Key ETF Performance In September, Q3, And Year-To-Date

Image Source: Pexels

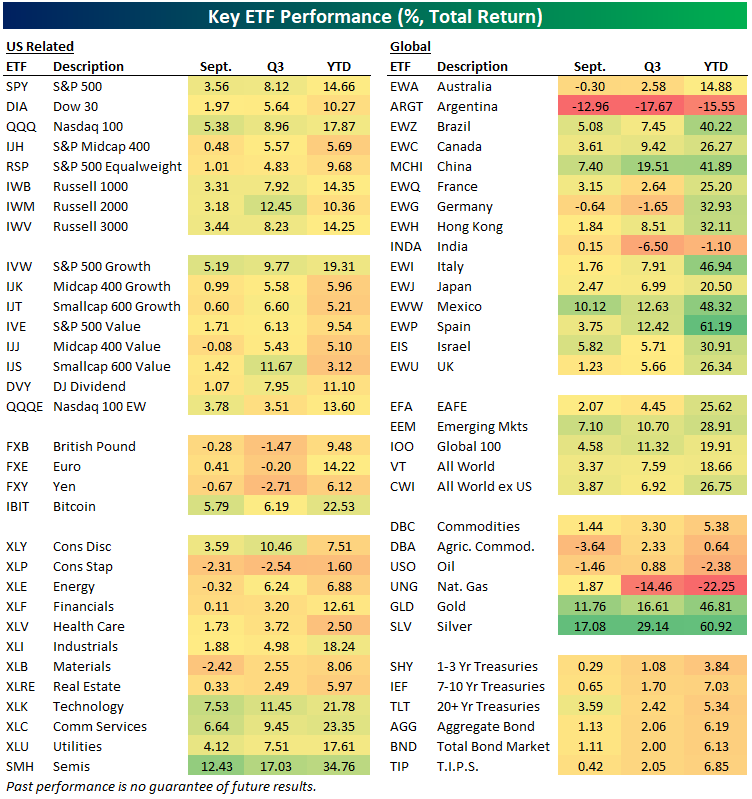

Here is a quick check-up on asset class performance using our key ETF matrix. For each ETF, we will show its September, Q3, and year-to-date total return.

US index ETFs posted solid gains in both September and for all of Q3, with the Nasdaq 100 (QQQ) leading the way in September and the small-cap Russell 2,000 (IWM) leading for the full quarter. Additionally, small-cap value (IJS) did well in Q3 in particular.

Notably, the S&P 500 Equalweight (RSP) was up much less than the cap-weighted S&P (SPY) in September, as the mega-caps once again drove upside performance.

Looking outside of the US, Argentina (ARGT) was the only real area of pain in September, although Germany (EWG) and Australia (EWA) were both down slightly as well. China (MCHI) and Mexico (EWW) were the two best country ETFs in September with gains of 7%+, while China led the way for all of Q3 with a gain of 19.5%. On a year-to-date basis, Spain (EWP) is still up the most, at 61.2%.

Gold (GLD) and silver (SLV) were on fire in September, with gains of 11.8% and 17.1%, respectively. Treasury ETFs were up slightly across the board during the month as rates fell, with longer duration up the most.

(Click on image to enlarge)

More By This Author:

Bitcoin Rallies Right On Cue

Tuesday, The New Monday

Home Sale Strength

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more