Amazon Earnings Preview: Here Are The Main Things To Look For

Image Source: Unsplash

Unlike yesterday's Facebook's (META) earnings, which were viewed by many including JPM, as the "least controversial" mega tech name of all, with most expecting stellar results - and judging by the move today they were not wrong - today's tech giant on deck after the close on this busiest day of Q1 earnings season is Amazon (AMZN), which JPM's Jack Atheron writes is "number 2 to GOOGL on the list of most controversial mega cap tech names."

Here is what the JPM trader expects from the online retail giant:

- Most focus will be on the AWS trends: buyside looking for Q1 +12-13%, Q2/Q3 tracking to ~8%, and Q4 bouncing back into double digits.

- At a group level, buyside whispers are Q1 revenue $125B, EBIT $3.0B (guide $121-126b, $0-4b);

- Q2 guidance of $130b, EBIT ~$3.5B (both midpoints). Commentary in last week’s shareholder letter gave more confidence in Retail profitability trends which will be the 2nd most important topic this quarter. After last quarter’s wobble, getting the call right will also be essential for mgmt.

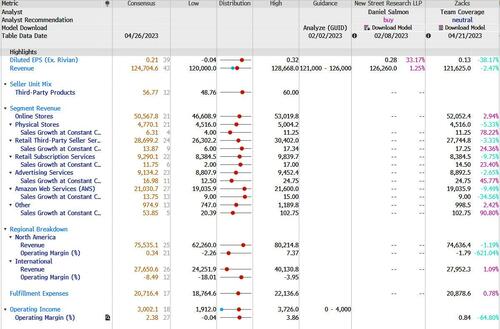

Taking a step back, here is what Wall Street's median sellside consensus expects AMZN to report: EPS of $0.21, Revenue of $124.7BN (around the mid-line of the company's $121-126BN guidance) and operating income of $3BN (guidance of $0-$4BN), translating into 2.38% operating margin.

Some more details:

Earnings: Analysts surveyed by FactSet expect Amazon to record 21 cents a share in earnings for the first quarter, whereas the company generated a 38-cent per-share loss in the year-prior period. On Estimize, which crowd sources projections from hedge funds, academics and others, the average estimate is for 23 cents a share in earnings.

Revenue: The FactSet consensus calls for $124.6 billion in total revenue for the first quarter, while those contributing to Estimize anticipate $125.5 billion in average. A year ago, Amazon logged $116.4 billion in revenue.

As MW notes, investors will be keenly focused on Amazon's online sales, which are expected to have declined to $50.7 billion in the latest quarter from $51.1 billion a year prior, as well as on sales from the Amazon Web Services cloud-computing unit, which are expected to increase to $21.3 billion from $18.4 billion, according to FactSet estimates. The forecasted AWS revenue implies a 15.3% growth rate, below the 20.2% rate seen in the December quarter and the 36.6% clip seen in the year-earlier March quarter.

Stock movement: Amazon shares have declined following eight of the company's past 10 earnings reports, including each of the last two. The stock is up 25% so far this year, as the S&P 500 has increased 6%. Of the 53 analysts tracked by FactSet who cover Amazon shares, 47 have buy ratings, five have hold ratings, and one has a sell rating, with an average price target of $130.71.

What else to watch for:

Analyst Ronald Josey will be paying attention to AWS growth and North America retail margins in particular.

- "AWS is among our top focus areas and given improving Azure and Google Cloud results in 1Q23, we will be listening for signs of stabilization trends and insights around optimizations and newer workloads," he wrote in a note to clients.

- He expects a 1% North America operating margin but thinks that Amazon has room to "improve materially going forward" on the heels of layoffs, fulfillment efficiencies, incremental fees for grocery orders and same-day shipments, among other factors.

- PIper Sandler's Thomas Champion wrote that he thinks Amazon "can surpass a low bar on core retail, offsetting slowing AWS growth." Besides AWS, "the biggest investor pain point with AMZN is the ability to drive margin expansion," he continued, but he thinks that "signs of leverage are emerging."

- Aaron Kessler of Raymond James is interested in the ways Amazon is incorporating artificial intelligence into its business.

- "We expect investors to be keenly focused on Amazon's AI initiatives, particularly for AWS," he wrote. "Amazon recently noted in its shareholder letter that it has been working on its own LLMs [large language models] for a while now and believes it will transform and improve virtually every customer experience, and will continue to invest substantially in these models across all of our consumer, seller, brand, and creator experiences."

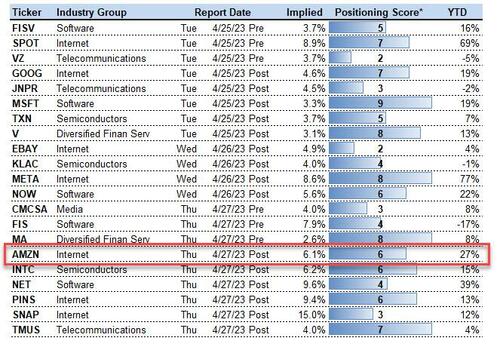

Finally, looking at Goldman's positioning score, we find that unlike META which was at the top of the rankings, positioning in AMZN (with a Positioning Score of 6) is far shakier. As a reminder, positioning is determined by the Goldman desk based on flows, positioning data, and feedback .

More By This Author:

Amazon Soars After Smashing Expectations, Guiding Higher

Stagflation: Q1 GDP Much Weaker Than Expected On Inventory Plunge As Inflation Comes In Red Hot

Meta Soars After Top- & Bottom-Line Beat; 'Metaverse' Losses Grow, MAUs Disappoint

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more