Market Briefing For Wednesday, May 3 '23

'Do they really know nothing' - what does the Fed define as a banking crisis?

It's not just about 'confidence', it's not just about 'inflation' now, actually it's just about something more basic: returns. And how that squeezes bank margins. I think there's an obvious toxic mix from various dynamics we've chatted about.

The Fed continues to fight inflation, which we knew was beyond the capacity given the countervailing programs like infrastructure, defense and energy as a global rather than local segment. It's not even about kicking the can down any road for Debt (though that's a separate issue), it's about common investor and business 'returns' on free cash, that is crippled for banks by the Fed's actions.

It's simple: the Fed needs to 'stop' (as have already preferred) hiking rates as immediately as feasible (now). As investors can garner about a 5% yield from Money Market Funds, why would they not move money into funds away from other accounts holding deposits? They already are.

The misnomer here might be a presumption that this holds true only for small or 'regional banks', which for some reason perceived as (mostly) ineffectively hedged compared to larger banks. That's not always the case, and just as we noted the other day about Goldman Sachs offering 4% (near market) rates on 'Apple Card' Savings accounts, that was competitive but notably higher so as to attract more business for Apple Card. However, consider banking margins if this becomes a banking 'trend' in-order to simply hold many depositors.

The majority of business customers don't want to switch banks, just protection for their accounts, and they'll have that. But consumers especially will monitor competitive return rates, and that's distinct from just having FDIC coverage.

Just for kicks, I asked AI what it thought about Wednesday's FOMC decision:

Chat Ai:

"Overall, the outlook for the FOMC decision tomorrow is uncertain. Markets are expecting the FOMC to raise interest rates, but there are some concerns that the Fed may be raising rates too quickly. The markets will be closely watching the FOMC's statement tomorrow for any clues about the future path of interest rates." (No kidding.)

Then I asked which banks are more at risk:

- Banks with high levels of non-performing loans: Banks with high levels of non-performing loans can lead to a decline in the bank's asset value and a decrease in its capital.

- Banks with high levels of leverage: Banks with high levels of leverage are more susceptible to changes in interest rates. A rise in interest rates can make it more difficult for the bank to service its debt.

- Banks with a weak capital base: Banks with a weak capital base are at risk of failure because they do not have enough capital to absorb losses.

Again no kidding, as states the obvious, but didn't identify failure candidates.

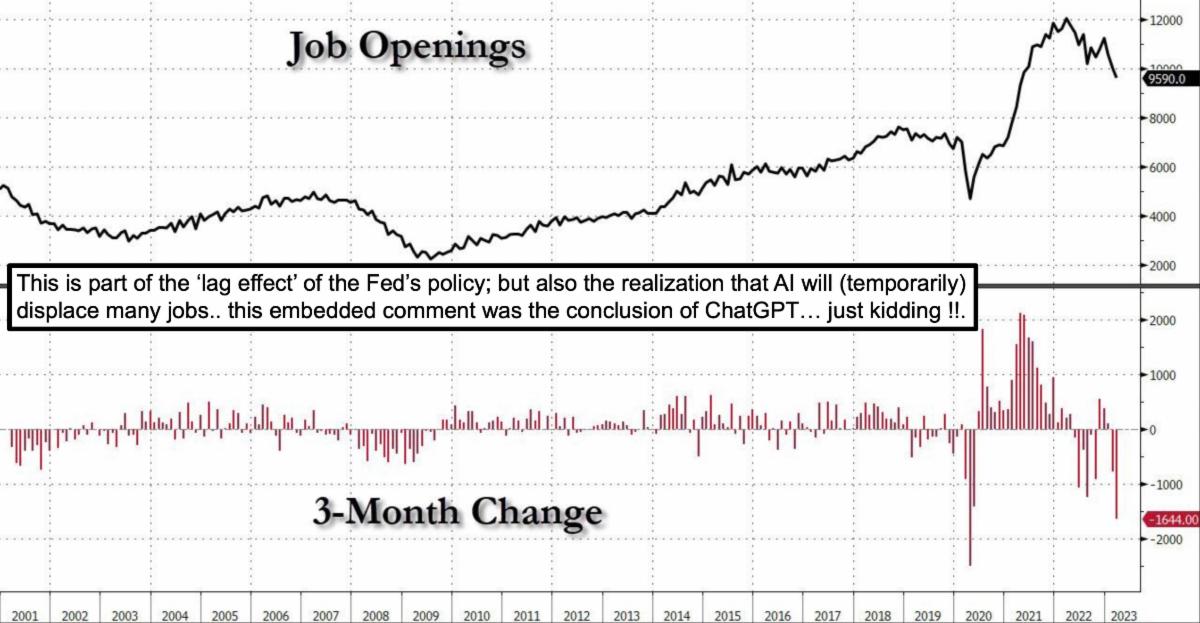

Another issue today (since we basically made the point that higher rates could evolve the banking crisis) beyond regionals if they're not careful and 'smell the coffee' so to speak is AI. An uncertainty of how AI is advancing breakthroughs in technology combines with unintentional (or comprised uses) that seems to be most worrisome, although I'm thinking engineers are worried about what's a traditional concern with new technology arriving: their job security.

I continue to believe the positives outweigh minuses by embracing AI, which has evolved for years without being condensed into a more integrated form. It also will be used by our adversaries whether we like it or not, hence we'll very clearly need to expand AI implementation in Military and tactical applications, regardless. Yes it is and will be quicker than most expected, but listen to IBM (with thousands of jobs to be replaced), or Samsung (trying to oppose AI for their staff) and you have a flavor of the resistance and the transition.

So having more fun, I asked Google 'Bard' which AI's are the most promising:

- Google AI's LaMDA: LaMDA is a large language model that has been trained on a massive dataset of text and code. LaMDA is able to generate human-like text, translate languages, write different kinds of creative content, and answer your questions in an informative way.

- OpenAI's GPT-3: GPT-3 is another large language model that has been trained on a massive dataset of text and code. GPT-3 is able to generate human-like text, translate languages, write different kinds of creative content, and answer your questions in informative ways. (GPT-4 in beta.)

- Facebook's Jarvis: chatbot has been developed by Facebook. Jarvis is able to understand and respond to human language in a natural and engaging way. Jarvis is still under development, but it has potential to be one of the most promising chat AIs in the future.

Ah yes, and then there's Microsoft, SoundHound and so.. not a word.. yet. I could go further, but have to be careful with 'AI', info accuracy varies widely. I think I will actually query it periodically, and always identify which isn't human.

In-sum:

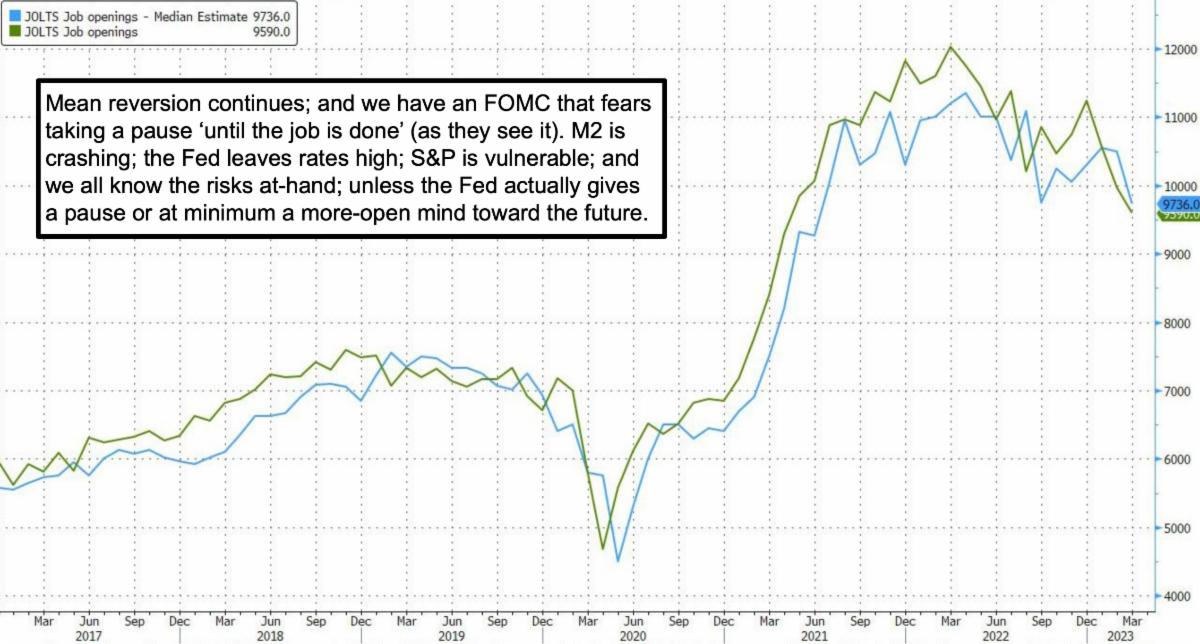

'If' the Fed grasps the situation they've created (too low for too long, then too fast a pace higher without thinking), they should stop hiking right now even if they cover that with some talk about 'taking a look again next month'.

You can have a real broader crisis if the mentality considers only protection of deposits, FDIC enhanced coverage or not. They must consider 'temptation' to move into Money Market Funds, just for the higher rate than banks offer, for a majority. That's why Goldman's Apple Card promotion was likely a trial balloon sort of marketing approach.

Basic banking doesn't work if they squeeze margins to that extend broadly. As I've noted before, banks borrow short and lend long. The FOMC primarily has just experienced bankers, so if they don't figure this out now, when will they? I hope it's not after a more serious decline, that they're able to sidestep now.

It's an unbalanced market, and one can hope the Fed takes note of that.

More By This Author:

Market Briefing For Tuesday, May 2 '23

Market Briefing For Monday, May 1 '23

Market Briefing For Thursday, Apr. 27

This is an excerpt from Gene Inger's Daily Briefing, which typically includes one or two videos as well as more charts and analyses. You can subscribe for more