Reasons To Be Skeptical Of The Recent Stock Market Rally

So far this year, the S&P 500 (SPX) has returned 26.41%, and the Russell 2000 has delivered a return of 21.46%. It has been a stellar year for equities amid loosening monetary policy conditions and progress regarding US-China trade negotiations. However, with three rate cuts behind us and the more difficult phases of the trade deal still left to be resolved, the uptrend in stocks looks more challenging from here.

Has progress in trade negotiations really been satisfactory?

As part of Phase 1, including China buying more agricultural products, Trump decided to cut existing tariffs in half to 7.5%. While lower tariffs are certainly positive, the risk of tariff re-escalation is still present. Phase 1 of the trade deal was meant to be the easiest part of the trade negotiations, but yet, it took both sides over two months to produce an agreement that the two nations would be willing to sign. If Phase 1 took this long, it would be naïve to assume that Phase 2 and 3, which will try to tackle the more strenuous issues, will be resolved in a timely manner without inducing volatility. In fact, based on Trump’s negotiation style over the past two years, it is very likely that he will not shy away from using tariffs again to pressure China to agree to the US’s terms. With stocks at record highs, markets are presently not pricing in the risk of tariff re-escalation amid the negotiations ahead.

Furthermore, the Fed has already cut rates three times this year in order to cushion the economy from negative trade developments. The central bank has indicated that it will likely be in ‘wait and see’ mode throughout 2020 to allow the 75 basis point reduction to take effect. As a result, any flare-up in trade tensions next year may not necessarily be countered by further rate cuts from the Fed, as the central bank will want to avoid running out of ammunition too easily in the event of a recession materializing. Hence the Fed’s reluctance to give into the market’s potential plea for further rate cuts is also likely to undermine equity market performance next year.

Profitability issues

Amid the focus on the lack of profitability of unicorns coming to the public market, one must also take note of the fact that many public companies are also unprofitable. One-third of Russell 2000 companies are unprofitable, which would explain why it has been underperforming the large-cap S&P 500. The performance of the small-cap stocks group is considered a good indicator of the economy’s strength. The fact that such a large proportion of this group is loss-making even during a period of historically low tax rates, record-low unemployment and interest rates is quite worrisome, and suggest that the economy is not as strong as the bulls would like to believe.

S&P 500 is not pricing in election risks at the moment

While markets appreciate that the election of a candidate like Bernie Sanders or Elizabeth Warren would be detrimental to market performance due to their regulation, taxation and business-unfriendly policies (e.g. higher minimum wages), markets are not concerned about it at the moment given the incredible rally we have witnessed over the past few months.

Perhaps markets are confident that Joe Biden will win the nomination from the Democratic party, but even if that is the case, his policy ideas are not exactly business-friendly either. His proposal to raise the corporate tax rate to 28% (from 21%) would certainly displease equity investors that are currently pricing stocks for perfection.

Trump’s re-election may not necessarily bring rosy days ahead either, as this may only further embolden him to engage in aggressive trade wars for four more years. Prolonged trade wars are very likely to tip an already weak global economy officially into a recession, which will definitely not bode well for stocks.

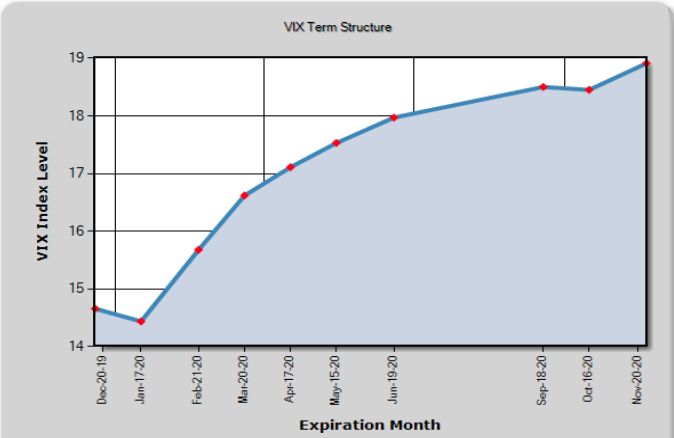

VIX term structure 2020

Source: CBOE

The CBOE VIX (VIX) term structure above reflects market participants’ anticipation regarding volatility over the next year. It reveals that volatility is expected to start climbing higher from February 2020 onward, which will mark the beginning of the Democratic primaries. Market participants also expect volatility to remain elevated through the election, as the VIX is expected to hover near 19 by November 2020. Hence based on this term structure, investors are likely to book profits over the next few months and remain on the sidelines at least until election uncertainty has passed by.

The term structure also reveals that the market expects volatility to drop between this month and 20th January 2020. The market could be becoming a bit too complacent in believing nothing between now and next month will cause volatility to rise. Market volatility tends to return and do the most damage when investors are off-guard and becoming too complacent. Therefore there is an unacknowledged likelihood that there could be events/ developments between now and next month that would cause volatility to spike higher before the Democratic primaries have even begun. This level of complacency is another reason to be skeptical about the sustainability of the current rally.

Bottom Line

Following a tremendous equities rally this year, markets seem to be neglecting bearish factors going into next year, including the possibility of trade tariffs re-escalation and election uncertainty. This level of complacency will not bode well going into 2020, as the stock market is very unlikely to deliver another year of solid gains in the face of rising uncertainty. This is the time to book any profits, not to make new investments.

I feel like all of #Trump's achievements have just been a tease. We keep hearing about progress on negotiations with North Korea and China, etc. But nothing ever really changes or happens.