Market Briefing For Tuesday, Nov. 22

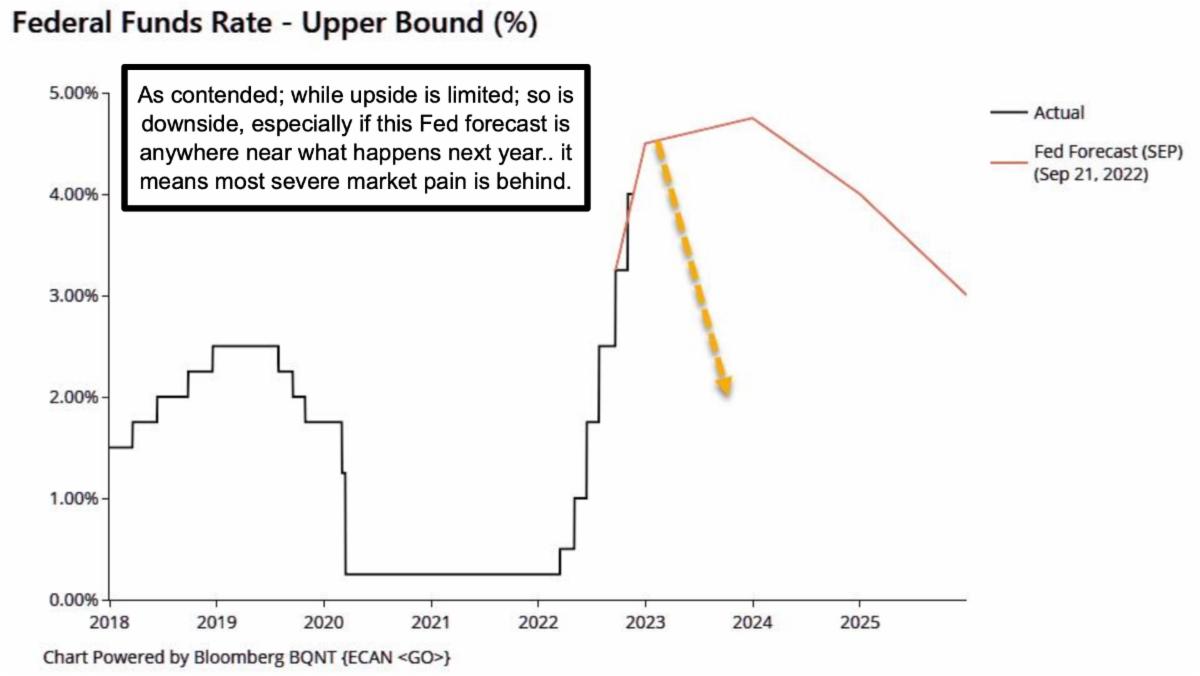

The 'cadence' of rate hikes - was pretty well telegraphed even before today, when Cleveland Fed President Mester opined rates 'need' to be higher. Her view is that we're 'not anywhere near stopping rate hikes', and that we're just now entering 'restrictive territory'.

I don't entirely disagree, as ~5% is, as a member reminded me months ago, a normal level for business, it's just that everyone was spoiled by absurdly low rates for too long.. something that I railed about throughout the previous year. At least Mester suggested the 'pace' of rate hikes will slow as I also concur. I do dispute her 'we're not near stopping' sentiment, as much depends less on rates, but more on what happens with the Dollar, consumer, and Oil prices.

Markets were not particularly moved as much by the Fed remarks as by Oil's action today, which saw a Wall St. Journal article suggesting rising production by Saudi Arabia / OPEC, and then the Saudi's dashed that story straight away to reflect their continuing opportunism (greed) while war etc. impact demand.

My morning view concurred that the Saudi's weren't about to reverse policies to accommodate the U.S. or Europe, which is not to say they shouldn't. OPEC members in-general are tough cookies, and maybe even the World Cup going on in Doha reminds the world of more than big money and fancy cities, when it becomes evident how inhumane the hosts were to the workers putting all of it together or even stoking fears lurking among some player minorities.

Oil for itself, rebounded nicely despite remaining in 'contango', and reflects in our view the presumed 'floor' for Oil based on restocking Strategic Petroleum Reserves in the 70's / bbl, just what President Biden had in mind and that's why I suggested Oil would find support essentially building over time in areas such as today's earlier lows (give or take a few dollars a bbl).

Much will correlate with 'war' plus waning Chinese demand, hampered again by the recurring outbreaks of COVID, which China -almost uniquely- seems not able to get a handle on, despite the most draconian of containment efforts. It's almost an embarrassment to Beijing (or should be) that they've declined, or at this point delayed embracing, the latest variations of treatments (yes we know vaccines don't prevent COVID nearly as well as was contended, but it's not at a zero level, and anything seems to be better than how they've handled things).

In-sum:

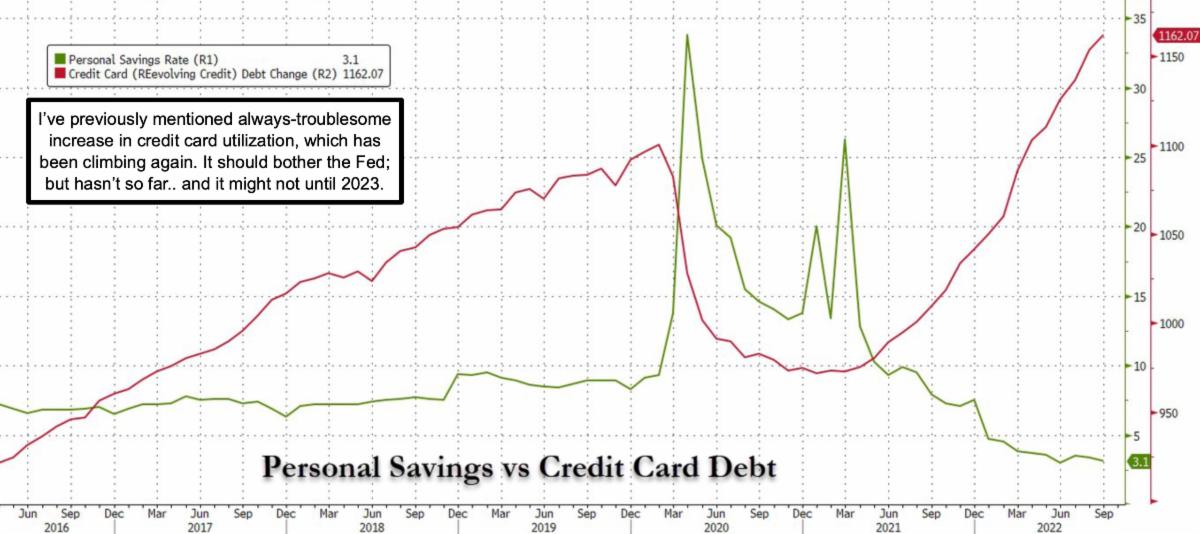

Investors have to contend with tax-selling and oscillations, besides the Fed on the rate-hiking path of course. Probably few will buy mega-caps into strength even if we get more of a seasonal relief, and we might witness more pressure in December's first half, possibly revived recovery thereafter.

There are few 'quick fixes' for the stock market here, or the economy, with a persistent conflict between monetary policy lagging reality (both ways), and a protracted war that (if it ended) would be helpful to equities if not to Oil.

Add to that the Chinese suppression of demand, which hampers business as well as consumption in China, and you have a dampened valuation situation, which continues. That may however be part of what tempers the Fed ahead, at least to a slower pace of hikes, and ultimately to pivoting to deflect disaster.

A broken-up holiday trading week tends to have intraweek rallies in the earlier portions, which was attempted by thwarted on Monday, and may likely a feature to be seen again on Tuesday.

Oil on the long side is almost a hedge against what takes stocks down, but I'd not join the crowd recently or now getting bullish on Oil stocks, though I'm on the long side (and have been for years) of Oil throughout the noted swings.

A number of stocks (including Disney) could bounce and then set-back a bit, with mixed performance early in 2023. We'll see, but definitely less negative after all the downside we've had, and with optimism for 'peace breaking out' in the year ahead, with a return to a focus on innovation and disruptive tech.

More By This Author:

Market Briefing For Monday, Nov. 21Market Briefing For Wednesday, Nov. 16

Market Briefing For Tuesday, Nov. 15