Weather Remains A Big US Corn And Soybean Yield Factor

Photo by Adrian Infernus on Unsplash

Market Analysis

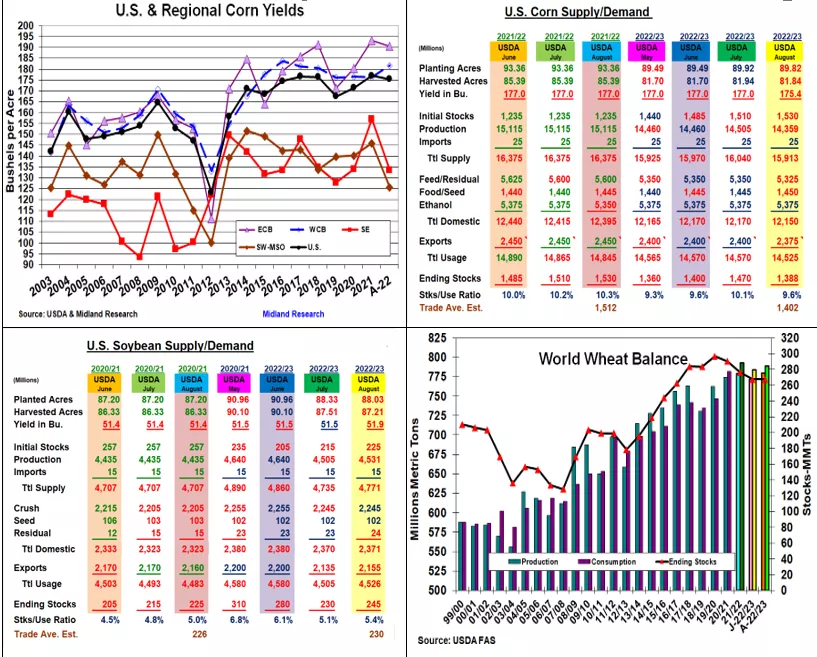

Given 2022’s low US crop ratings, the market was expecting lower August US corn & soybean crops this month. The USDA, however, mixed it up with a lower US corn yield while their US soybean yield was higher. Despite current ratings being the lowest since 2019’s extreme wet spring, 2022’s August soybean yield forecast is at the same level as 2016’s record annual average. This month’s US wheat crop rose 2 million bu. Spring wheat output is up while winter wheat’s US crop is lower.

The USDA’s August US corn output of 14.359 billion bu came from lower eastern Midwest yields (2.8 bu), higher western Midwest yields (5.4 bu), and sharply lower SE (23.6) & SW (20.2) yields than 2021. Last year’s heat and dryness in the N Plains shifting to the southern half of the US dramatically changed regional output. For the 2nd year, the USDA’s August crop has been below the trade vs the USDA being above the trade estimate for 6 years going back to 2015. The USDA sliced 25 million from ethanol’s old-crop demand & 25 million bu from corn’s 2022/23 feed and export forecast. However, this month’s 146 million smaller crops lowered corn’s 2023 stocks to 1.388 billion bu.

The N Plains resurvey revealing 300,000 lower bean acres in the Dakotas countered the USDA’s higher Midwest yields. This limited the US crop to 4.531 billion, up just 26 million vs July. The World Board sliced 10 million from old-crop exports but increased its overseas demand by 20 million in the 2022/23 balance sheet. Overall, soybeans ending stocks increased just 15 million to 245 million bu.

USDA rearranged wheat’s old-crop US S&D. They upped food demand, lowered feed usage & slightly decreased exports. Overall, 2021/22’s US stocks stayed at their June 30th 660 million bu level. These adjustments prompted a 6 million increase in 2022/23’s food demand. The USDA upped Russia’s & Australia’s crops by 6.5 and 3 mmt this month, but they reduced India by 3 mmt & the EU by 2 mmt. They upped US exports by 25 million dropping US stocks to 610 million and kept world stocks at 7-year lows.

What’s Ahead:

Given the generally low US 2022/23 carryovers, the balance of the 2022 US growing season remains important, particularly in the Western Midwest. Various field reports and Pro Farmer’s Midwest crop tour in 8 days doing field samples from corn and soybean fields from Ohio to S. Dakota will be watched closely. Hold 2022/23 soybean sales at 45%, corn at 33%, and wheat at 25%.

More By This Author:

Weather May Nip Corn & Soy Yields, But Will Resurvey Show More Beans?

US Wheat Stocks Remain Tight, But US Weather Remains Focus

Pre-July U.S. S&D/Wheat Updates - Despite A Lower U.S. Soybean Acreage, The Market Focus Is On Weather

Disclaimer: The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of any futures brokerage firm or its ...

more