Market Briefing For Monday, Apr. 3

'April Fools' constantly believe our Fed 'wants' to crush the economy. In my opinion they don't truly 'want' to crush jobs; just ease inflation. They're getting a 'credit contraction', even a 'crunch', but not a broad banking blowup, despite a poor record of regulatory oversight that helped get to the SVB failure etc. It's in my mind that this forecast rally was also 'window dressing' so allow respite, then likely forge ahead; but there are some financial challenges still lurking.

Otherwise few overriding negatives here; except for 'war'; except for a China possibly attacking Taiwan; and except for .. a longer-range plan .. to decouple trade from the U.S. Dollar. Just today we hear China has a deal with Brazil (a sort of friendly country) to commence trade without using the Dollar. Of all the 'black swans' or 'gray gooses' circling; the eventual Dollar role means most, of course aside the slaughter that actual combat with China would inevitably be. For the moment, on the weekend, the only Grey Goose might be 'bottled'.

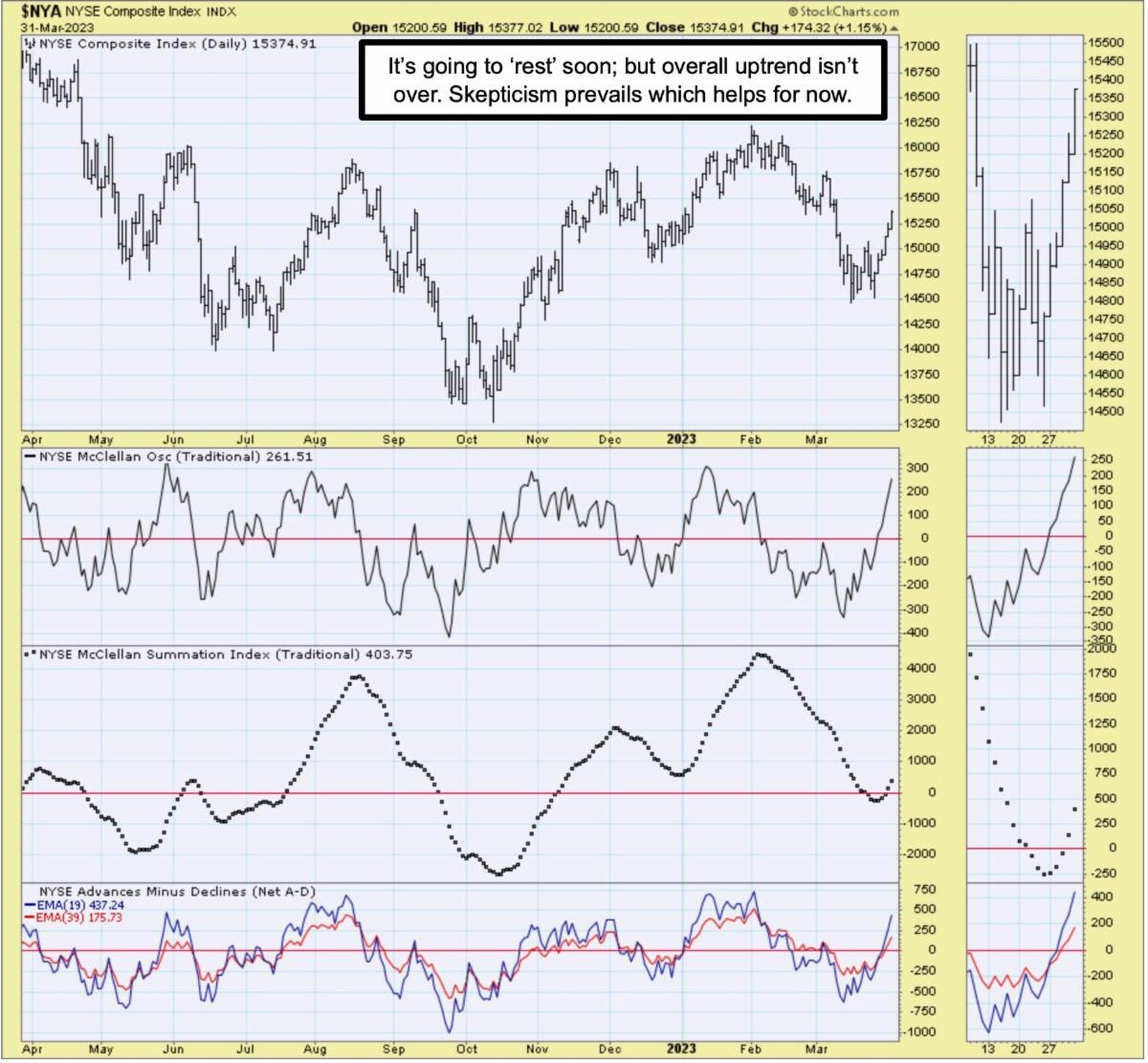

Absent a really big-blow-up militarily or financially; we're not moving into a sort of 'severe' earnings recession; but a 'milder' variation of earnings contraction, in some but not all areas. Thus it's tough to gauge recovery prospects, but it's Spring, the market is conforming to our overall forecast (erratic at times such as last month, but nevertheless with our 'inverse head & shoulders bottom' of last October undisturbed and unlikely to be challenged anytime soon); and we expect an ebb & flow but basically stable to higher in many stocks in April.

Notice I suggested "in many stocks", because unless something incredible like Apple buying Disney actually occurs (that would rocket the S&P itself); most of the action should be in smaller stocks, especially low-float candidates with a decent proportion of that float shorted, which provides fuel for rally ignition.

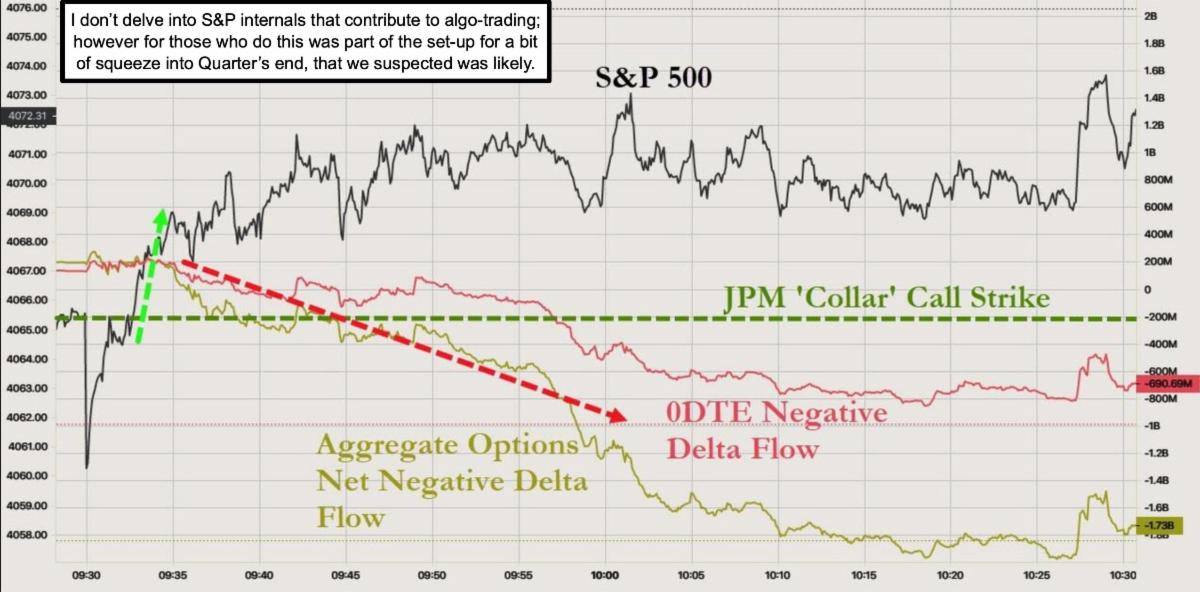

In sum: superb end-of-Quarter / month-end rally; and particularly in smaller stocks in which we thought the heavily shorted lower-float ones were primed to move for awhile, and this was the opportunity to do so. Follow-through will likely be contested, but at the moment most should squeeze shorts further in the new week, even if they have an initial effort to fade the first 'thrusts'.

This was largely Quarter-end 'window dressing'; to show on-the-books stock rather than just cash or Treasuries, as they miss an upside move; especially as relates to 'AI'. Lots more (with individual stock reflections) follows below.

I'll expand on other areas, including geopolitics, next week. It's important not to have the U.S. situation really cave-in, which is why whatever Fed intentions they need to recognize that in a time of military preparedness (China called it 'pre-war' in three separate 'dear leader' speeches this past month) we must be 'on point' and capable of financing the necessary advances where we lag adversaries. I'm not encouraging reckless spending; just 'peace thru strength'.

Friday was 'epic' in terms of how you squeeze a handful of oversold survivor small stocks, while bigger ones came along for the ride generally; not entirely.

I don't dispute that banking stress persists; but also that inflation is easing; as I have suggested for some time 'naturally'; and the PCE showed that. Now we have an upcoming CPI number; that too should reflect easing price pressures.

Bottom line: a few analysts are 'allowing' for a grinding upside move (how kind of them); while some technicians remain bearish (good; helps upside in this situation, but only short-term). Basically they are capitulating to the rally.

Dynamics next week include Oil (strong); the Dollar (not making much of the trading agreement between China and Brazil); and of course the CPI which I suspect will be friendly, as was the (adequately milder) PCE on Friday. We're optimistic that the market's rally was not a month-end 'head-fake', but gains a bit of staying power, though I expect it to be put on the defensive, essentially to test its mettle as we progress early in the new week.

More By This Author:

Market Briefing For Thursday, Mar. 30

Market Briefing For Wednesday, Mar. 29

Market Briefing For Tuesday, Mar. 28