Market Briefing For Tuesday, Sept. 20, 2022

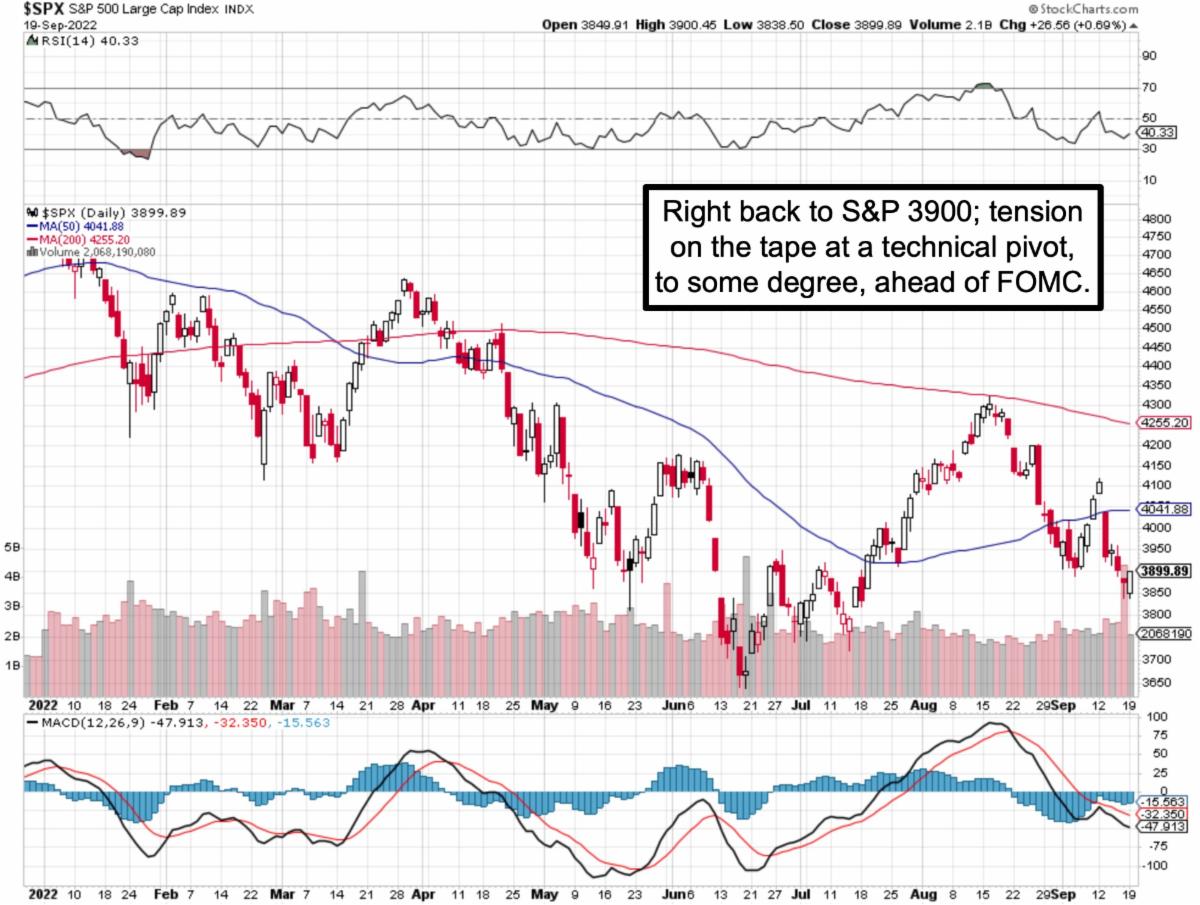

It's not quite critical how this week's goes, but certainly the anxiety's there. A reset of profits/earnings probabilities as contrasted with pie-in-the-sky S&P PE multiples, is a concern we've expressed for some time, and it's not really a big uncertainty as some contend, but rather a known prospect for the Index.

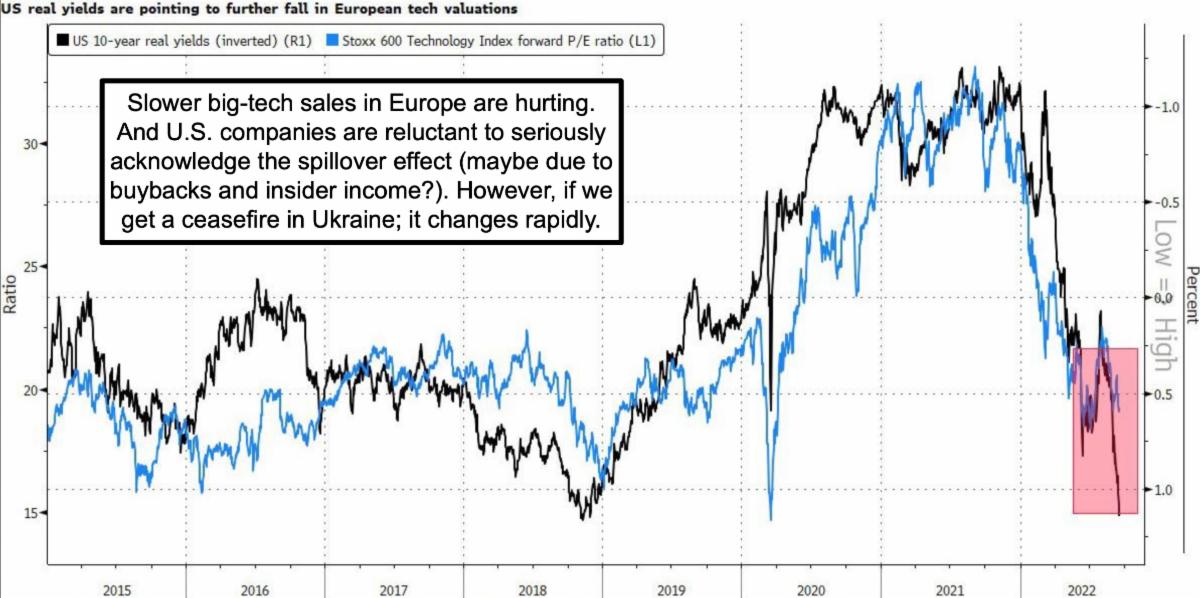

Of course there will be stocks deviating stocks from simply lower multiples as this unfolds, and it's unreasonable to suggest the Fed Chairman will adhere in a draconian way to higher rates next year. If indeed you don't get a rate cut in 2023, and it's delayed until 2024 as Goldman's Hatzius suggested today, well that requires resetting expectations even lower, but mostly for 'Grand Dames' in the S&P and/or NDX, not generally the bulk of stocks already crushed.

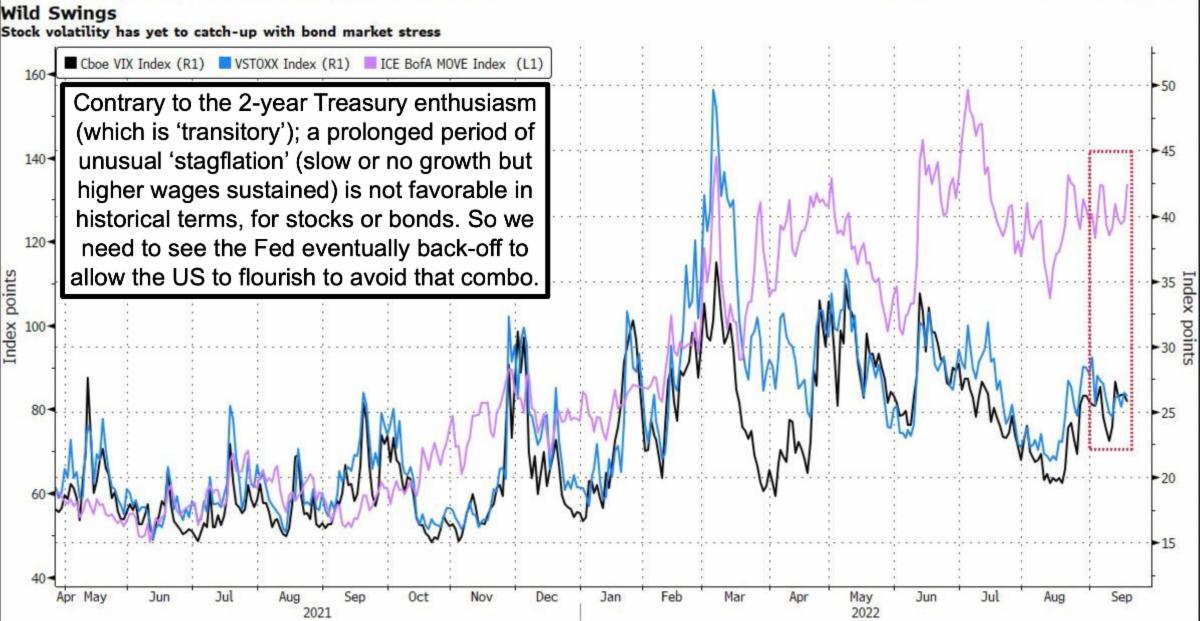

However it can be brutal if inflation doesn't calm down, and the Fed gets lots of criticism, but can't reverse overall stances without CPI / inflation data rolling over. I suspect however something will happen so that this will rollover and of course the uber-bears will miss an entry time. That could be as soon as well.. this Fall... if S&P works low enough or with obvious geopolitical progress.

S&P has some stocks trading at absurd multiples, however we need to listen to both the market and history, which means becoming 'less' bearish as stock prices decline. Now that's not to say we don't have strong headwinds whether it relates to interest rates, too high earnings guidance, or even buybacks that, starting now, are restricted for many companies during earnings 'quiet times' that they are now entering, and for the weeks just ahead.

There is no 'Fed pivot' for now, and the preceding rebound that failed served a good purpose by providing a 'cushion' for S&P, as we said, within context of a continuing downtrend overall. A good part of inflation did indeed peak, but it is a slow process and of course isn't working fast enough to help politicians.

That is all a 'lag effect', which is why CPI should see not just current 'flatish' data, but actually a slower pace of increase, which could surprise super bears that can't rationalize any sort of rebound. Seasonally this is all defensive and should be for a number of reasons, plus we must deal with Ukraine variables.

In-sum:

People are seating the FOMC's decision in a couple days, so despite the 'heat being on', the market generally was able to rebound in late going on Monday, probably because there is so much near-universal bearishness.

That won't prevent S&P (or other Indexes) reacting to the coming rate hike of course, although how defensive Fed Chairman Powell 'might or might not be', itself could have an impact on whether stocks deflect the negative prospects for rates, briefly thereafter. Regardless we are still within a contraction 'era'.

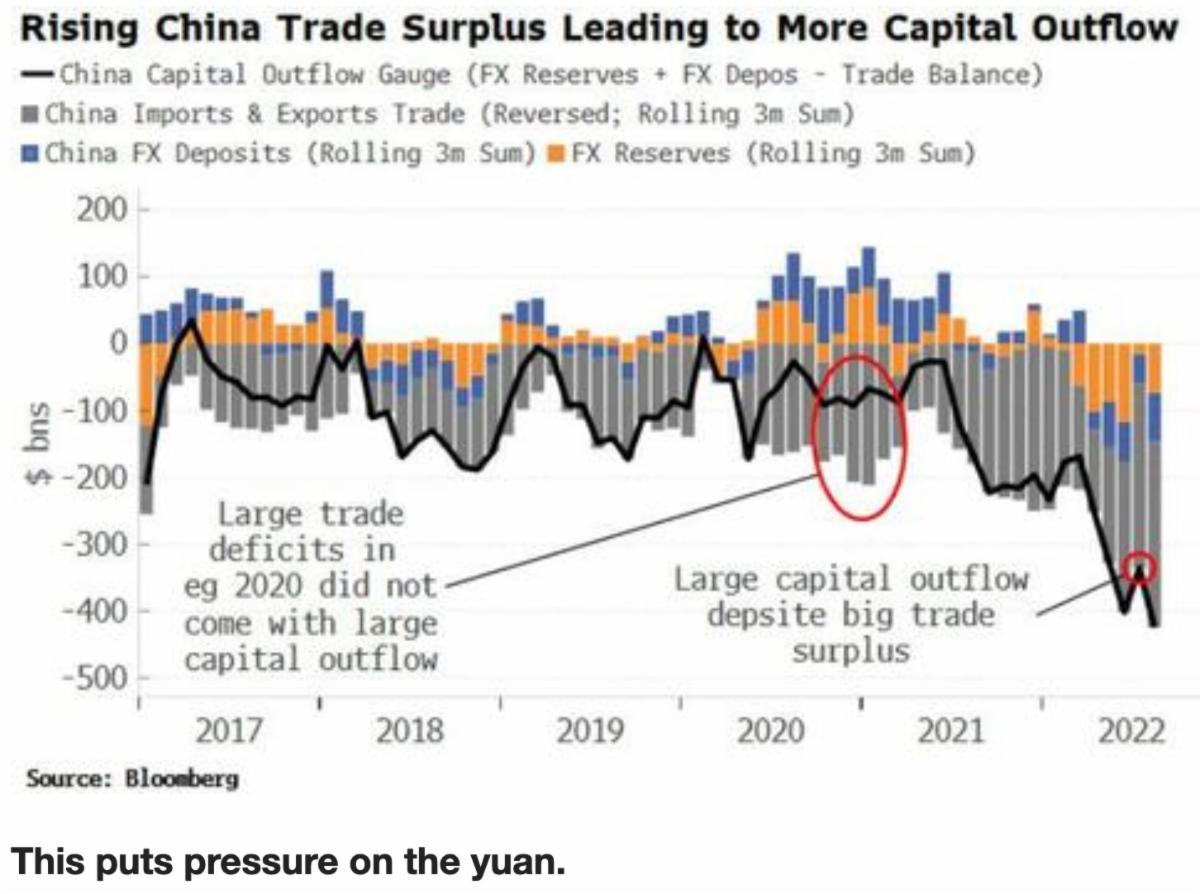

This is basically perilously close to a 'definite' doublt-dip recession as noted, and it already is in much of the world, especially Europe and even China. It's important that Ford's warning is 'not' about chip supplies alone, but general parts shortages, including from small American parts suppliers who just can't ramp production adequately or in some cases find competent workers.

It's a big problem not merely for autos, but 'if' there were war. If, as some have suggested, the U.S. economy is based on 'social media and lattes', the we've got a challenge the USA basically beat Soviet Russia by outspending them. A generation earlier, we beat the Nazi's by outproducing them, even though for sure Germany was the most industrialized nation in Europe. Would you say at this point we are? I'd submit not really, China is the world's factory and they've got lattes and EV's too, but at this point it might be a race for production in an extended conflict, which in a sense we may already be embroiled in.

Incredibly, yet-again S&P finished Monday right at the 3900 level. More pain, presumably absent news (such as on the war or something else), is coming, but not necessarily in a linear fashion. Especially if Powell doesn't shock us in the form of (say) a full point hike, rather than continuing the stair-step moves.

Every major bear bottom has occurred with more 'pain' and capitulation than has surfaced so far, but again it has to be in the 'Grand Dames' primarily, as a great portion of other stocks are already eviscerated, many for some time.

More By This Author:

Market Briefing For Monday, Sept. 19Market Briefing For Thursday, Sept. 15

Market Briefing For Wednesday, Sept. 14

This is an excerpt from Gene Inger's Daily Briefing, which includes videos as well as more charts and analyses. You can subscribe here.