Market Briefing For Wednesday, Dec. 7

'The depth of decline' - and expectation of revived earnings recession; are a part of the debate going on now. There is a distinction between estimates and reality; while a 'soft landing' has more likely been assumed rather than harder responses to the Fed.

The presumption surrounding the economic within S&P decline; are based on expecting that cyclicals have not discounted a recession yet. I tend to demur on this; and actually would add to semiconductor (domestic) positions in this month's weakness; especially if there is any kind of event-driven decline.

So far we don't have that kind of backdrop; although the Ukrainian justified air attack on Russian bases could be cited in the evaluation; even as there's no earthly reason 'why' Ukraine should do anything other than attack attackers.

Russia had at least 2 'Bear' (4 engine turboprop) bombers damaged; and an important fuel depot at Kursk was also on-fire as a result of Ukraine's attacks, that I'm told by an authoritative experienced military chap, was from 'drones'. Ukraine is justified; Russia's response is unknown; but Ukraine's initiation of a series of attacks deep inside Russia resulted from Putin trying repeatedly to break their will by attacking cities, civilian infrastructure and power plants.

All that is considered 'war crimes', and you don't know (yet) who's behind the attacks on U.S. (mostly Duke Energy, DUK) powerplant substations; with nobody of course willing to suggest saboteurs acting on behest of a foreign power.

In-sum:

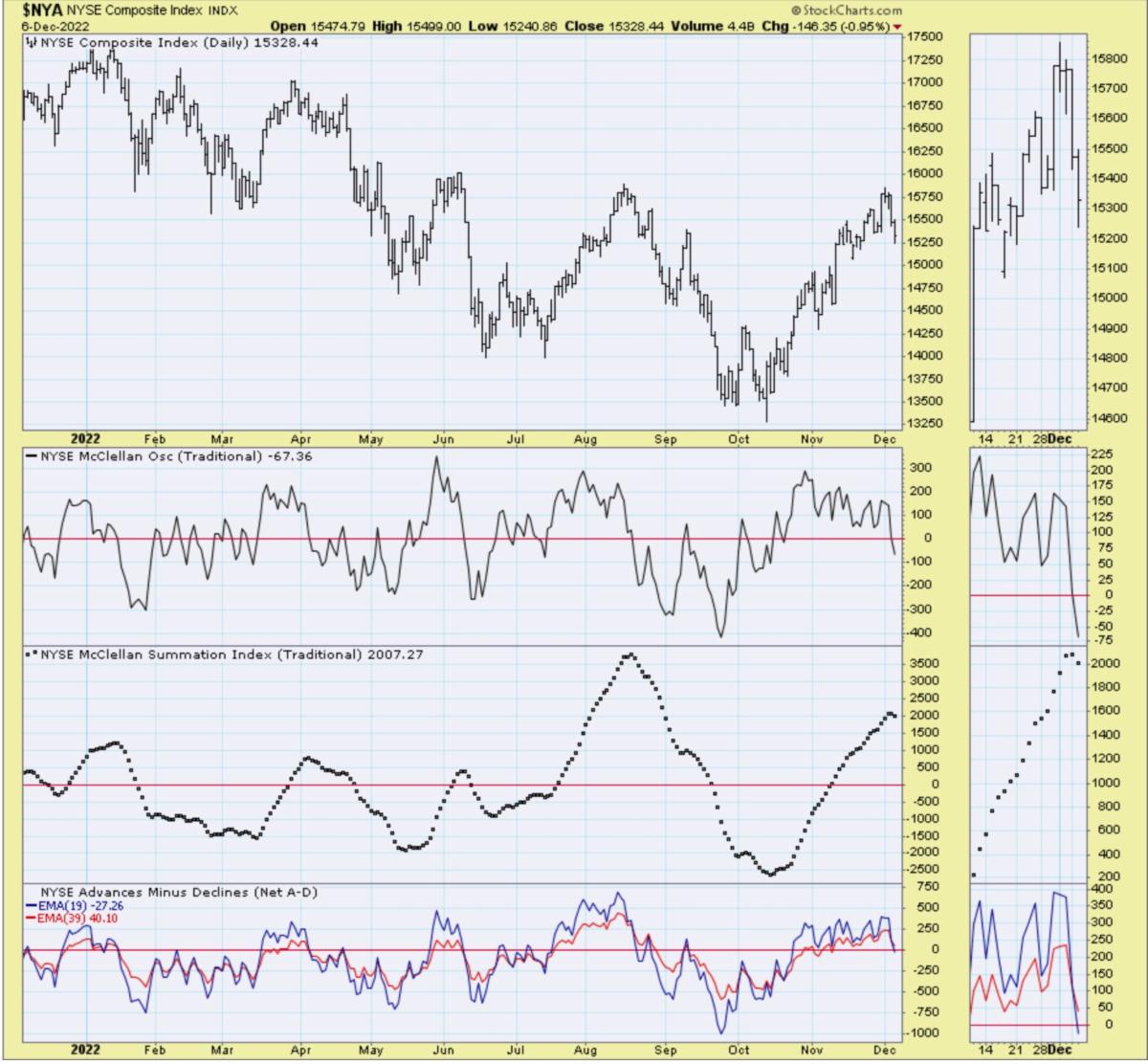

Today was heavier than thought likely (I was too optimistic for rally at least of an intraweek basis); with little in the backdrop to change assessment.

However we have suggested any rebound would be within context of an early (first half of) December defensive period, and so far that's an understatement. It's really complex with so many variables, that it's hard for strategists to take a meaningful position ahead of next week's FOMC position.

So you sort of have an 'absence of bids' situation; rather than real changes.

Tora Tora Tora . . wasn't just the Japanese Pearl Harbor attack radio call; but sort of is how the market appeared today; a bit more aggressively down than I suspected likely. There's no change of suspecting little enthusiasm for now; in a suspicion defensiveness overall continues; possibly until the FOMC meets.

Barring a dramatic escalation of the war (retaliation by Ukraine on air bases that launched attacks on their country is about time I suspect some believe) .. barring that, with Oil prices still soft and the Dollar mixed after dropping; you do have a continuation pattern that increasingly threatens optimistic patterns.

Bottom-line:

S&P 500 (SPX) clearly on the defense; and while we thought a rebound (of course might still get one) would be within context of first-half December more or less being defensive, some of this should set-up interesting speculative buy spots again. I think that's especially so for domestic-centric semiconductors.

People are not confident; selling first and asking questions later; and majority negativity among analysts and pundits hasn't helped. However they'll take just a little solace knowing that money managers who missed the rally off the twin low areas of June and late October, are happy to see this decline; as they get a chance to position for early 2023 from a better perspective than they had.

More By This Author:

Market Briefing For Tuesday, Dec. 6

Market Briefing For Monday, Dec. 5

Market Briefing For Thursday, Dec. 1

This is an excerpt from Gene Inger's Daily Briefing, which typically includes one or two videos as well as more charts and analyses. You can subscribe for more