September US Crop/S&D Reports - Lower Midwest Yields Pulled US Crop Outputs Down

Market Analysis

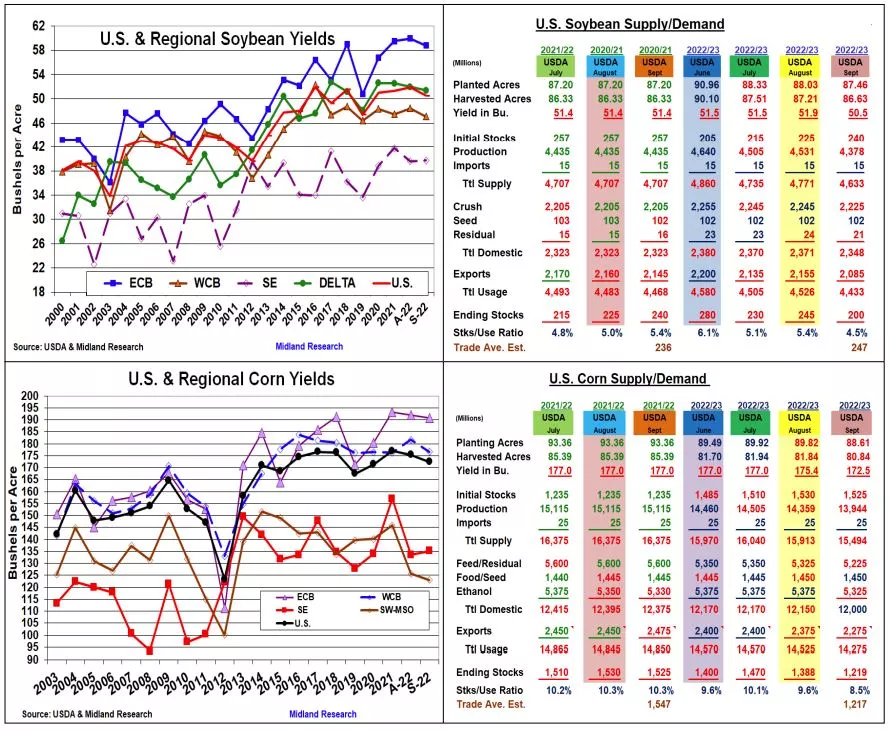

The USDA’s latest updates revealed lower US corn & soybean yields, crop sizes and new-crop endings stocks then the trade were expecting. Adding to the 2022 output changes were substantial changes in this year’s US corn and soybean acreages. Corn’s harvested area was decreased by 996,000 acres lead by states west of the Mississippi River (except +200K in Iowa). Soybeans harvested area was also cut by 580,000 acres with lower IL, IA & SD plantings leading the smaller seedings. These area changes prompted today’s smaller US crop forecasts.

September’s US bean yield was the biggest surprise when it was cut 1.4 bu to 50.5. 2022’s late season heat & dryness except for a couple of hefty thunderstorm streaks that occurred in the central US decreased the Midwest yields. The east was off 1.1 bu while the west dipped 1.4 bu. Moisture improved the SE yields (+0.2 bu) while excessive rains curtailed the Mid-South (-0.6 bu). Overall, this month’s soybean crop was reduced 156 million to 4.378 billion bu. The USDA lowered both old-crop’s (-15 million) and new-crop’s exports (-70 million bu) and sliced 20 million in 2022/23’s crush demand. This lowered 2022/23’s ending stocks to 200 million, down 45 million bu from August.

September’s 172.5 US corn yield was near expectations. However, this month’s reduced area lowered the US output by 415 million bu to 13.944 billion bu, which was 144 million below the trade’s average estimate. With 480,000 of September’s reduced harvested acres in the WCB and the region’s yields being down 5.1 bu, this area accounts for 292 million bu of this month’s smaller US crop. This smaller supply prompted the World Board to aggressively trim the upcoming 2022/23 demand levels. They sliced 100 million from both feed & exports while also reducing ethanol’s usage by 50 million. This dipped new-crop corn stocks to 1.219 billion. This is near the trade’s expectations, but this leaves little room for any further smaller yields.

With the US Small Grain report out September 30, no US output or demand changes in wheat were made this month.

What’s Ahead:

This month’s smaller US soybean & corn crops are positive for prices. However, La Nina weather concerns in South America delaying their plantings or a Black Sea flare-up curtailing their exports are probably needed for a big upside push with the US harvest just ahead.

Utilize the $15.00-20 & $7.00-05 price points to have your 2022 bean & corn sales at our 45% & 35% suggested levels.

Hold wheat.

More By This Author:

Western Midwest Heat/Dryness Vs. The ECB Moderation - The Big Question

US ECB Corn & Bean Counts Couldn’t Cover WCB Heat/Dryness

Weather Remains A Big US Corn And Soybean Yield Factor

Disclaimer: The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of any futures brokerage firm or its ...

more