Should Investors Buy Alphabet Stock Before It's Too Late?

The tech stock decline could offer investors what many see as a once-in-a-lifetime opportunity. While this may be reaching, big tech stocks such as Amazon (AMZN) and Alphabet (GOOGL) are trading at their cheapest levels in over a decade after their 20-for-1 stock splits.

Alphabet recently dipped below the $100 a share level after routinely trading over $2,000 pre-split. The lower price makes the stock more attainable to many investors and offers a great chance to buy Alphabet shares for the long haul.

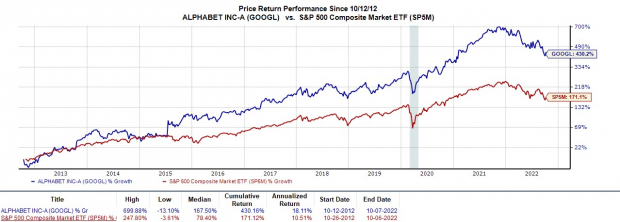

When considering GOOGL’s 10-year price performance the current stock price does appear to be a compelling opportunity. As shown in the nearby chart, GOOGL is up +430% over the last decade to crush the benchmarks +171%.

Image Source: Zacks Investment Research

Also, there are two classes of Alphabet stock – (GOOG) and GOOGL. GOOGL trades slightly higher, but the main difference is that GOOG shareholders have no voting rights, while GOOGL shareholders do.

Alphabet’s Transformation

Formally Google, Alphabet changed its name to better highlight growth opportunities among its other businesses. Alphabet is considered one of the more innovative companies in the modern technology age. The company is still a search-engine powerhouse, but Alphabet has transformed itself to include cloud computing, ad-based video, music streaming, and autonomous vehicles.

Recent Performance

Trading 35% off its highs, investors may want to consider GOOGL for an eventual rebound among tech stocks. GOOGL is down -32% year to date to underperform the S&P 500’s -22% drop. This is also the same as the Nasdaq’s -32% fall as the technology sector has been riddled by higher interest rates and slowing consumer spending.

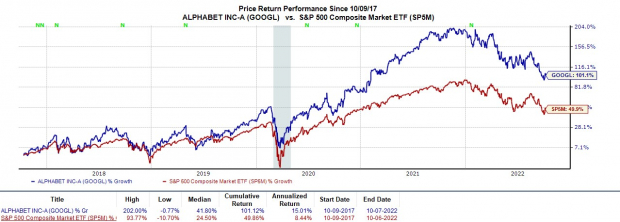

Image Source: Zacks Investment Research

Over the last five years, GOOGL is up +101% crushing the benchmark’s +50%, the Nasdaq’s +64%, and the Internet Services Markets +72%.

Beyond its stellar performance in the past and the attractive post-split stock price, let’s take a look at GOOGL’s valuation to gain further insights on whether it’s time to buy.

Valuation

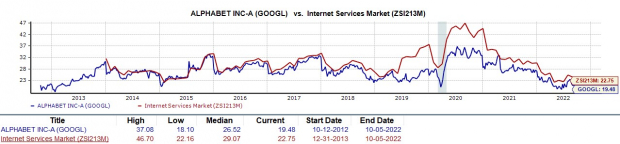

At current levels, GOOGL has a forward P/E of 19.4X which is near the industry average. This is also below the Internet Services Market’s 22.7X. Even better, GOOGL trades well below its 10-year high of 37X and the median of 26.5X.

The move to cloud computing could be very beneficial long term but the unit also lost $858 billion during the second quarter and faces stiff competition from Amazon’s AWS and Microsoft’s (MSFT) Azure. Alphabet’s video streaming service YouTube also faces competition from the increasingly popular TikTok.

With that being said, Alphabet’s search revenue remains strong and advertising revenue also increased during the second quarter despite declines from YouTube. Investors may not want to be overly optimistic about ad revenue after the warning of slowing advertiser spending from social media platforms such as Snapchat (SNAP) during the second quarter. However, Alphabet’s platforms should still fair well due to their popularity.

Last year google topped the U.S. digital ad space, controlling an estimated 26.4% of the market, topping Facebook (FB) and Amazon.

Bottom Line

Although there may be more risk ahead for Alphabet and the broader technology sector, investors might want to start considering GOOGL stock. GOOGL currently sports a Zacks Rank #3 (Hold) and its Internet-Services Industry is in the top 25% of over 250 Zacks Industries.

This year’s decline is starting to present long-term opportunities. From a valuation perspective, GOOGL trades at a discount relative to its past. This combined with its steady growth may be attractive to longer-term investors. Plus, the average Zacks Price Target offers 45% upside from current levels.

Image Source: Zacks Investment Research

Google appears to be trading at a discount relative to its past, and its continued growth will be critical to the value investors get from buying the stock.

Outlook

Alphabet’s earnings are expected to be down 7% this year but rise 11% in FY23 at $5.80 a share. Top-line growth is expected, with FY22 sales projected to climb 11% and another 10% in FY23 to $260.44 billion.

While Google is experiencing top-line growth this year, operating costs have weighed on FY22 earnings. During the second quarter, its autonomous vehicle segment Waymo, health tech projects, and venture projects lost $1.69 billion. While this looks to be better managed in FY23 investors will want to monitor Alphabet’s innovation costs.

More By This Author:

Airline Stock Roundup: Allegiant's Q3 Revenue View Down, September Traffic Upbeat At Ryanair

Forget Negativity; 3 Inspiring Acquisitions In 2022

PepsiCo Earnings Preview: Should Investors be Thirsty for PEP Stock?

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more