Market Briefing For Monday, Jun 5

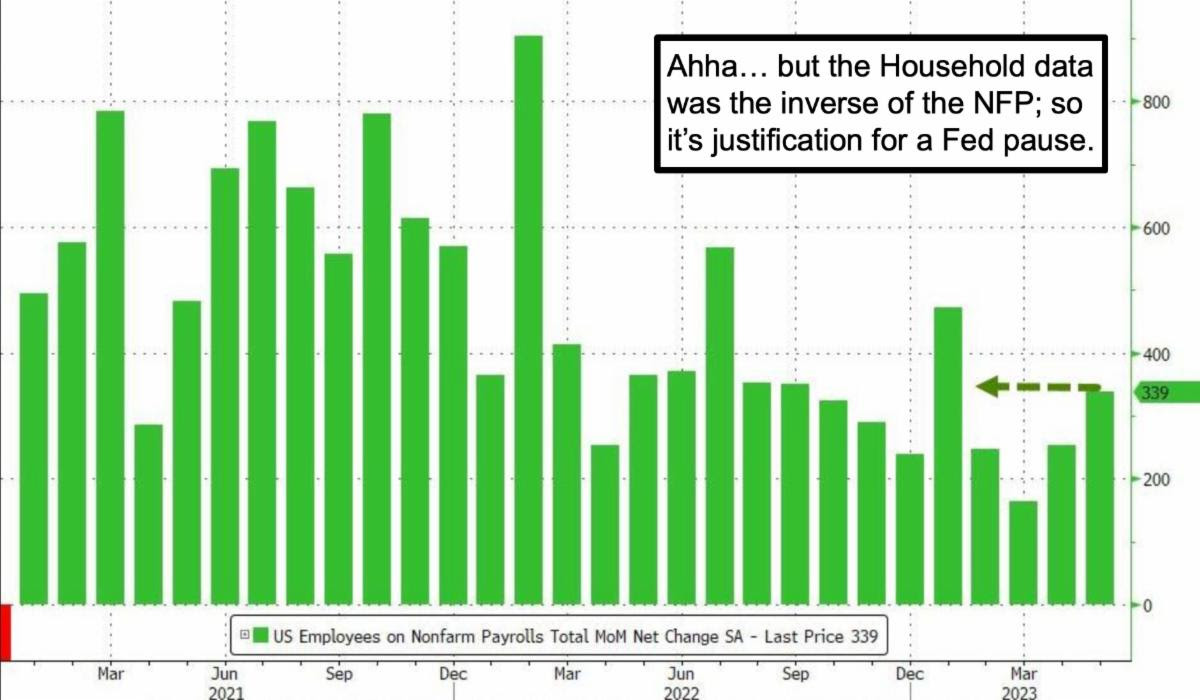

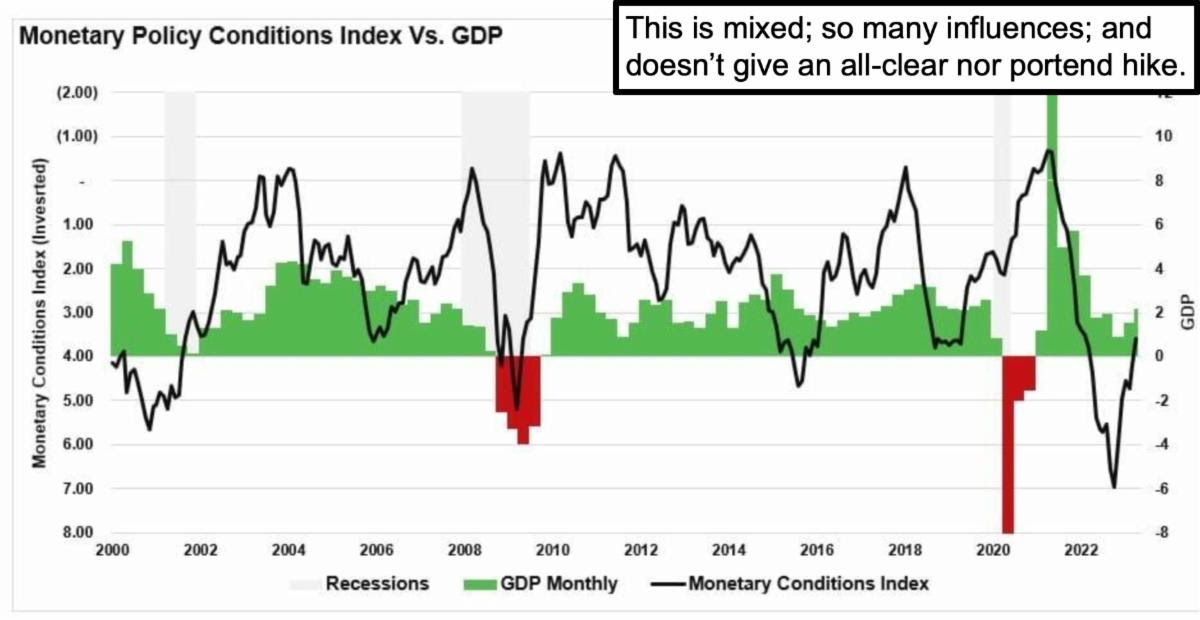

No overall policy change should be assumed from adjusted Jobs numbers; as the Household measure was up considerably in 'job losses'; hence labor strength is not so robust as superficially gleaned; thus the Fed can still pause.

We have ideally preferred that the Fed take a pass in June and assess data in July, to determine if they want to press their luck on hiking even more. Note all the data is supportive of our 'softish' view on the economy (not hard landing in light of tighter policy; but not soft either... sort of a middling sweetspot).

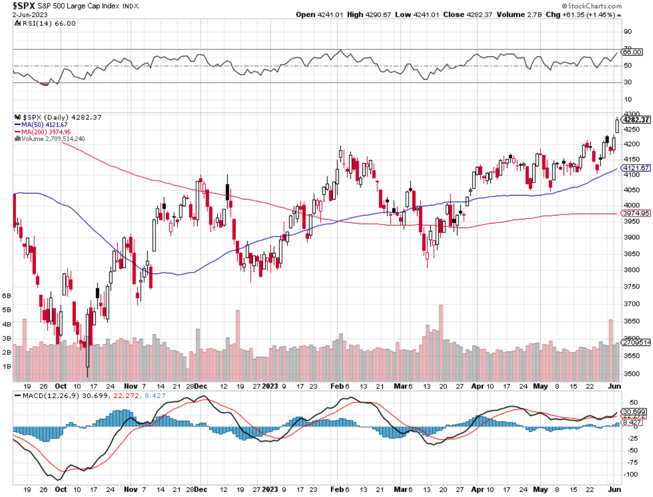

Excellent behavior in many ways; including breadth improving... ie: the small caps coming up rather than just big-cap leadership trying to extend.

This would be viewed as a positive overall; given broadening of the market as contrasted with the bifurcated behavior. However it can also be tricky and able to occur in the final stages of a rebound; but it's premature to ordain that.

I've mentioned the VIX often enough; others are starting to notice. It doesn't mean we'll simple continue shuffling; but can be a concluding short-term part of the action. We have not advocated a strong stance on VIX in ages; and still don't; but we're getting there. I don't know if VIX can make it down to 12 or so, but if so that might be an interesting speculative hedge of sorts.

I'm not too enthused about hedges because the bearish bias persists, and so does the excessively crowded short-side of the ledger; which has been helpful for many months in terms of not really upside dramatics; but lack of collapse. I had pointed out repeatedly how difficult it is to 'crash what's already crashed'.

Bottom line: Generally the S&P is becoming long-in-the-tooth; but broadening-out of the overall list is helping, especially with more small-caps showing signs of life. I expect more of the same (barring bad news) early in the new week; especially if the market is briefly on the defensive to start, rather than up immediately.

Enjoy the weekend!

More By This Author:

Market Briefing For Thursday, June 1

Market Briefing For Wednesday, May 31

Market Briefing For Tuesday, May 30 '23

This is an excerpt from Gene Inger's Daily Briefing, which typically includes one or two videos as well as more charts and analyses. You can subscribe for more