Forget Negativity; 3 Inspiring Acquisitions In 2022

Image: Bigstock

It’s easy to get caught up in all the negative news headlines we’ve received in 2022. Investors seemingly can't catch a break, whether that be a hawkish Fed, geopolitical issues, or lingering COVID-19 effects spoiling the fun.

However, when taking a step back, several notable announcements seem to have been forgotten amidst all the negativity. And they’re not small announcements by any means, either. We’re talking about significant acquisition news from large-cap tech companies.

Alphabet (GOOGL - Free Report), Microsoft (MSFT - Free Report), and Broadcom (AVGO - Free Report) have all announced major acquisitions in 2022, indicating that they are still laser-focused on growth opportunities. Let’s take a deeper dive into each acquisition a little further.

Broadcom To Acquire VMware

Broadcom announced its plans to acquire VMware (VMW - Free Report) in a cash-and-stock transaction valued at approximately $61 billion in May, expected to close in Broadcom’s FY23. VMware is a leading provider of multi-cloud services for all apps, having pioneered virtualization technology, an innovation that has positively transformed x86 server-based computing.

The combined company will offer enterprise customers a broader platform of critical infrastructure solutions to help them accelerate innovation and address the most complex information technology infrastructure requirements.

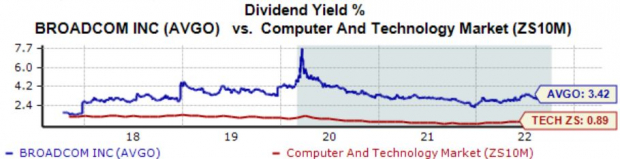

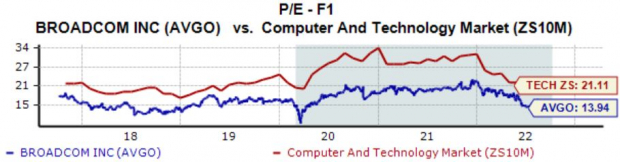

It’s been a challenging road for AVGO shares in 2022, down nearly 30%. However, the company’s dividend metrics are too hard to ignore; AVGO’s annual dividend yield sits at a steep 3.4%, visibly higher than the Zacks Computer and Technology sector average of 0.9%. Further, the company carries a massive 26.3% five-year annualized dividend growth rate.

Image Source: Zacks Investment Research

For the cherry on top, Broadcom shares are cheap for a technology company – the company sports a 13.9X forward earnings multiple, well below its 16.6X five-year median and reflecting a sizable 34% discount relative to its Zacks sector.

Image Source: Zacks Investment Research

Microsoft To Acquire Activision

Microsoft made a big splash earlier this year, putting forward its plans to acquire Activision Blizzard (ATVI - Free Report) for a whopping $68.7 billion - the largest acquisition in the video game industry’s history.

Activision Blizzard is a video game development and interactive entertainment content publisher best known for its Call of Duty franchise. The reasons behind the deal are clear – Microsoft wants to bolster its stance in the video game industry.

MSFT shares have been no exception to the market’s woes in 2022, down 30%. However, the company is still forecasted to grow at a solid pace; earnings are forecasted to climb 9.2% in FY23 and a further double-digit 16% in FY24. Pivoting to the top line, estimates suggest revenue growth of 11% and 13.4% in FY23 and FY24, respectively.

Image Source: Zacks Investment Research

Alphabet Acquires Mandiant

In March of this year, Alphabet told its plans to acquire Mandiant for a price tag of $5.4 billion. The deal was completed in September. Mandiant is a dynamic provider of cyber defense and response solutions, utilizing its cloud-based Mandiant Advantage software as a service (SaaS) platform. It’s a clear attempt from Alphabet to capitalize on the rapidly growing cloud computing market, with Mandiant joining forces with Google Cloud.

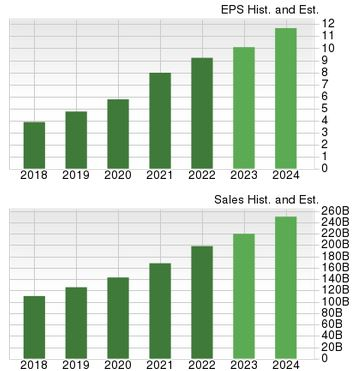

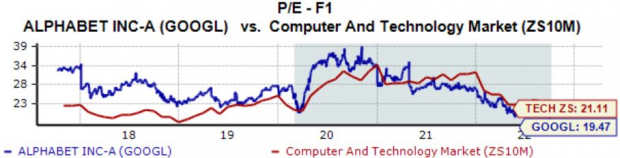

The adverse price action in 2022 has caused GOOGL’s forward earnings multiple to slide down to 19.5X, nowhere near its five-year median of an expensive 26.8X. Further, the value reflects a respectable 8% discount relative to its Zacks sector.

Image Source: Zacks Investment Research

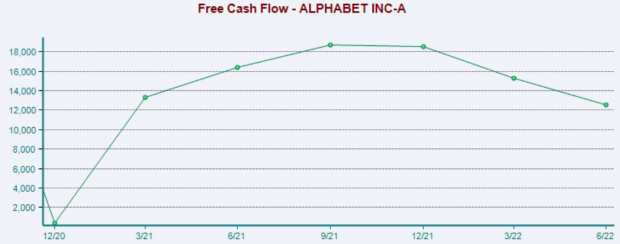

Alphabet generates serious cash – in its latest print, the company reported quarterly free cash flow of $12.6 billion, the fourth highest of any S&P 500 company in Q2 2022.

Image Source: Zacks Investment Research

Bottom Line

While negative sentiment has been widespread all year, there are still many positive announcements we’ve received from companies, including acquisitions from the three titans above.

Acquisitions allow for a vast range of growth opportunities and for companies to get their hands on impressive talent. Further, acquisitions speak volumes about a company’s future roadmap, telling us that it's willing to pursue long-term growth opportunities.

All three companies above – Alphabet (GOOGL - Free Report), Microsoft (MSFT - Free Report), and Broadcom (AVGO - Free Report) – have all taken on notable acquisitions in 2022.

More By This Author:

PepsiCo Earnings Preview: Should Investors be Thirsty for PEP Stock?Bull of the Day: Air BnB

Bear Of The Day: Eagle Bulk Shipping

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more