PepsiCo Earnings Preview: Should Investors Be Thirsty For PEP Stock?

Investors will get a taste of how PepsiCo (PEP) is handling the increasingly tough operating environment when it releases its third quarter FY22 financial results on Wednesday, October 12.

While many businesses struggle during high inflationary periods, investors hope that PepsiCo can excel or at least shrug off the current economic downturn. PEP’s stock has performed considerably better than the broader market this year and may very well help investors fight inflation.

PepsiCo and rival Coca-Cola (KO) have historically been defensive hedges amidst economic uncertainty given their standing as consumer staples giants.

Let’s take a look at what to expect from PEP’s Q3 earnings release to see how PepsiCo is performing during the economic uncertainty.

Overview

Trading roughly 10% from its highs, it will be important to see if consumers’ thirst for PepsiCo’s products continued during the third quarter. PepsiCo has also diversified its business to include complimentary brands like Frito Lay Snacks, Gatorade sports drinks, Tropicana juices, and Quaker foods.

Last quarter PEP beat earnings expectations by 7% and sales remained stable despite consumers dealing with rising expenses such as gas. CEO Ramon Laguarta mentioned that while PepsiCo is concerned about rising inflation PEP had not seen a shift in consumer purchasing behavior.

Performance

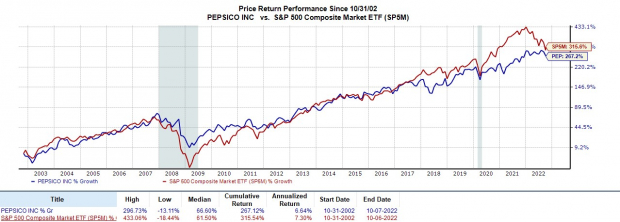

PEP is only down -6% year to date, outperforming the S&P 500’’s -22%, as investors look for stability amid market uncertainty. Although the S&P 500’s +315% climb, beat PEP’s performance over the last 20 years, we can see from the nearby chart that PEP stock held up much better than the broader market during the financial crisis.

(Click on image to enlarge)

Image Source: Zacks Investment Research

If we take the most recent five years of the 20-year chart and focus on the total return including dividends, we will see that PEP has outperformed the benchmark. PEP’s impressive +70% total return outpaced the S&P 500’s +64%. This also crushed rival Coca-Cola’s +20% total return. PEP’s total return in the last year is +4%, which also topped the benchmark’s -16% and KO’s return is virtually flat.

(Click on image to enlarge)

Image Source: Zacks Investment Research

Outlook

The Zacks Consensus Estimate for PEP’s Q3 earnings is $1.84 a share, which would represent a 3% increase from Q3 2021. Sales for Q3 are also expected to be up 3% at $20.85 billion. Estimates for the period have mostly stayed the same over the past two months.

Year over year, PEP is projected to post 6% earnings growth in 2022, with its FY23 earnings set to grow another 8%. Solid top line growth is also expected, with FY22 sales projected to rise 5% and another 3% in FY23 to $86.74 billion.

PepsiCo is also expected to see 7.6% earnings growth over the next five years, which Is above Coca-Cola’s 6.4%.

Valuation

Trading around $162 a share, PEP has a forward P/E of 24.4X. This is lower than its high of 27.8X over the last decade and not too far from the median of 21.6X.

PEP’s P/E is slightly higher than the industry average of 22.3X, which is on par with rival KO as well. However, investors have historically been willing to pay a premium for PEP compared to its industry.

PEP’s cash flow per share of 8.1 is higher than the industry average of 0.5 and KO at 2.6. PepsiCo’s higher cash flow could certainly be important in the current economic downturn as operating costs could rise.

Bottom Line

PepsiCo’s third quarter earnings are much anticipated and will help investors get a clearer view of how consumer spending behavior has affected the company. This will also give insight into PEP’s stock being a potential hedge against inflation or if the current economic conditions have started to weigh on the company.

PEP currently has a Zacks Rank #3 (Hold) and its Beverages-Soft Drinks Industry is in the bottom 32% of over 250 Zacks Industries. However, PEP’s 2.83% annual dividend yield at $4.60 a share helps investors add solid income as well.

While PepsiCo’s dividend yield is lower than Coca-Cola’s 3.20% yield, the combination of a solid dividend along with its growth has helped the stock outperform its rival and the benchmark over the last five years.

More By This Author:

Bull of the Day: Air BnBBear Of The Day: Eagle Bulk Shipping

Biohaven Ltd. Surges 7.6%: Is This An Indication Of Further Gains?

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more