Market Briefing For Tuesday, Mar. 28

Driving around Windermere reminds me of watching the market action. It's 'bifurcated'. By that I mean impressive and often-fabulous homes on lakes but riddled with 'dirt roads'. Imagine pricey homes and cars navigating overgrown trails, just for a moment, as it seemed like watching overpriced big-cap stocks, while most of the rest of the market remained 'in the weeds'. One moment its design or image is impressive, but dig a bit deeper and you find varying flaws, and once in awhile hit unmarked ruts in the road, risking sliding into a ditch.

In that sense the 'Californication' of Florida for now misses the floods, but of course when severe storms arrive here, those among a 'chain of lakes' might have similar problems (so yes I still fear major 'temblors' coming to California).

In any event nothing has changed with our 'aggressive neutrality' toward S&P, with a broadly-defined 3800-4100 trading range continuing to prevail. Many of course are very bearish now, and I see their big-cap perspective.. for later on.

And price trends in real estate suggest continued decline, buyer reticence due to awareness that a year from now mortgages will likely be 2 full points lower. For now the combination retards listing and deflects buyers. That will change.

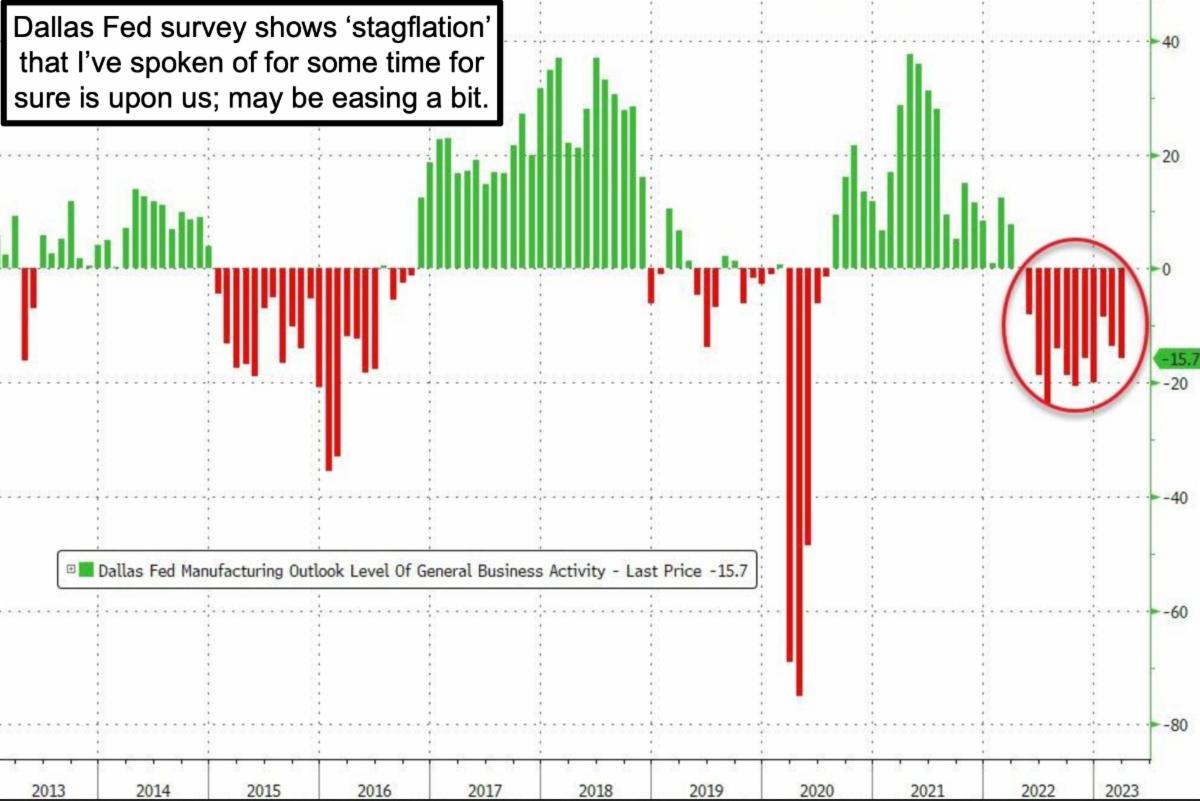

Of course that relates to the stock market, where an 'inverted yield curve' has bears growling and bulls frustrated. Yes it usually means recession, and as I'd said before I don't see much upside for S&P, but do think stabilization persists for now, with big-cap downside risk postponed, not necessarily denied.

In any event nothing has changed with our 'aggressive neutrality' toward S&P, with a broadly-defined 3800-4100 trading range continuing to prevail. Spring's sprung, but a Spring Rally really depends on Oil stocks and even Banks a bit. Just like many golf courses around here, there's no fast green or holes in one, there are challenging paths to success void of any overall championship yet.

I say that because most big-cap tech stocks are not exactly bargain priced. At the same time many smaller-caps are basically 'cruising around' more or less with aspirations of being stronger, and possibly achieving that fairly soon. For sure that depends on fundamentals, as technicals are languishing oversold in many cases (essentially lateral sideways narrow-range behavior for awhile).

In-sum:

Techs have been outperformers, but not very impressively. Notably it is not much of a 'relief' rally, and sort of drifting. There are global nuances that might be encouraging: a) Israel will not do the controversial 'judicial reform' at this time, with Netanyahu backing-down today, b) the 'friendship' between the Chinese and Russians was limited to strategic cooperation with no alliance, c) Iran remains a threat, but if they got the message they'll 'chill', and d) Russia's movement of 'tactical nukes' to Belarus differs from forward-deployment of the similar NATO weapons, because Russia is an aggressor in an active war (and as I've mentioned, any fallout would drift in prevailing winds right to Moscow).

Domestically, given European banks now moving to 'slightly' positive interest rates, the backdrop is improving relative to absurd effective negative rates. It's nothing exciting for EU or American banks, showing a lack of real clarity in the wake of the rescues that just happened, with 'price discovery' clearly ongoing.

So-called value stocks are not adequately helping markets much if at all this year, although some more M&A in small-banking can help relieve stresses. In the case of another scandal in the 'crypto-crooks' (not saying all but suspicous for a long time) you have more help for Banks by frustration with 'the people', or organizations, that have been at the helm of mostly-unregulated crypto that is fed by generally illicit operations South of the Border and from Asia. Not all of course, but enough that it's not only flight capital, but laundered capital.

A bit more, but eventually the Fed will need to step-back from fighting inflation lest they leave a large 'divit' that would displease the players. Bond volatility is a factor, but the Fed & Treasury think they can contain any disruptions . . so if the economic data continues to weaken, it's illogical for the Fed to do more.

This day was about 'crisis averted' and more relief. S&P up, then down to fill the gap from Friday's end, and support my contention that intraweek traders almost always will not change opening upward action, but await a dip. Other than that, the market was sort of languishing and focused on interest rates as well as economic data.

By the way there was a poor 2-year Auction with a lower bid-to-cover ratio. It is more avoidance than negativity, as many 'may' think rates will go back up, which I suspect would only be temporary as we settle into a fairly high range, but neither above the prior peak, nor anything as low as before last year's.

The market could use a reason, or new paradigm, to make a significant move, rather than languishing in 'recession fear' as the landscape otherwise appears to many. We had stabilization in big techs, weakness in banks for quite some time (and we've been bearish on Banks, more neutral on Tech, with optimism for selected stocks, but not much activity of significance in any of the areas).

If we can get a rebound in Oil, combined with 'slightly' better Bank behavior, and simply Tech stability, that would help the S&P get-on with a Spring rally.

Underlying sectors have to be scrutinized rather than broadly embraced. For sure that applies in 'commercial real estate', which remains under pressure of course, and for which there is no expectation of improvement. Actually, that's also the case for overpriced residential real estate in many areas, part of what I've affirmed by checking-out prices in the hot Central Florida market. It's not a cooling market, but there is both seller reticence if they have a low-rate or free and clear home, and buyer deflection when they contrast current vs. prior sale prices. So it's not even a 'seller's market' if the buyers are extremely reticent if they don't have to move from where they are.

And if there's a sector to steer-clear of and not go off-roading into a 'rut', we'd say that's crypto, where yet-another investigation of Binance, contributed to a solid decline by Bitcoin, which we do look at almost daily, and are negative on from a standpoint of normal investors. We suspect Chinese laundries (:)) and Latin cartels are the primary users of crypto, and normal American speculator players can catch a move now and then, but should generally avoid the area.

More By This Author:

Market Briefing For Monday, Mar. 27

Market Briefing For Monday, Mar. 20

Market Briefing For Thursday, Mar. 16