Market Briefing For Thursday, Sept. 22, 2022

'Higher for longer' - was the Fed's message. So over-tightening plus war are enough to intensify concern. Simply put, there was no big upside prospect for S&P anyway, and hasn't been for awhile, particularly absent growth.

Today housing continues to soften, the Fed remains 'less' data-dependent and had a few negative projections for late 2022 and 2023, and that of course was all it took. How they can sound so hawkish while also calling for slow growth might be a mystery, but that's the prolonged pain we've talked about from this Fed. Late Wed. S&P finally broke 3800, which I considered key during the session.

The economy really can't take this, which is why I've said not just 'stagflation', for months actually, but also 'double-dip' recession. Perhaps fairly serious for the general economy, especially if the latest 'dot-plot' suggests 4.5-5.0 Funds rate, which may be a 'bridge too far', but is a level we've mentioned before.

This is sort of a 'mark-to-market' for policy, so likely wracks havoc on big-caps as this Fall evolves, but again that's not surprising. What stands out was the discussion by the Fed suggesting they don't get to their 'target inflation rate' well until 2025. I personally have doubted they will get there at all shy of really breaking the economy on the premise of trying to stabilize it.

Their forecast will not be correct, because you can't stay tight for that long as well as somehow fight inflation and not cripple economic stability in the US. It is a 'tough love' aspect by a mediocre Fed that left pandemic emergency rates on for far too long (as we constantly assessed until they started tightening but did continue to believe that was too little too late from the curve's other end.

The central bankers created this mess to a significant degree, and while that's a situation where the Fed puts the economy in deeper recession, bumpy ride and then it emerges heading higher, but much damage will have occurred? It might be appropriate to add an additional consideration: the prospect of a war that drags-out longer, and that's seriously depending on no nukes and a deal.

In-sum: the Fed wants to keep doing this tightening until they have restrictive monetary policy, not merely relative to US economic prospects. Tough words that I'm not sure he's be able to stick too until a 2% inflation pace, partially as I don't believe inflation will drop that low without a major dislocation. Too much hubris still, as I also believe lots of this is drought and war, not Fed policies, at the same time they risk going too far the other way and too-easy for too long.

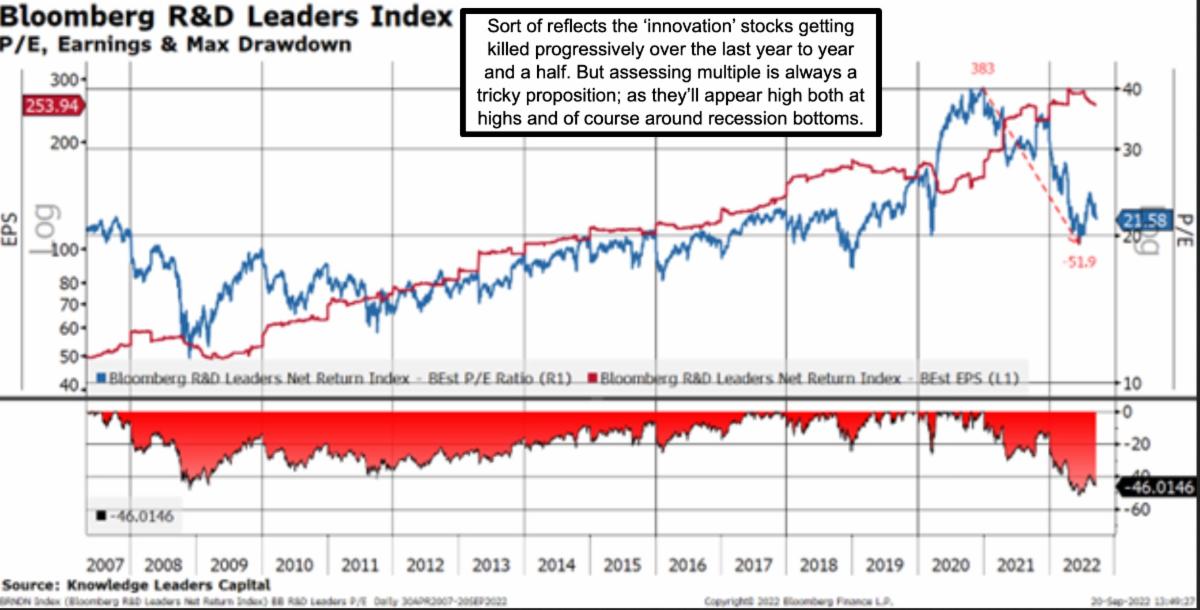

As to S&P .. working lower, and the difference in my view versus many might be that I think enough damage will occur quickly enough so that we get a low in 'this' Fall, regardless of delusional talk by the Fed about everything tighter until 2025 or sometime like that. We've been declining internal more than one year, and the managers concentrated in the 'Generals' (major big-caps), that's the riskiest segment while others meander or erode (or even rarely rally with specific fundamentals) and as I've said, this process persists for awhile now.

Discretion remains the better part of valor.

More By This Author:

Market Briefing For Wednesday, Sept. 21Market Briefing For Tuesday, Sept. 20, 2022

Market Briefing For Monday, Sept. 19

This is an excerpt from Gene Inger's Daily Briefing, which includes videos as well as more charts and analyses. You can subscribe here.