Large & Small U.S. Banks See Deposit Outflows Continue, Small Bank Lending Growth Tumbled

It's late on a Friday afternoon, after a total collapse in First Republic FRC (which likely saw massive deposit outflows today as it stock collapsed to low single-digits), and we may get a hint of how bad it was heading into this chaos as The Fed's H.8 (commercial bank deposit data) just dropped.

After yesterday's report showed the Fed balance sheet shrinking but bank bailout facility usage higher, total US Commercial Bank deposits rose $21 billion during the week ended 4/19...

Source: Bloomberg

However, US commercial bank deposits (ex-large time deposits) continued their freefall (during the week-ending 4/19), tumbling $10.4 billion (less than last week) to the lowest since April 2021...

Source: Bloomberg

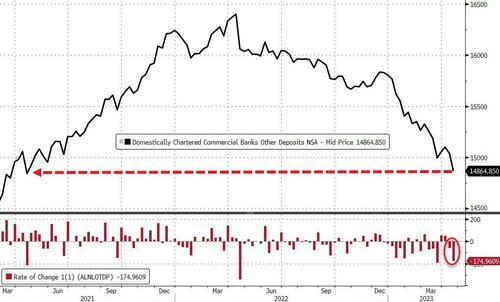

On a non-seasonally-adjusted basis, US commercial bank deposits (ex-large time deposits) tumbled a massive $174 billion (also at its lowest since April 2021)...

Source: Bloomberg

Yesterday's reported resumption of money market fund inflows hints strongly at ongoing outflows from commercial bank deposits

Source: Bloomberg

It is key to remember two things - 1) the deposit data is a week lagged to the MM flow data and 2) it's tax time and the total deposit outflows are likely driven by corporate tax payment demands...

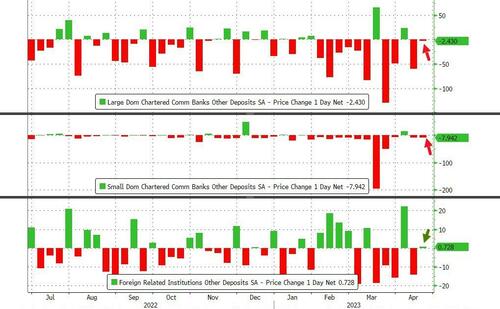

Both large and small US banks saw outflows last week while foreign banks saw inflows...

Source: Bloomberg

Small banks saw the largest outflows

- Large Banks -$2.43bn

- Small Banks -$7.94bn

- Foreign Banks +$0.728bn

Source: Bloomberg

And on the other side of the ledger, commercial bank lending rose $15.08 billion in the period after increasing $13.8 billion in the prior week on a seasonally adjusted basis. On an unadjusted basis, loans and leases rose $20.9 billion after two weeks of loan contractions.

Source: Bloomberg

Small bank loan growth slowed notably with only $4.04bn lent (vs $10.4bn the prior week) while large bank lending re-accelerated to

Source: Bloomberg

Finally, for those who think the crisis is over (and FRC and SVB were outliers), there's just one more thing. Wondering why regional banks just can't catch any kind of reasonable bid?

Source: Bloomberg

It's simple - as we detailed previously (as far back as Nov) - as long as we are above the reserve constraint level for small banks, there is stability courtesy of the Fed's massive reserve injection.

Source: Bloomberg

It appears Small banks are moving back towards the critical level, and the closer we get to that level, the greater the risk of bank failures and Fed panic.

Finally, we remind readers, this data does not include this week's potential problems (as the deposit and loan data is lagged by a week).

More By This Author:

Nomura Warns "De-Risking Supply" Is Building, Options-Traders 'Fingers Caught In Front Of Steamroller'

Exxon Smashes Expectations, Reports Strongest Ever Q1 Results

Bank Bailout Facility Usage Soars For 2nd Straight Week, Money Market Inflows Resume

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more