Airline Stock Roundup: Allegiant's Q3 Revenue View Down, September Traffic Upbeat At Ryanair

Image: Bigstock

In the past week, Allegiant Travel (ALGT - Free Report) updated its projections for the September quarter, taking into account the likely impact of Hurricane Ian. With air-travel demand rebounding from the pandemic lows, Ryanair Holdings (RYAAY - Free Report) transported 13% more passengers in September than three years ago.

Again, owing to the favorable air-travel demand scenario, consolidated traffic at Gol Linhas (GOL - Free Report) increased 41.4% in September from the year-ago level. The proposed merger between JetBlue Airways (JBLU - Free Report) and Spirit Airlines (SAVE - Free Report) got the support of two prominent proxy firms. Read the last Airline Roundup here.

Recap of the Latest Top Stories

ALGT now expects third-quarter 2022 operating revenues to increase 27.5% from the third-quarter 2019 actuals (earlier outlook hinted at growth of 29%).

Per Drew Wells, senior vice president, revenues at Allegiant, “The impacts from Hurricane Ian have resulted in the cancellation of the majority of our flights touching Florida over the course of the next few days. Although the situation is still developing, we believe the impacts from Ian will bring down our revenue guide by 1.5 percentage points."

Total system capacity (measured in available seat miles) for the September quarter is anticipated to rise 14.5% from the level reported three years ago (earlier outlook hinted at 16% approximate growth). Scheduled service capacity for the September quarter is now anticipated to rise roughly 17% from the third-quarter 2019 actuals (earlier outlook hinted at growth of nearly 18%).

Cost per available seat miles (excluding fuel) is now expected to increase in the 13-14% range from the third-quarter 2019 actuals (earlier guidance called for a 10% increase). Fuel cost per gallon is now expected to be $3.87 per gallon (earlier guidance: $3.80).

In September, RYAAY’s passenger volume was a robust 15.9 million compared with 10.6 million a year ago. Load factor (the percentage of seats filled by passengers) was 94% in September 2022 compared with 81% a year ago. Ryanair aims to increase its traffic in fiscal 2023 to 165 million, indicating 11% growth from the pre-COVID-19 traffic numbers.

In September, Gol Linhas’ consolidated load factor improved 2.6 percentage points to 81.7%, with traffic growth outpacing the capacity expansion of 36.9% year-over-year. The upbeat traffic in its domestic markets is leading to a rosy scenario on a consolidated basis.

In September, domestic traffic and capacity improved 27% and 23%, respectively. On the domestic front, 27.9% more passengers boarded GOL’s flights in September 2022. Domestic load factor was 81.7%. The volume of departures and seats increased 24.5% and 24%, respectively.

JetBlue’s impending $3.8-billion takeover of Spirit Airlines was backed by two independent proxy advisory firms, namely Institutional Shareholder Services and Glass, Lewis & Company. The firms recommended that shareholders of SAVE vote in favor of the deal at its special meeting on Oct. 19.

Expressing delight at winning their backing, SAVE’s president and CEO Ted Christie said, “We appreciate that both of the leading proxy advisory firms recognize the merger agreement with JetBlue is the best path forward for Spirit, creating significant value for our stockholders and enhancing our ability to grow and compete with the dominant U.S. carriers.”

Performance

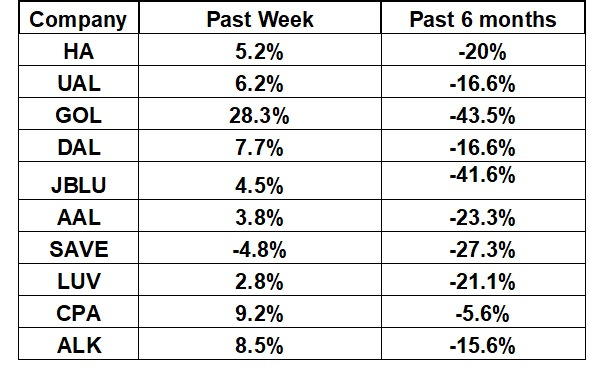

The following table shows the price movement of the major airline players over the past week and during the last six months.

Image Source: Zacks Investment Research

The table above shows that almost all airline stocks have traded in the green over the five trading days. The NYSE ARCA Airline Index has increased 8.6% to $54.53. Over the past six months, the NYSE ARCA Airline Index has plummeted 27.7%.

What's Next in the Airline Space?

Investors would keenly await the third-quarter 2022 results of Delta Air Lines (DAL - Free Report), scheduled to be out on Oct. 13. We expect strong air-travel demand to have aided the top-line performance of DAL. However, high fuel costs are likely to have dented its bottom line.

Our proven model does not predict an earnings beat for Delta this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy), or 3 (Hold) increases the odds of an earnings beat.

However, this is not the case here. Delta presently has an Earnings ESP of -2.50% (the Zacks Consensus Estimate is pegged at $1.57 while the Most Accurate Estimate is currently 4 cents lower) and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

More By This Author:

Forget Negativity; 3 Inspiring Acquisitions In 2022

PepsiCo Earnings Preview: Should Investors be Thirsty for PEP Stock?

Bull of the Day: Air BnB

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more