Nomura Warns "De-Risking Supply" Is Building, Options-Traders 'Fingers Caught In Front Of Steamroller'

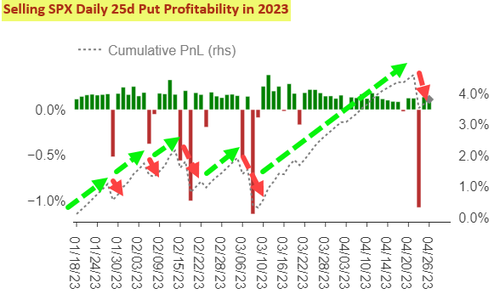

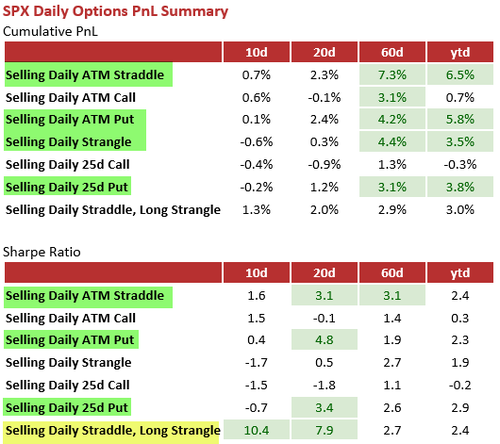

The last few weeks have been 'easy street' for options traders - selling puts has been extraordinarily and very smoothly profitable... until this week when, as Nomura's Charlie McElligott notes picking up the pennies in front of the steamroller always ends the same way - like Taleb's "life of a Thanksgiving turkey"...

The question is - will that pain trade be enough to stall the exuberance vol-selling crowd that has been enabling the equity market's gains amid growing stagflationary threats?

McElligott suggests that more than likely, this battle of fresh longs as a potential source of future "de-risking supply", versus Volatility which keep getting suppressed by Shorts / Overwriters / Underwriters will probably again come down to behavior of 0DTE Options users... and whether they reload what had been that recently winning “Sell Put” or “Sell Put to Credit / Buy Call” behavior which then fed this week’s Vol expansion.

Positioning / Net Exposure continues being “forced-in” with this tape refusing to buckle, as said “earnings recession” is yet again delayed...

McElligott sees the path of max pain continuing to be this near-term Equities melt-up through EPS season on “better than feared” prints... before this ongoing price-momentum rally and still squelched vol suppression allows for that final “topping-off” into forced reallocation / longs that then sit at risk of creating instability, into even just a small Vol move looking out when projecting just a few weeks from now, on mechanical deleveraging potential with such “full” positioning then at risk of deleveraging.

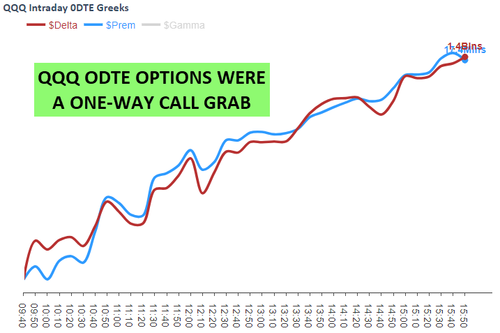

Yesterday's performance has that smell - it was "very chasey" as one market participant noted:

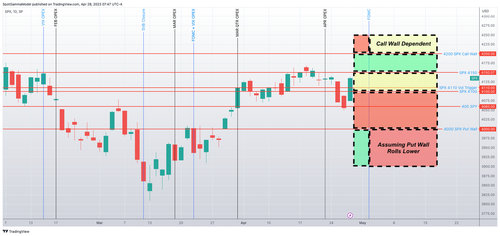

Which leaves SpotGamma suggesting that the end result of all this is that we think markets are now likely to take a breather, and volatility is likely to decline after back-to-back 2% SPX moves.

They hold the 4100-4150 area as neutral and look for trade to mean revert off of these support and resistance levels. Just as with earlier this week, a break of 4100 implies a quick test of the 4050 level.

A move over 4150 places the 4200 Call Wall in play, as SpotGamma thinks that 4200 level will "attract" or "pull" the market higher.

More By This Author:

Exxon Smashes Expectations, Reports Strongest Ever Q1 Results

Bank Bailout Facility Usage Soars For 2nd Straight Week, Money Market Inflows Resume

Amazon Soars After Smashing Expectations, Guiding Higher

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more