Powell’s Dilemma Reveals A Fed Stalemate

Image source: Wikipedia

The Federal Reserve is trapped between policy, politics, and reality.

The U.S. economy is slowing, while inflation remains above target.

After two years of aggressive tightening, followed by 100 basis point rate cuts last year, the Fed faces two competing options:

-

Ease more now, appear politically motivated, and negate inflation dogma.

-

Wait too long, and risk looking behind the eight ball amidst economic slowdowns.

That’s what made this week’s Fed meeting so critical, not for what Powell said, but for what he didn’t say. You see, the Fed under Jerome Powell’s leadership and the credibility it leverages depends on projecting control. However, its actual toolkit and timeline are shrinking. Meanwhile, the gap between the Fed’s posture and power is widening.

So, what did the central bank do when facing that gap? The Fed bunted. The FOMC left rates unchanged at 4.25% - 4.50%.

Last month, Powell reiterated that the Committee is “well positioned to wait for greater clarity” before making additional moves.

And after this week’s meeting, when responding to a reporter who asked what would have to happen to prompt a rate cut, he reiterated the need for more data and rounded out by noting, “It’s really not at all clear what it is we should do.”

Market Tone Shifts

Powell’s deer-in-the-headlights stance, aside, the market is increasingly pricing in more rate cuts. The S&P 500 has bounced back to around 10% since early-April, driven by hopes that the Fed will adopt a more dovish stance in response to mixed economic data.

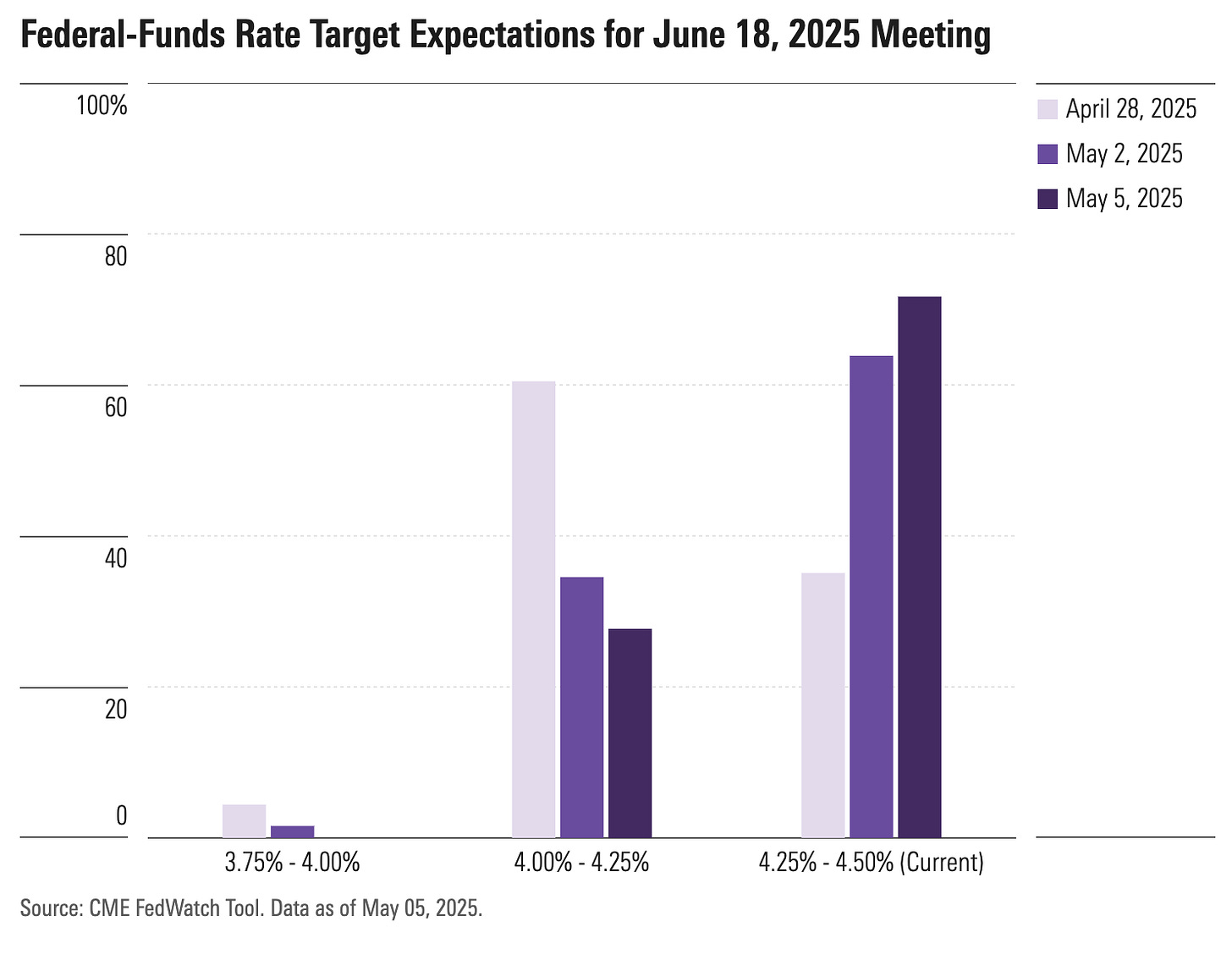

Fed Funds futures are pricing in a 68% probability of 100bps in rate cuts by the end of 2025, with the first cuts coming as early as June 2025.

The 2-year Treasury yield stands at about 3.8%, down from 4.87% a year ago, and the 10-year yield has declined to 4.33% from 4.58%. These drops in yields suggest investors expect the Fed to ease policy in the near future.

These are all signs that rate cuts will be greater than the Fed’s projections last December, when it penciled in just 50bps of cuts for 2025.

For those that have been following here, this all remains on target with what Prinsights has been detailing.

For the rest of us, that largely translates to: the Fed may be willing to move – but only if Powell can make a credible case that the data supports it.

Ultimately, the undertones show that the FOMC is working to shield any forthcoming decision from looking politically motivated.

But, since that statement, the subsequent data has shown that stance is becoming muddy.

As I said on CNBC last week, given the slowing economy, the Fed will have to ease more than forecast.

So, while Trump may have blinked first – it might be high time for Powell to blink next.

This is why we’re still forecasting 100bps of rate cuts to come this year.

For investors looking to navigate over the long term, that’s good for gold.

Why Gold Is Positioned to Keep Running

Indeed, gold remains a solid asset. At just around $3,370, gold prices are creeping back toward the April record, following a brief pullback amid optimism over US-China tariff talks.

Gold remains primed to continue rising, buoyed by strong central bank demand, its safe-haven status, and tightening supply. The Fed’s move toward more rate cuts to stimulate economic growth will serve as an additional catalyst.

That’s why our gold forecast remains $3800-$4000 by the turn of the year, with a potential surge to $5000 by the end of 2026.

As our Prinsights Premium issue detailed for those looking to capitalize on gold’s continued rise, a leading junior miner is positioned for significant growth in the next phase of this gold rally. To unlock that Premium analysis, upgrade here now.

Lastly, please stay tuned for our upcoming new premium product launch, focusing on under-the-radar long-term opportunities in real assets.

Economic Signals Flash Yellow

Meanwhile, the U.S. economy has run out of steam.

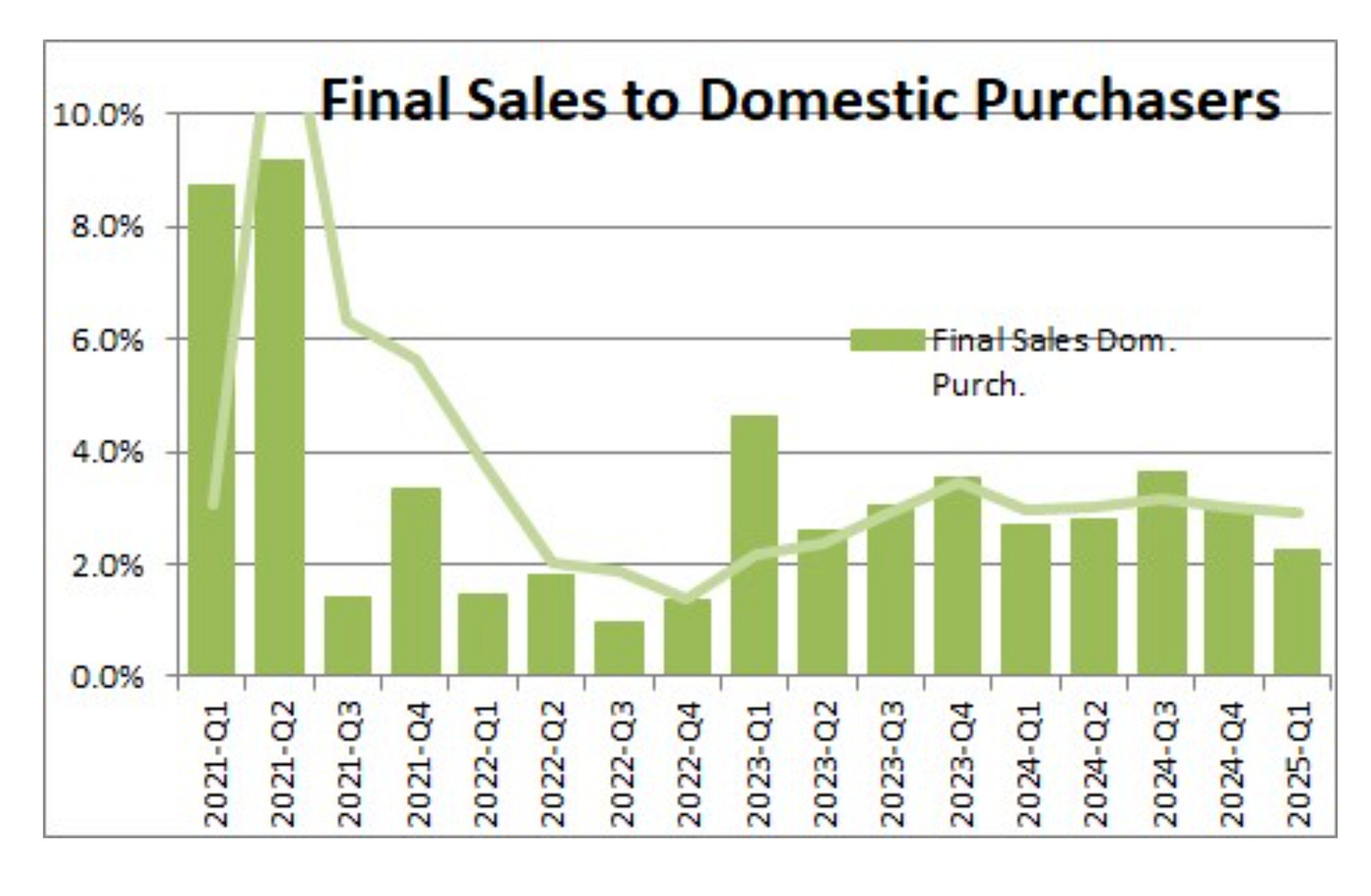

Q1 2025 GDP showed a -0.3%, contraction, a reversal from the +2.2% growth during the previous quarter, pointing to a faster than expected slowdown, and further intensifies pressure on the Fed to ease sooner.

Other signs of a slowing economy included McDonald’s posting its largest U.S. consumer sales drop since Covid.

The manufacturing sector also contracted for the second month in a row. Real final sales, the cleanest read on consumer demand, declined.

Unfortunately, business investment has all but flatlined.

Earnings estimates across publicly traded companies appear to now be on a steady downward trajectory.

On the labor front, April headline jobs numbers still looked healthy, but full-time positions have been trending lower since February, and average hours worked slipped again in April.

Yet, inflation hasn’t eased enough to give the Fed cover.

Despite the Fed’s prior tightening efforts, the Q1 2025 Personal Consumption Expenditures Price Index (PCE) came in at 3.6%, significantly higher than the Fed’s 2% inflation target.

Trade, Policy Pressure and Political Optics

In April, we questioned whether Trump or Powell would ‘blink’ first.

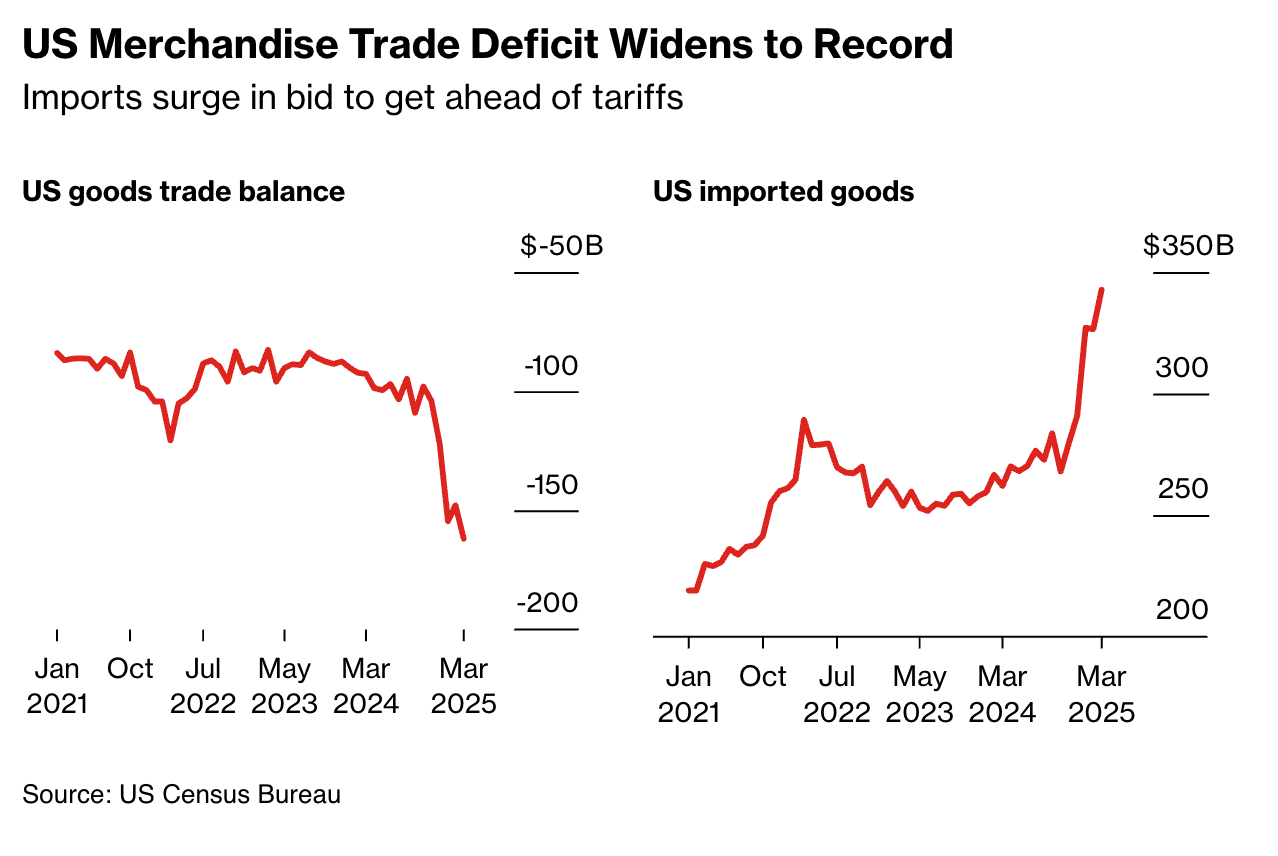

While President Trump has given a temporary reprieve to certain tariffs, his ongoing economic policies, such as new import taxes, continue to add inflationary pressures.

Yet, we’re still in the 90-day post-Liberty Day tariff window where anything can happen. And while Beijing has signaled that Washington is back at the negotiating table – and some say Trump blinked – the damage may already be done. Price uncertainty continues to plague key sectors and supply chains, especially in autos, semiconductors, and capital equipment, complicating Powell’s ability to ease.

The numbers also show that trade corrections, at least so far, are not taking hold. While it is true that those areas do take time to materialize in the global economy – prices, consumers and trading partners are seemingly less than willing to play ball.

So, where are we at the crossroads between trade, policy implications and the political football?

Powell and the Fed can now either keep policy tight and risk recession or resume easing and risk reigniting inflation.

That’s why this week’s meeting, as the Fed left rates unchanged, served as a signal that the decision-making process is growing even more complex.

Powell recently stated, "For the time being, we are well positioned to wait for greater clarity."

More By This Author:

Here’s Why This Gold Run Is Just Getting Started

The Next Big Market Shift In Defense

Beyond Big Tech: 3 Key Global Hedge Opportunities

Disclosure: None.