Market Briefing For Monday, Sept. 26

The challenges are multiple, and have been growing for months, as we outline regularly. Especially as relates to the September/October timeframe.

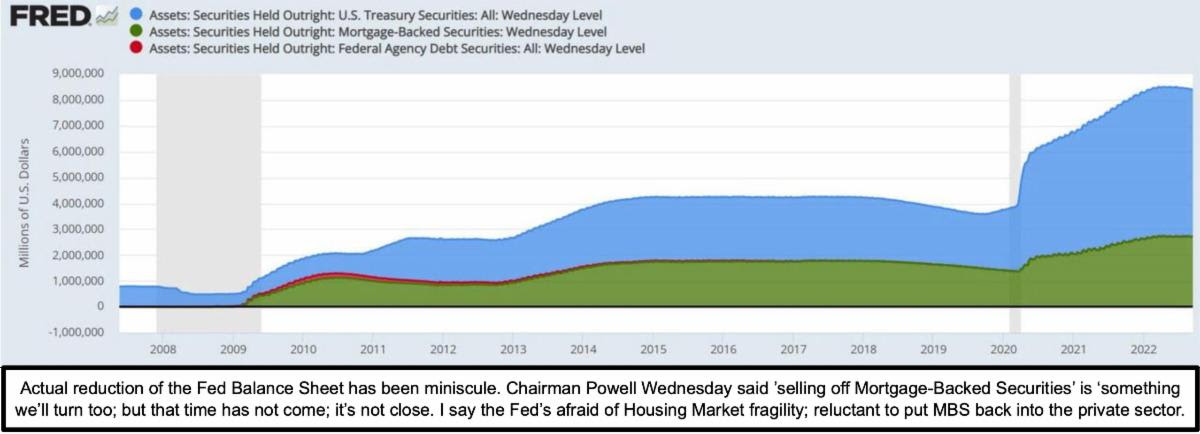

These ongoing media discussions, often expressed either to 'soothe' or 'alarm', are really nothing new, and what is happening now is mostly relegated to the Fed 'policy error', which is a fear we also addressed often, and thought something would probably have to break, to get the Fed to abandon moving to a positive 'real rate' (inflation adjusted) level.

I have thought that ludicrous because lots of what's going on wasn't related to inflationary influences that monetary policy can significantly influence beyond a rather obvious 'over-compensation' in terms of snugness (over-steering is the common term heard) which related to those aspects, not simply stimulus and a few other excessively miscreant and mismanaged easy-money policies, that of course proliferated during pandemic, but weren't reversed soon enough.

That's what I've railed about for about a year and a half and now they go into a mode that of course has actually freaked most participants, bull & bear alike. I would emphasize that the backdrop was 'never bullish' this year; it was mostly a distributional process that actually started with last year's 'masked' selling in the midst of excessive buybacks by many big companies, which I complained were not being criticized as 'excess executive compensation' because mostly the shareholders benefited too. Even last year, valuations were off the wall.

Semiconductors and similar are pressing 52-week lows. Qualcomm noted in this week's little-noticed presentation that the 'total addressable market' goes well beyond EV's, although that alone is a huge sector of forward demand. I believe leading chip stocks will participate in rebounds; but again this overall sell-off is very broad; with everything pummelled.

In sum: the downside progression persists and I supposed we must mention the old adage: "sell on (or before) Rosh Hashanah; then buy on or after Yom Kippur". The holidays are not entirely a myth because many traders follow the axiom regardless of their faith; so we'll see it that impacts this year.

For the most part most stocks are so far down that I wouldn't be surprised to see an intervening rebound between the holidays, then more defensiveness in October; though again this is a manufactured decline by the Fed and surely impacts from the war. If anything a U.K. policy shift tanking the British Pound is part of this too. Central banks insanely responded as they often do but way too late, in what had become a 'negative rate scenario'; especially vs. inflation.

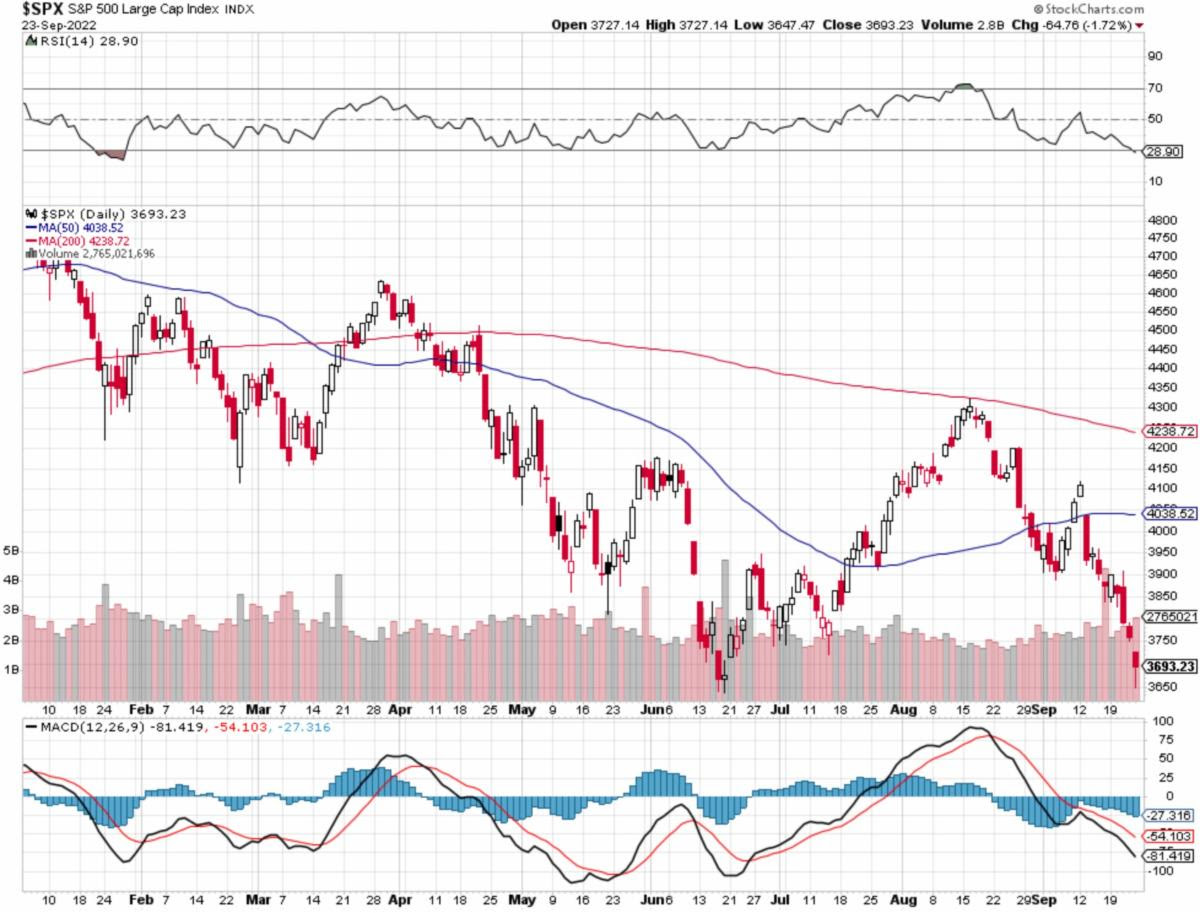

This was also a commodity breakdown; almost every complex; and stocks for the most part were almost universally down 4-8% or so. That's a liquidation as well as something that usually precedes compelled selling in the days ahead, as well as a rebound; but not necessarily more than than barring better news.

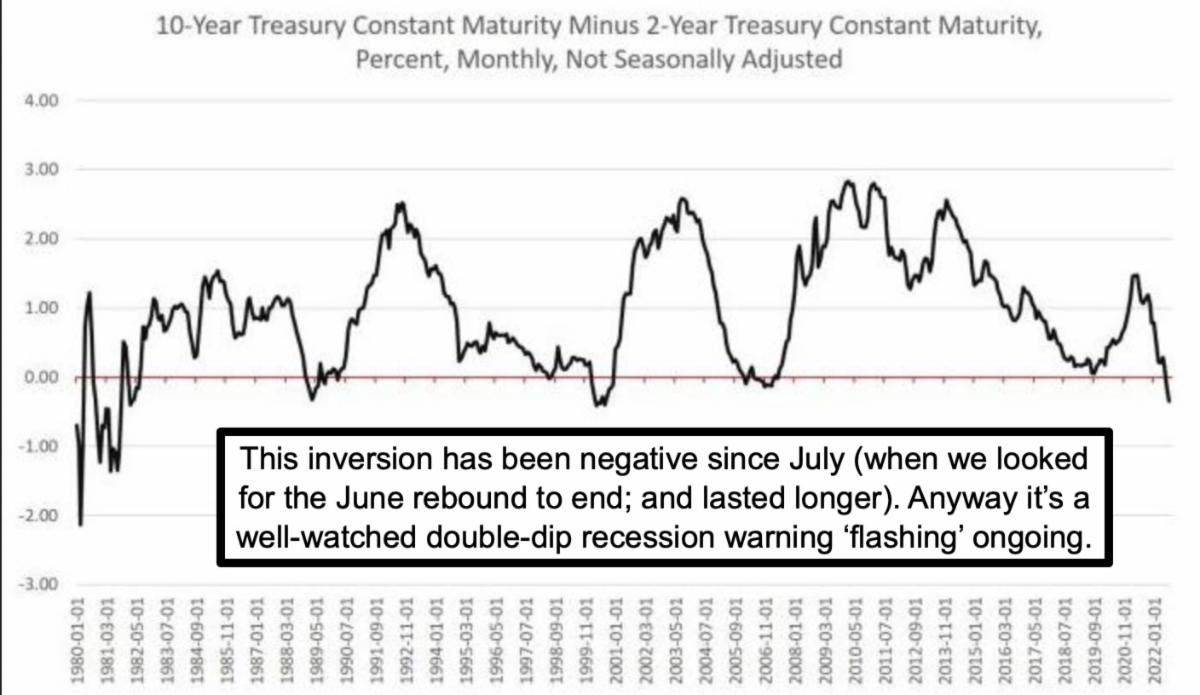

Valuations were super insane or just excessive, depending on the sector or a stock in recent months; so we called for rallies; but not anything durable. So basically we don't want to be contrite about it, but this generally was the S&P and 'Grand Dames' assessment; including the end of the June low rebound .. that actually lasted a couple weeks longer than envisioned.

There is no sense in emphasizing risk now (suddenly everyone figures out a over-zealous Fed and slow growth projections for 2023). This isn't news and it may well mean the majority of decline is 'almost' behind but as I sadly had to say these recent days, there was more downside to be seen. Remember S&P estimates were failure at 4100-4200; minimum downside of 3600-3800; and if the Fed stayed stubborn and we get the forthcoming guidance downgrades; a drop to 3100-3200 is possible; but in sheer panic I wouldn't be stunned to see an 'overrun' such as 2600-2800. Ideally that heavy won't occur; but let's listen closely to the market's messages.

It's also a time to focus on the global picture as I contend, because 'disarray' is the operative term for humanity; and the Fed and others have been really a bit too myopic. Hence my criticism not only of the Fed; but ECB, where I was a bit disappointed Christine Lagarde let them hike rates in the face of chaos.

Europe is largely 'in' recession; Russia is threatening its own citizens about as severely as Ukraine (by arresting them and then releasing if they agree to go to 'the front') and the discussion of nuclear conflict comes from an unstable as well as slightly neurotic autocrat; Putin. Also Oil prices way down for now; but part of that is the SPR draining; so we suspect Oil will soon reverse and rally.

Bottom line: S&P working lower; absent bids going into the weekend; likely leading to a feasible washout and bounce next week;within the overall context of a bearish move that internally has been going on for about 18 months now (as masked by distribution under-cover of the firm S&P and NDX last year).

Now, even though the rhetoric from economists, after this decline, pretty much finally reflects what I've been saying about Fed policies; is late in this struggle. It is one of the toughest 'global situations' I've seen; and hence why I've made comparisions to the 1930's; not so much Depression; but ahead of World War.

All we need is more war and hurricanes. Of course I'm being cynical there; as we do not need either; but we have the prospect of more of both for now. If it changes on the warfront, you'll see a big market change too. The moon rocket (Artemis) might be scrubbed if they can't get it off before the Florida storm.

Speaking of that, I 'probably' will ride it out and 'guard the fort'; but if there is a monster storm in a couple days, I will consider an escape.. if feasible. I'm not on the water these days (the low elevations was a contributing factor to that), so in theory I could stay put. But the storms can be stronger than 'normal' (if anything is 'normal' anymore). I'll advise as we know more; and I do have the basic backup batteries; but cannot install a generator; so there is that. The big storm that hit several years ago knocked-out power for days; but I was luckily in Berlin at that time; and stayed in Europe extra days until things stabilized.

A 'State of Emergency' has been declared by Governor DeSantis for at least 28 Florida counties; so for now I'm here (actually getting new tires tomorrow, good service sales pitch that I need full treads for slick roads). The good news is that the cardiologist says I'm doing well; and the bad news is the market's behavior, which I need not belabor and do not find surprising.

Stay safe and take 'Ian' seriously if in the Southeast; depending on track.

More By This Author:

Market Briefing For Thursday, Sept. 22, 2022

Market Briefing For Wednesday, Sept. 21

Market Briefing For Tuesday, Sept. 20, 2022

This is an excerpt from Gene Inger's Daily Briefing, which includes videos as well as more charts and analyses. You can subscribe here.