Market Briefing For Thursday, Dec. 23

'Fortune favors the brave' it is said, and that's sometimes true. It's partially so in this market, where we certainly got the ignition Tuesday of the seasonal rebound we looked for, and after an early pullback Wednesday, more upside.

Christmas wish -'Game Changer' - has arrived

When it comes to speculative tech stocks (and many others) fortune is never assured, hence the need to sprinkle a bit of diversification among selections, a point I've recently emphasized. And even today it was a 'summer market' (some were up and some were down). Not a sleigh-ride, but mixed blessing.

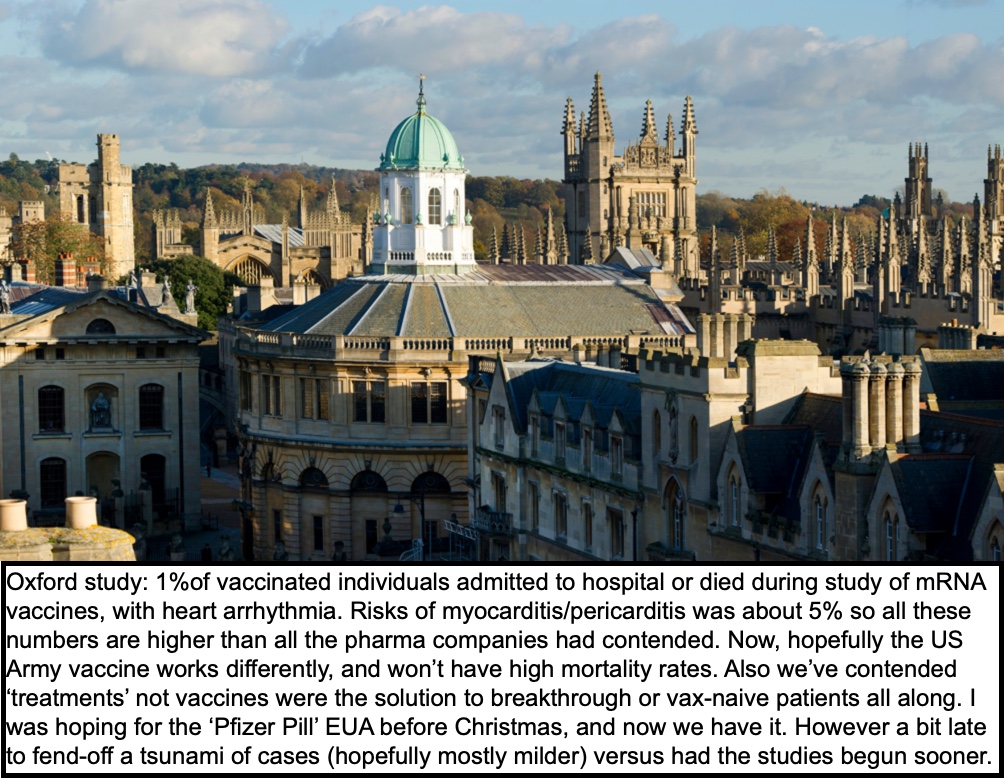

However there were significant developments ahead of Christmas which also play an indirect if not direct influence on 'market psychology', and that's why I had hoped to see the Pfizer (or even Merck) pills approved before Christmas. The President didn't get that in time for his speech (would have made it seem more substantive I think) but at least the EUA did arrive today, as hoped for (PFE, MRK).

The other major development is a U.S. Army / Walter Reed hospital research team revelation about a new (apparently non-rMNA) vaccine that fights all the variants of COVID. It's only Phase 1, but if Phase 2 & 3 pan-out, this could be a vaccine that is more in-line with what the public largely expected but didn't get in the mediocre first ones (degraded to touting severe illness protection which is important of course, but doesn't prevent the disease and isn't a lifetime shot or anything nearly that). If the Army vaccine achieves that, then we'll have the kind of 'real' vaccine, not 'repeated jabs or shots' as the initial ones became.

In the meantime, the arrival of the 'pill' and the market's response (probably at the same time not precisely) tied-to the arrival of 'treatment solutions' gives us what we wanted: a seasonal rally boosted by a 'relief factor' pushing S&P up a bit more on the basis of seeing the cavalry on the horizon if not yet here.

I think that's appropriate as the 'pills' will help our defense while actual Army troops develop the vaccine at Walter Reed, with pharma partners presumably brought into it. (I don't presume it's Sorrento (SRNE), also less likely Inovio (INO) or others, and we'll not encourage speculation about how that might be unfolding. Dept. of Defense earlier pulled funding for Inovio's vaccine, although the FDA just gave them a go-ahead to test it 'in' the United States, go figure that one.)

So, with approval of the (generally preferred) Pfizer pill, the demand for 'any' of the various vaccines will diminish, and the world will be better-off once we get past the stage of prescribing the Pfizer 'only' for severely ill patients (that is not the intended group, early symptomatic is). Since they don't have supply in adequate quantities, hence you hear about reserving it for the very sick. Of course you should presume they'll expand that indication once supply grows.

For now let's presume that at least a couple (not all) of the burnt coal stocks (I mean speculations pounded into coal) will be pressed into future diamonds.

Tonight, not because it's the anniversary of AMD entering our target buy-zone just before Christmas 2018, A new pick is in the area we (and others) expect to be hot next year: photonics.

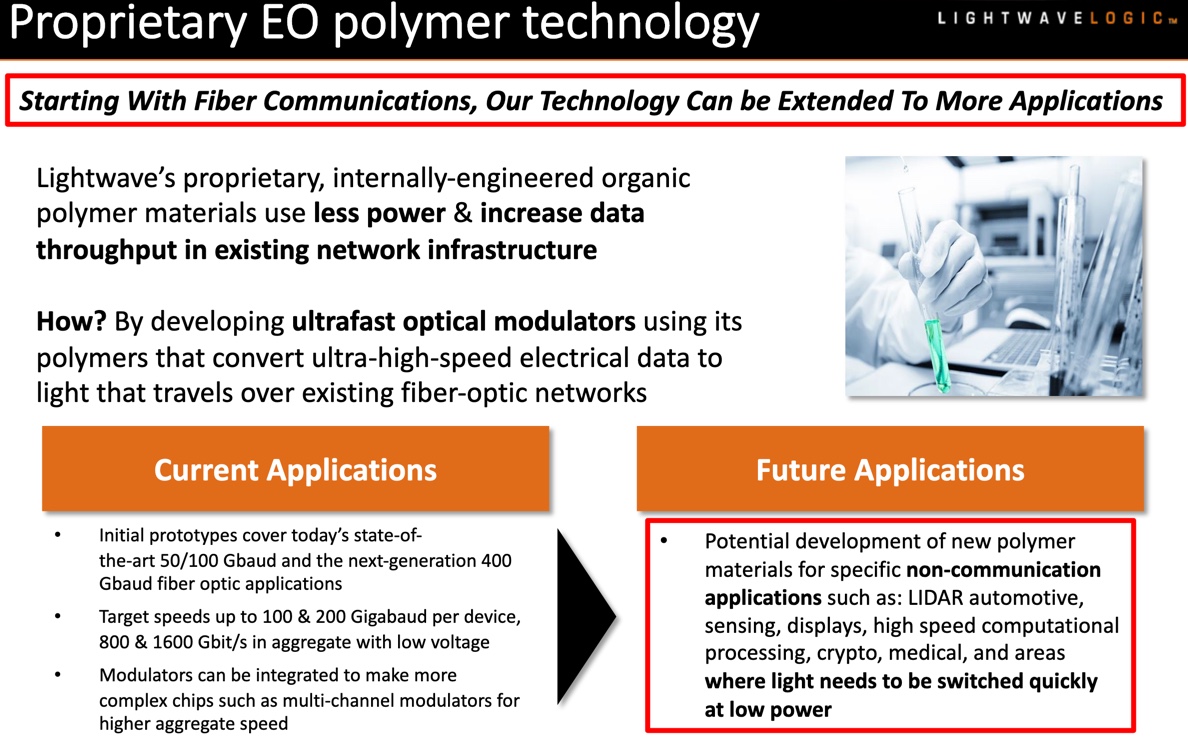

The Company Lightwave Logic (LWLG), uplisted to NASDAQ just several months ago; is not subject to lockup restrictions as it was public. Lightwave Logic is developing a platform leveraging proprietary electro-optic polymers to transmit data at higher speeds with less power.

Lightwave Logic's high-activity high-stability organic polymers allow creating next-generation photonic devices, which convert data from electrical signals into optical signals (EO), for applications in both data and telecommunications markets. The stock is all about the technology and potential to speed up the internet. Simple but not so simple. And it's not near lows; but near highs.

A lot of stocks in the sector (LightPath (LPTH) is an example) languish for ages, then suddenly take-off, that was the case for AEHR this year too. And may be for a new pick or old pick, as much depends on the global semiconductor demand, as well as the rolling-out of EV's, of which a couple newer picks relate, and of course corporate execution if they've got the numbers and catalysts to move. That's especially a focus on companies making components for name-brand companies, and in-essence have a chance to prosper regardless who wins in the end-user, or even consumer, end. However that's always a presumption.

Bits & Bytes:

Clearly focused on smaller stocks, which were mixed today, at the same time as there are challenging and interesting tidbits besides ongoing discussions about COVID, vaccines and pills. The pills are a very big deal, far more so than the casual release of them 'for very sick patients'. That stop-gap description is, as far as I can determine, to prevent massive scrambling for it.

We've pointed-out regularly the little-known 'specialist' for 'burn-in-testing' for Silicon Carbide in the manufacturing process, and that's our pick-of-the-year stock: AEHR Test Systems. We premiered it back in August as our earlier than usual pick of the year for 2022, around 6 / share and then it doubled. As it pulled back from the mid-teens to 12 'ish we suggested adding to, or even initiating positions for those that didn't originally or if later fit their objectives. As is the case with most successful semiconductor plays, it probably gets a lot more expensive and that's when the institutions get even more enthused.

Bottom-line:

All metrics are complex, the health aspects less murky (our view anyway), and the market has rebounded somewhat, and shall persist for now.

Enjoy the rest of the holiday week!

This is an excerpt from Gene Inger's Daily Briefing, which typically includes one or two videos as well as more charts and analyses. You can subscribe for more