Exxon Smashes Expectations, Reports Strongest Ever Q1 Results

And the hits for the company that makes "more money than god" just keep on coming, while the White House looks on with impotent fury.

Exxon Mobil (XOM), our favorite stock since 2020 when it briefly traded below $40, posted its strongest-ever first quarter as oil production soared from new wells in the US and off the coast of South America.

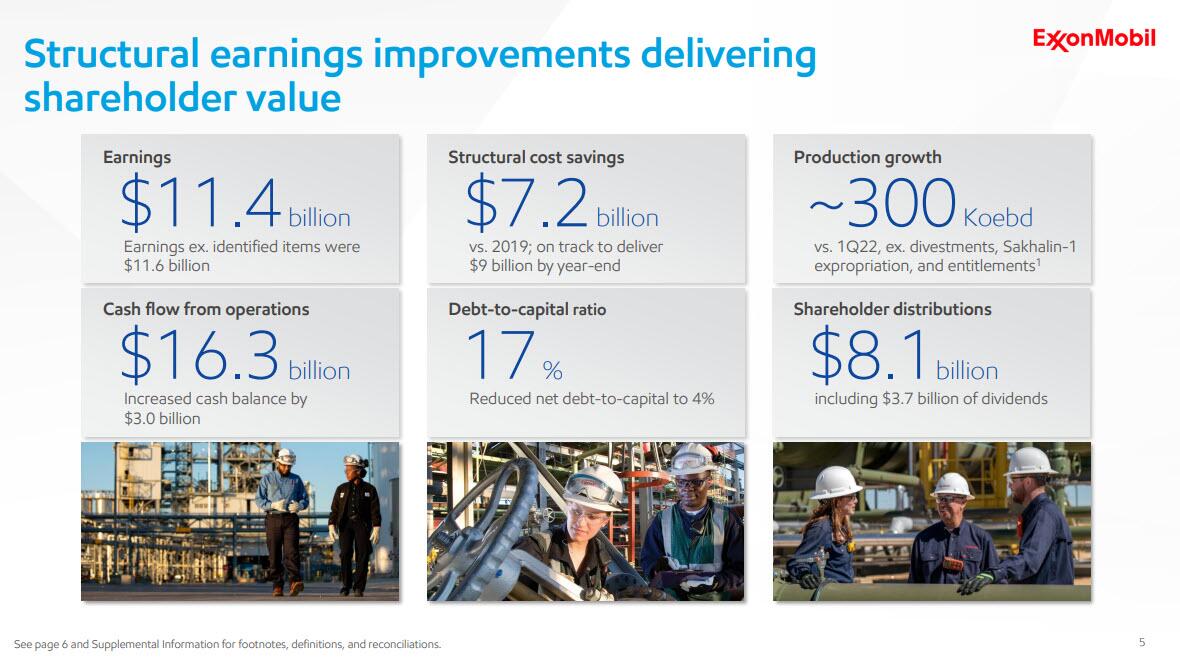

Net income more than doubled from a year earlier to $11.4 billion ($11.6bn ex items), the highest Q1 profit in the oil giant’s 140-year history, which is remarkable since oil prices tumbled during Q1. Adjusted EPS of $2.83 a share blew away the consensus estimate of $2.63; this even as total revenue of $86.56 billion (which beat expectations of $84.55 billion), dropped -4.3% from a year ago.

Exxon’s quarterly profit has exceeded $10 billion for four consecutive quarters, a streak not seen since the era of $145-a-barrel crude in 2008.

Some other details from the first quarter:

- Upstream adjusted net income $6.62 billion, estimate $6.51 billion

- Energy products adjusted net income $4.21 billion, estimate $3.89 billion

- Chemical products adjusted net income $371 million, estimate $398.3 million

- Specialty products adjusted net income $774 million, estimate $522.5 million

(Click on image to enlarge)

- Chemical prime product sales 4,649 kt, estimate 5,643

- Downstream petroleum product sales 5,277 kbd

- Production 3,831 KOEBD, +4.2% y/y, estimate 3,788

- Crude oil, NGL, bitumen and synthetic oil production 2,495 KBD, +10% y/y, estimate 2,418

- Refinery throughput 3,998 KBD, +0.4% y/y, estimate 3,970

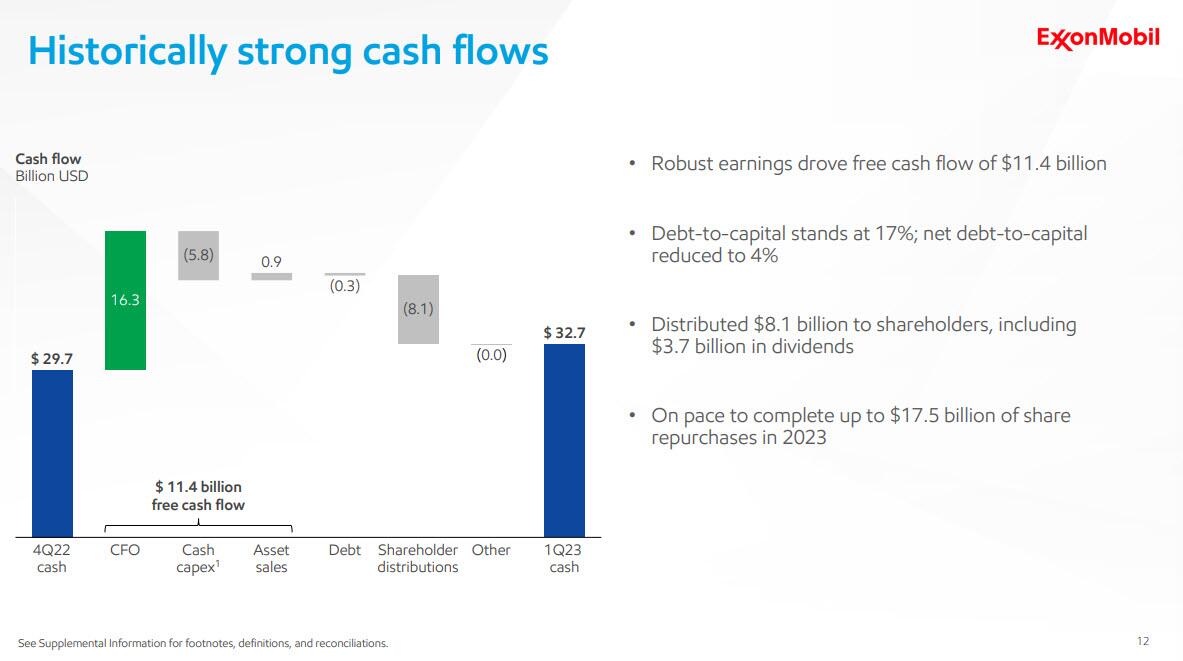

Exxon said its net debt-to-capital ratio shrank to just 4% at the end of the period, thanks in large part to a cash pile of almost $33 billion.

(Click on image to enlarge)

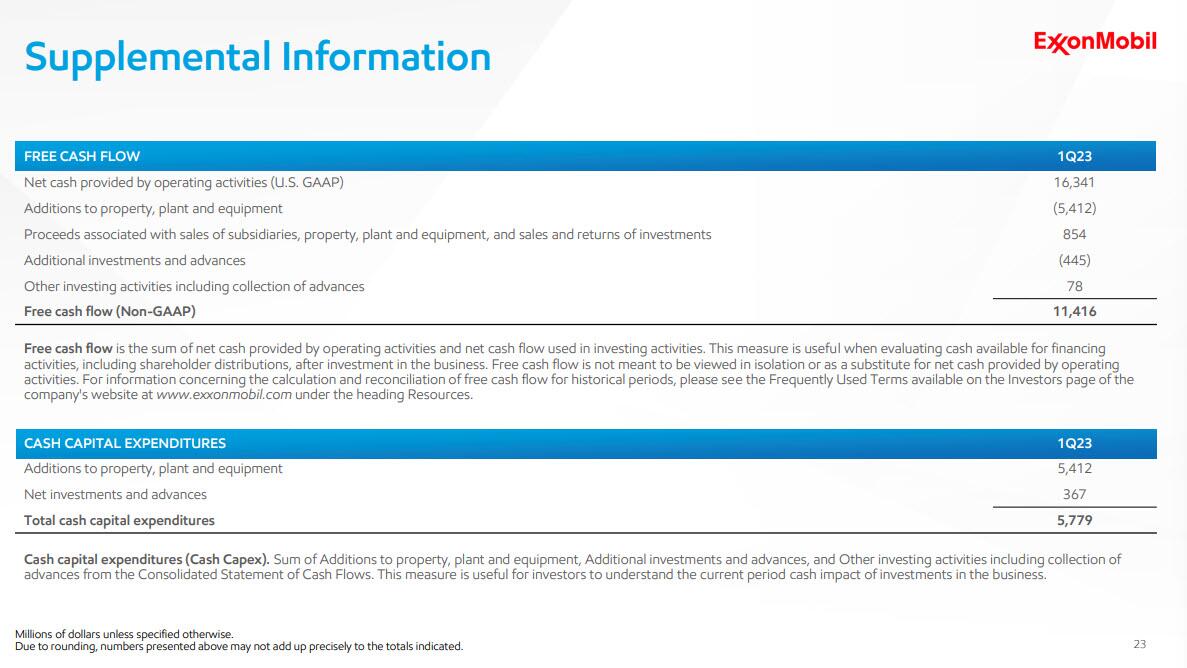

(Click on image to enlarge)

As shown in the next chart, the company is comfortably generating billions in Free Cash Flow after dividends and buybacks, which amounted to $3BN in Q1.

The company has enriched its faithful investors via billions in dividends and share buybacks, while infuriating the senile occupant of the White House basement; it's why Exxon is the best-performing energy stock in the S&P 500 Index this year, after being the best performing stock in all of 2022.

The unexpectedly strong results were “really all about us increasing our production volumes significantly,” CFO Kathy Mikells said during an interview. Output off the coast of Guyana and in the US Permian Basin rose 40% on a combined basis from a year earlier, she noted.

As Bloomberg notes, production growth in those two regions was so strong that it more than offset the negative impacts of asset sales and Russia’s expropriation of the landmark Sakhalin-1 development. Net output increased by the equivalent of 160,000 barrels of a day compared with a year earlier, Mikells said.

And so, flush with cash and with its trading near a record high, speculation is rife that Exxon may be gearing up for a big acquisition. The Wall Street Journal reported that Exxon held early-stage talks with Pioneer Natural Resources earlier this month. While both companies declined to comment on the rumors, analysts pointed out that the deal makes strategic sense and would make Exxon far and away the largest producer in the US Permian Basin, one of management’s highest-priority targets globally.

Chief Executive Officer Darren Woods signaled his interest in making shale as well as so-called low-carbon acquisitions earlier this year, but cautioned that it’s “difficult to go in and buy at the top of a commodity cycle.”

During a conference call scheduled to begin at 8:30 a.m. New York time, analysts are expected to ask about the company’s appetite for dealmaking, and how it will deploy cash. Even with oil prices down about 25% in the past year, Exxon is generating considerably more cash than it’s spending on capital projects, buybacks and dividends.

After reporting earnings, XOM's stock price traded up to $118.1, just shy of its all time high. It will likely hit a fresh record either today or in the coming days.

Exxon's full Q1 slidedeck is here.

More By This Author:

Bank Bailout Facility Usage Soars For 2nd Straight Week, Money Market Inflows Resume

Amazon Soars After Smashing Expectations, Guiding Higher

Amazon Earnings Preview: Here Are The Main Things To Look For

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more