Market Briefing For Friday, Dec. 9

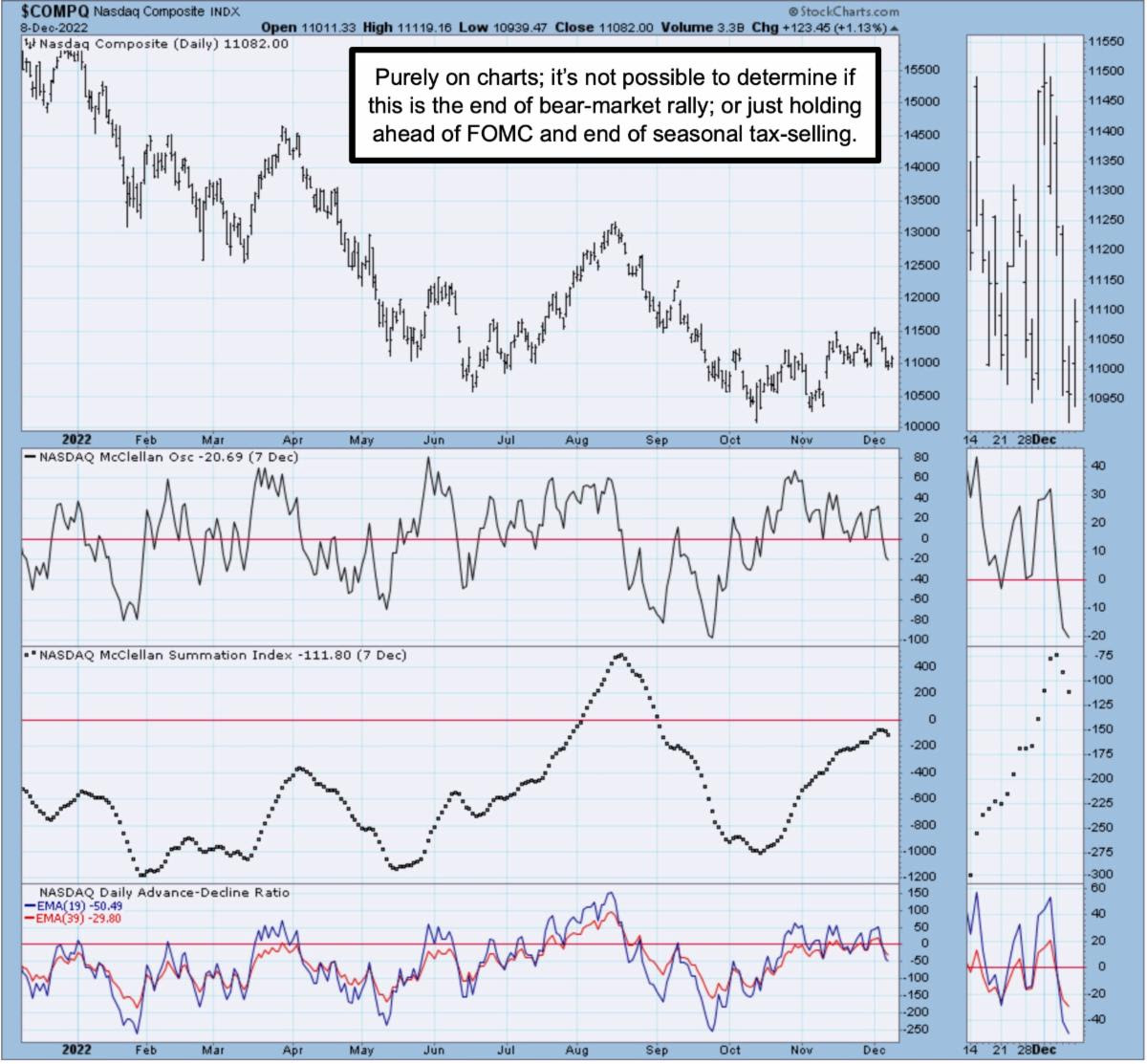

Persistent range-bound neutrality prevailed again absent accommodation expectations for the FOMC next week. It is basically on hold pending what's likely another (but milder) pace of rate hiking; or ideally a 'pause' in the pace.

If the Fed does only 25 bp or nothing, it would be a recognition that a 'softish' landing is unlikely if they do anything heavier. It also might be seen as 'relief', and absent aggressiveness from the Fed, the market would likely commence a year-end rally, if for that matter it's not already shuffling a bit towards that.

Wage-inflation is not the culprit; and putting more people out of work in basic service jobs, while there's a shortage in advanced technology, isn't very wise. I doubt the Fed wants that either; but it's what they get. Correlating all this will be reflected again in the upcoming CPI report; which should see a tempering of inflation in certain key areas (commodities and Energy broadly); hence I'm not in the camp that expects a huge Fed hike and a revisit of S&P lows.

At the same time, while many debate the terminal rate of hikes being 5-6%; I think that's not the solution; but a movement towards peace in Europe would, in my humble opinion, be the resolution. Also Oil is nearer the lower end of a range that has prevailed for awhile; so indexes should not see inflationary or upward price pressure from that area; as transportation costs were dropping. So I think it's irresponsible for calling for a 6% terminal rate some do; but that is what makes a market; and it would be worse than that if the Fed actually is poised for another 75 bp hike, though there is a 'little' room for them to hike.

Meanwhile .. Fidelity seeking an ok to make bigger bets on individual stocks, sort of rings hollow as while I respect some concentration in a few stocks; the need for a mutual fund to invest in the biggest-cap stocks is problematic. It's a move towards 'active management', but in this case limits the activity by their need to move into the biggest cap stocks.

But that may help Indexes, so essentially provide some 'cover' for smaller-cap stocks to catch a bid or hold that; without being swept along repetitively by all the overly-sweeping moves as 'pools' move back and forth, as I just recently talked about again (over-emphasis by managers on ETF's and Indexes). So diversification has it's merits; but lumping dissimilar stocks together is tricky.

In sum: less diversification is riskier; but makes some sense for big funds as we gather what is contemplated. It might be a desire to increase exposure in one or two stocks rather than spreading it out; and of course that potentially is a positive for stocks like Apple or Microsoft, even if they're shaky near-term. That goes doubly so for companies with chaotic C-suite drama; e.g. SalesForce.

Ironically I had just discussed this concentration topic the other day; and now I guess at least Fidelity is trying to modify how they approach handling difficult huge sums of money. But I think it can be a positive for 'active management' both of such big-cap behemoths and also keep innovative small-cap stocks a bit detached from the behavior of the Senior Averages alone.

I probably should make a point that by sprinkling some speculative money (of course not core funds) in several small-or-smaller caps that 'probably' remain solvent through this unusual period, the idea is to focus on innovation; a bit on disruption of the existing dominant players in a field (typically tech); and try to avoid getting caught-up 'like the big institutions who must' in yesterday's stock favorites. Those stocks (and I'll include Google, Microsoft, Tesla and others) may go up at times (especially if certain mutuals can focus more on them) but they also have vulnerability (such as Disney and Boeing and Tesla all saw).

It's just a perception that the 'easy' (no money is easy but we mean long ago) has been made, and rarely do the former leaders remain so in the next cycle, even if they do well to recover good portions of preceding peak-to-trough hits. In the small ones I'm interested in 'disruption', vision and energy among CEO leaders, who often are 'hungrier' than those running the now-old-school firms.

Bottom line: the facts and psychology of this market remain angina-inducing; unless one contemplates that most stocks already crashed and only big stock machinations managed to cover that distribution .. mostly 'last' year not now.

Nevertheless many on Wall Street continue to try talking the market down, at a time when year-end pressures are generally ignored as the focus should be on positioning for 2023.. and that doesn't mean short-selling, even if we get a sell-off briefly or even dramatically, should FOMC be draconian (suspect not).

The odds of defensiveness dominating this first half of December continues; at the same time Oil is probably bottoming concurrently; and both Energy as well as many smaller stocks rebound later in the month. It's theoretical; there are contrary technical indications; and we thought this time would be murky.

More By This Author:

Market Briefing For Thursday, Dec. 8

Market Briefing For Wednesday, Dec. 7

Market Briefing For Tuesday, Dec. 6

This is an excerpt from Gene Inger's Daily Briefing, which typically includes one or two videos as well as more charts and analyses. You can subscribe for more