Market Briefing For Monday, Nov. 28

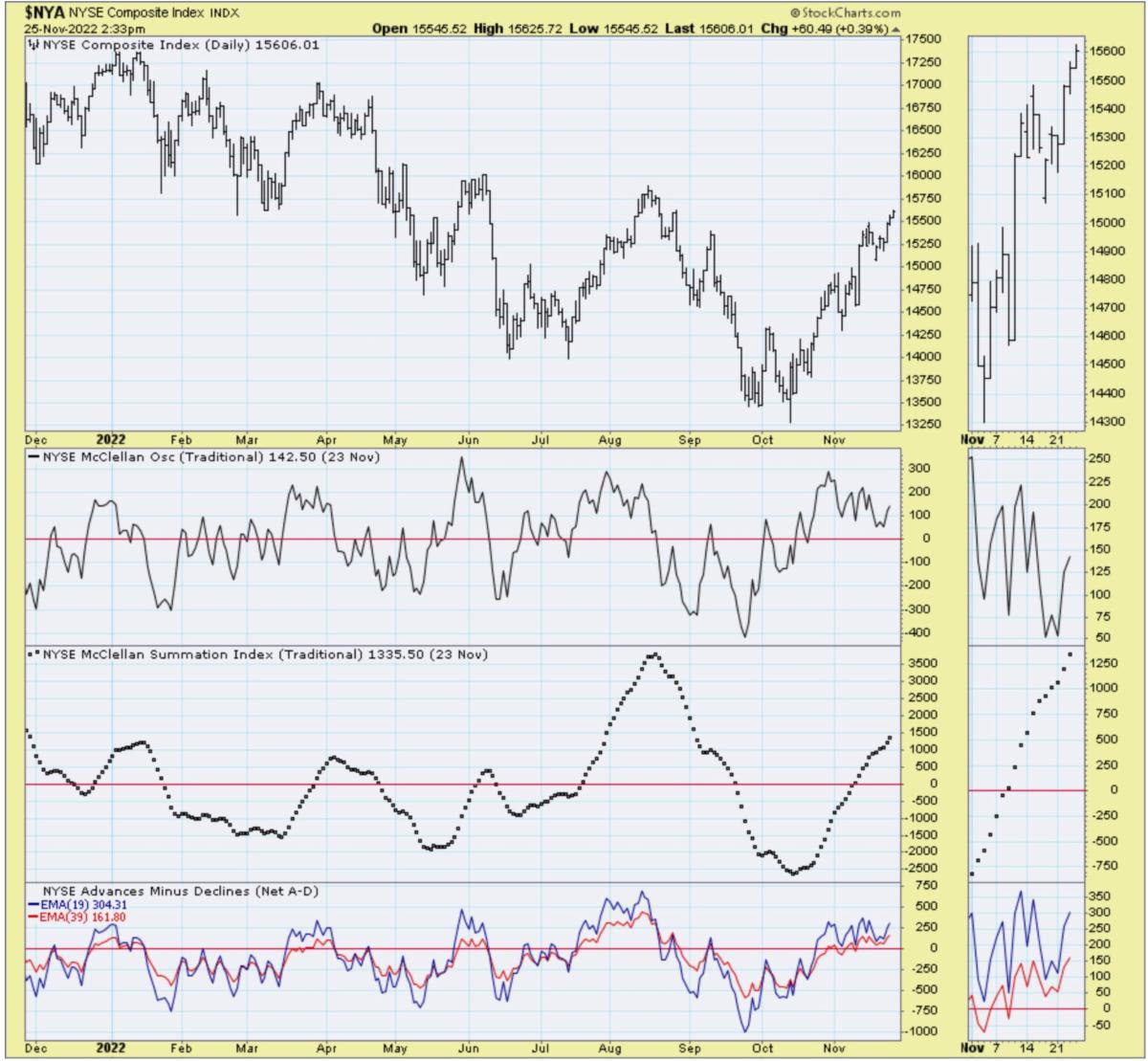

The market didn't wobble as much as some of the traders after yesterday's gobble. That leaves the 'options open' for post-holiday trading; even though I suspect there's going to be at least one more upside 'punch' before defense takes over, or at least tries to surmount the S&P 4000 level temporarily.

During Friday's abbreviated session the VIX was up 'with the market', which is often an indication of trader suspicions about the upward trending market, although I discount the significance given that it was a short Friday session.

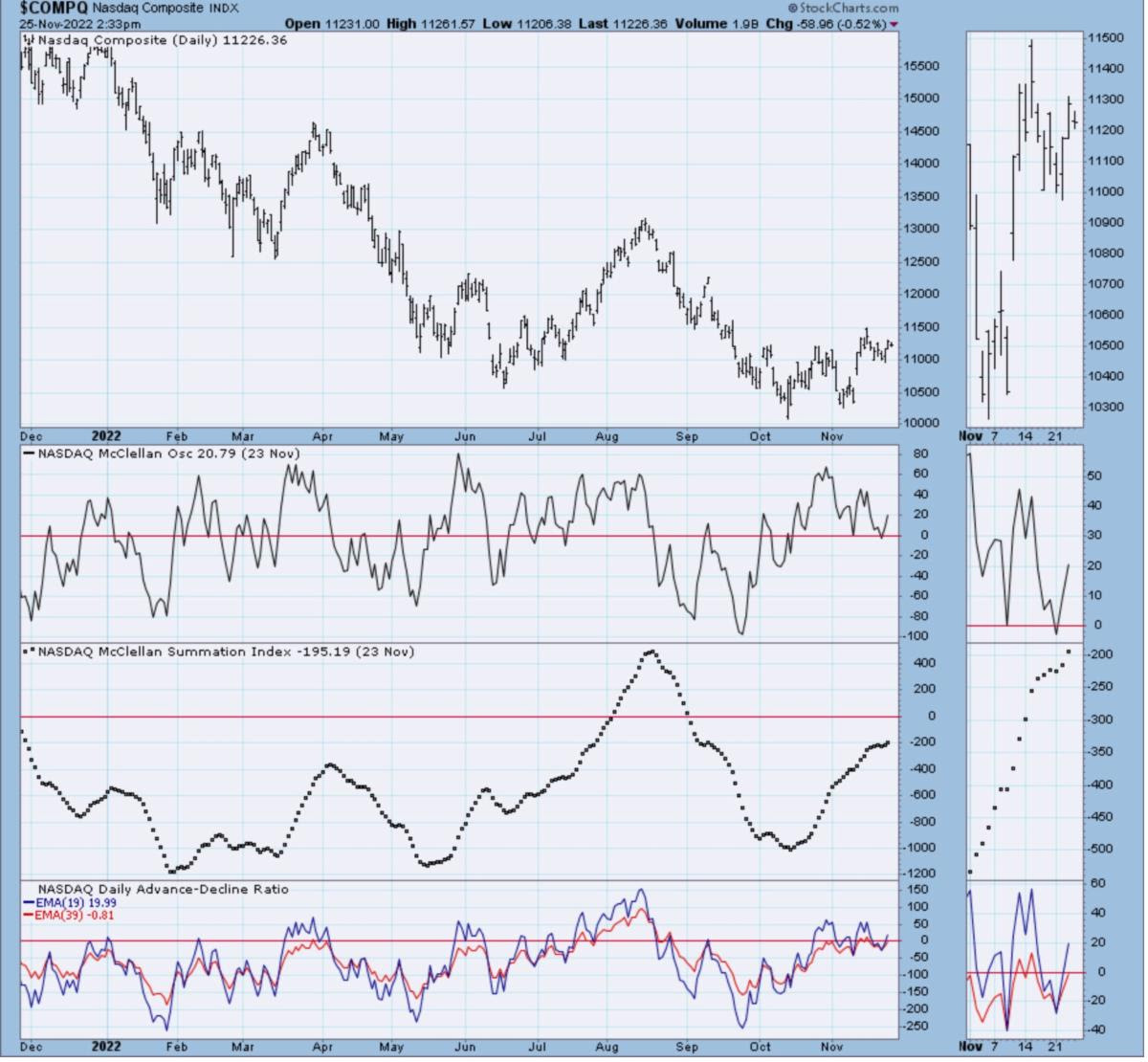

Presumably 'tech' is a bit safer which 'perceptions' of the Fed calming down a bit with regard to the pace of hikes; though this aspect is well-grasped by the market at this point. If there's a first half of December pullback; it might be on the broad side, only because you have last-ditch tax-selling competing with a revising of holdings by managers ahead of 2023.

In this regard the Chinese situation comes into play; not just the shutdowns of course, but whether it's leading to 'revolution' which challenges the regime. Of course we suspect the Chinese Communist Party will put 'its survival' ahead of principals or their insane extreme quarantining; before they willingly..leave.

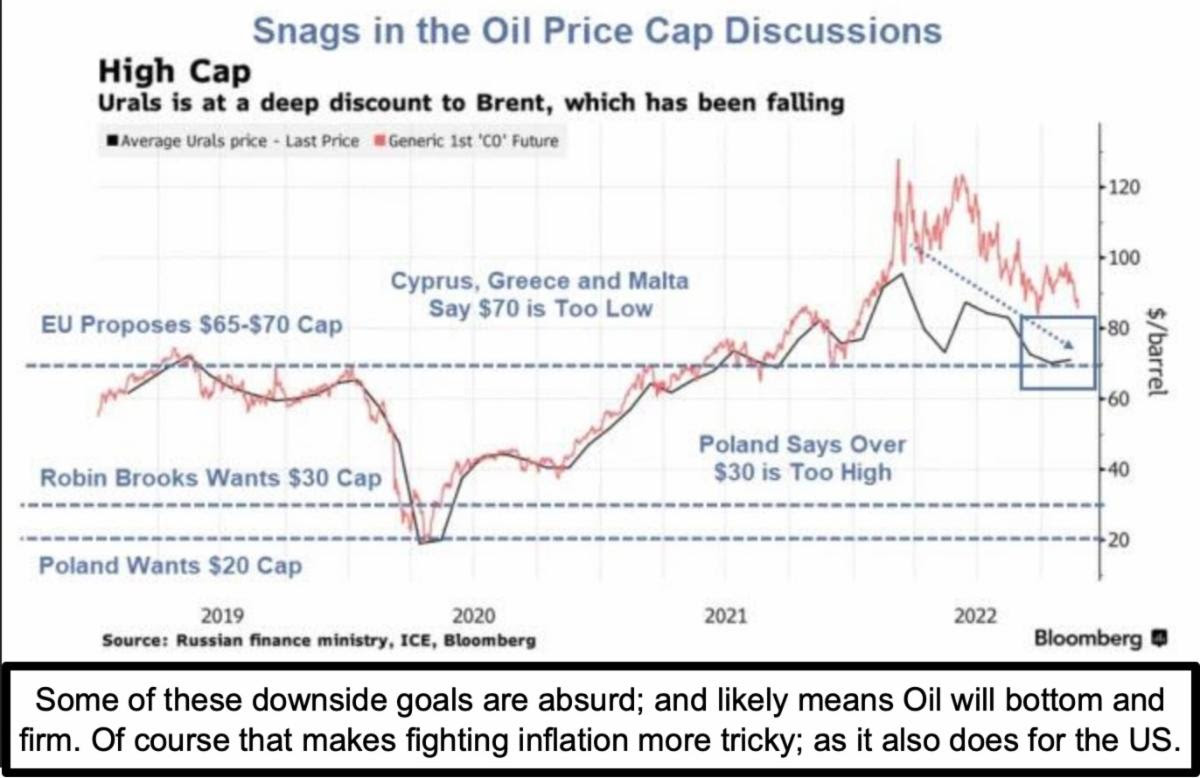

It does matter for both production and of course Oil demand as well. Europe also is debating what to do with price-caps; without input from the supplier (so that's sort of amusing as a seller has something to say ... in this case Russia).

In sum: We're pleased to see certain stocks in-position for new breakouts to the upside; but of course recognize this could run into resistance during December's start.

Late Friday Russia indicated it wouldn't sell Oil to any country with price-caps conformity; so we'll see. It's fair to be critical of almost everything Russia has been doing; while also critical of the twisted logic of (socialist Europeans?) all who think they can control prices by putting a cap on them. It's all in flux.

Bottom line: more upside on the menu; but realize some of this is like eating leftovers after gobbling-down lots of the best (gains) over recent weeks.

We'll see if S&P can actually hit 4100 (probably); though 4300+ is tougher at least for now. So much cynicism is part of why this market has some legs.

Enjoy the rest of the holiday weekend!

More By This Author:

Market Briefing For Wednesday, Nov. 23

Market Briefing For Tuesday, Nov. 22

Market Briefing For Monday, Nov. 21