.28% for 2024; SPX up 23.67% for the year. Above is a momentum chart for the SPY. The top window is the daily 14 period RSI for the SPY. SPY appears to be in a momentum move. For that to be confirmed, the daily RSI for the SPY must reach +80 range (noted with red lines). When the daily RSI hits +80 it’s never the last high. The last time the RSI hit +80 came on July 10, 2024 and then moved higher into January 2025. Current RSI reading is 69.32; for the RSI to reach +80, the current rally would have to continue with small pull backs on the way higher.

We shaded in light blue where the TRIN close was above 1.20 and the Tick closed <-200; these readings appear to be the current panic levels for identifying the lows. Previously, we had TRIN closes above 1.20 with tick closes below -300 to define short-term lows. Statistics change slowly over time. Last Thursday’s TRIN closing at 1.39 and tick close of -243 triggered a buy signal. SPY was up 5 days in a row going into last Friday, suggesting the market will be higher within five days 83% of the time (momentum matters). The market wants to go up. Long SPX on 5/15/25 at 5916.93.

The top window is the daily GDX. It appears a “Three Drives to a top” is forming. This pattern has a downside target to where the pattern began, which is near the 39.00 range. It is said that “Three drives to A top” are not long-term topping patterns but rather a “timeout” in an uptrend; so once the 39.00 range is tested, it’s expected the uptrend to resume. A gap formed near the 48.00 range on 42 million shares on May 12. GDX may be attempting to test this gap on the current bounce. The gap will have resistance, which is tested on 39 million shares or less (which is likely). In general, the current pullback that started in mid-April is expected to continue, possibly into the July 4 holiday.

More By This Author:

Three Gap PlayPotential Pull Back

The Potential SPY Bounce Will Be Limited

Signals are provided as general information only and are not investment recommendations. You are responsible for your own investment decisions. Past performance does not guarantee future performance. ...

more