Retail Sales Growth Marginally Improves In November 2018?

Retail sales were slightly up according to US Census headline data. The unadjusted rolling averages rate of growth declined.

Analyst Opinion of Retail Sales

There was upward adjustment of last month's data. The real test of strength is the rolling averages which declined.

Things to consider when viewing this data:

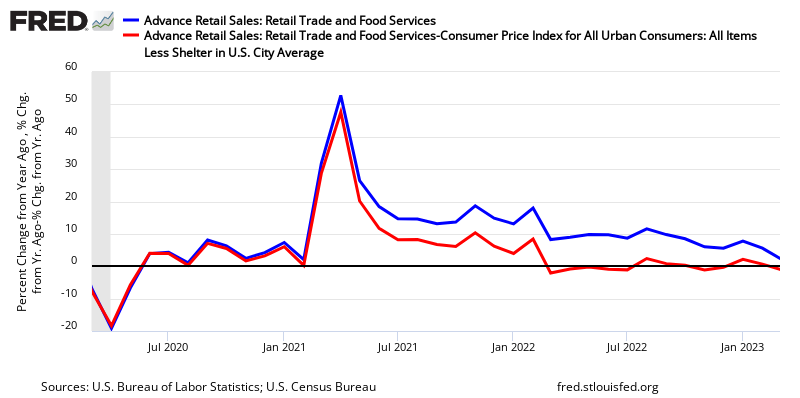

- it is not inflation adjusted.

- the three month rolling averages of the unadjusted data declined.

- still, our analysis says this months' year-over-year growth was about average for the growth seen since the Great Recession.

The year-over-year growth rate in inflation-adjusted retail sales and retail employment have diverged.

Backward data revisions were upward.

Econintersect Analysis:

- unadjusted sales rate of growth decelerated 1.3 % month-over-month, and up4.9 % year-over-year.

- unadjusted sales 3 month rolling year-over-year average growth decelerated 0.6 % month-over-month, up 4.4 % year-over-year.

- unadjusted sales (but inflation adjusted) up 3.2 % year-over-year

- this is an advance report. Please see caveats below-showing variations between the advance report and the "final".

- in the seasonally adjusted data - the major strengths were non-store retailers and electronics.

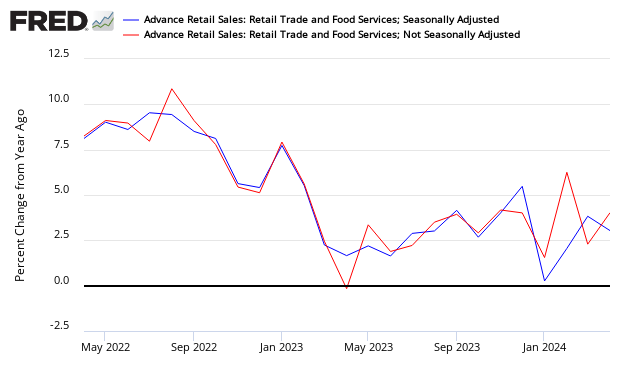

- seasonally adjusted sales up 0.2 % month-over-month, up 4.2 % year-over-year (published up 4.6 % YoY last month).

- the market was expecting (from Econoday):

| seasonally adjusted | Consensus Range | Consensus | Actual |

| Retail Sales - M/M change | -0.1 % to +0.4 % | +0.1 % | +0.2 % |

| Retail Sales less autos - M/M change | -0.1 % to +0.9 % | +0.2 % | +0.2 % |

| Less Autos & Gas - M/M Change | +0.3 % to +0.6 % | +0.4 % | +0.5 % |

| Control Group - M/M change | +0.3 % to +0.5 % | +0.4 % | +0.9 % |

Year-over-Year Change - Unadjusted Retail Sales (blue line) and Inflation Adjusted Retail Sales (red line)

Retail sales per capita growth trend is mixed depending on periods selected - see graph below.

Year-over-Year Percent Change - Per Capita Seasonally Adjusted Retail Sales

From the U.S. Census Bureau press release:

Advance estimates of U.S. retail and food services sales for November 2018, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $513.5 billion, an increase of 0.2 percent (±0.5 percent)* from the previous month, and 4.2 percent (±0.5 percent) above November 2017. Total sales for the September 2018 through November 2018 period were up 4.3 percent (±0.5 percent) from the same period a year ago. The September 2018 to October 2018 percent change was revised from up 0.8 percent (±0.5 percent) to up 1.1 percent (±0.2 percent). Retail trade sales were up 0.3 percent (±0.5 percent)* from October 2018, and 4.0 percent (±0.5 percent) above last year. Nonstore Retailers were up 10.8 percent (±1.4 percent) from November 2017, while Gasoline Stations were up 8.2 percent (±1.6 percent) from last year.

Seasonally Adjusted Retail Sales - All (red line), All except food services (blue line), and All except motor vehicles (green line)

The differences between the headlines and Econintersect are due to different approaches to seasonal adjustment (see caveats at the end of this post).

Comparison of the Year-over-Year Census Seasonally Adjusted Retail Sales (blue line) and Econintersect's Unadjusted Retail Sales (red line)

Declines of short duration often occur in the seasonally adjusted series without a recession resulting.

Retail and Food Services Sales - Seasonally Adjusted

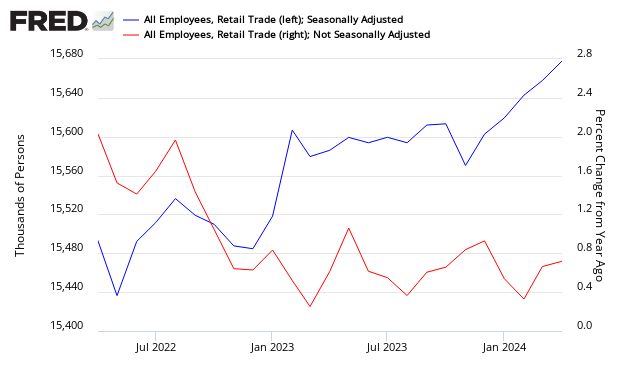

Using employment as a gauge to check growth, employment in retail has been declining.

Retail Employment - Total Seasonally Adjusted (blue line, left axis) and Year-over-Year Change Unadjusted (red line, right axis)

And finally, as retail sales can be a component of determining a recession start date, the zero line of the graph below could be an indicator a recession was underway (or about to begin).

Retail Sales - Recession Watch Graph

Caveats On Advance Retail Sales

This data release is based on estimates. However, the estimates have proven to be fairly accurate although tend to miss at economic turning points. Therefore up to three months are subject to backward revisions, although normally slight, can sometimes be modest.

The data in this series is not inflation adjusted - and Econintersect adjusts using CPI less shelter CUSR0000SA0L2. The St. Louis Fed also inflation adjusts the Census seasonally adjusted data. The last two recessions began as the inflation-adjusted retail sales crossed the zero growth line.

Comparison of Real Year-over-Year Growth between FRED's Real Retail Sales (green line) and Econintersect's Inflation Adjusted Retail Sales

As in most US Census reports, Econintersect does not agree with the seasonal adjustment methodology used and provides an alternate analysis. The issue is that the exceptionally large recession and subsequent economic roller coaster has caused data distortions that become exaggerated when the seasonal adjustment methodology uses more than one year's worth of data. Further, Econintersectbelieves there is a New Normal seasonality. Using data prior to the end of the recession for seasonal analysis could provide the wrong conclusion.

The impact of the monthly retail sales data on GDP is not straightforward. Real GDP (of which the consumer is over 60%) is adjusted for inflation. Further, GDP is an analysis of quarter-over-quarter or year-over-year growth, while retail sales is a monthly data series.

Econintersect determines the month-over-month change by subtracting the current month's year-over-year change from the previous month's year-over-year change.

Disclaimer: No content is to be construed as investment advise and all content is provided for informational purposes only.The reader is solely responsible for determining whether any investment, ...

more

Considering prices are at rock bottom, this is pretty dismal. Great article.

thank you Gary