Bitcoin Rallies Right On Cue

US futures are higher again this morning as the S&P 500 looks to push further into record territory with a gain of 0.23%. Gains in the Nasdaq are more than twice as much as the index looks to start the session with a gain of half a percent. Oil prices are lower, trading at $61.5 per barrel, while the 10-year yield is very little changed at a very well-behaved 4.10%. Gold is fractionally higher, while silver is lower, and other precious metals like platinum and palladium are up closer to 2%. Even copper is up over 1.5%. Crypto is also having a strong morning as Bitcoin rallies more than 1% to $119K and Ether is right below $4,400.

We’re supposed to get weekly jobless claims at 8:30, but those will be delayed by the shutdown. But Challenger Job Cuts declined 25.8% year/year.

Overnight in Asia, it was a very strong session as the Nikkei was up nearly 1%, while Hong Kong, Korea, and Australia all surged over 1%. Korea surged 2.7% taking its YTD gain up to 48%! The overnight gain was driven by rallies in Samsung and SK Hynix, which rallied 4.7% and 12%, respectively, after the two companies announced an advanced memory chip deal with OpenAI. These two stocks have also been driving most of the gains for Korea all year.

In Europe this morning, we’re also seeing broad-based strength as the STOXX 600 gains 0.7% with Germany and France leading the way with gains over 1%. This morning’s strength comes as Unemployment for the region unexpectedly increased to 6.3% from 6.2%

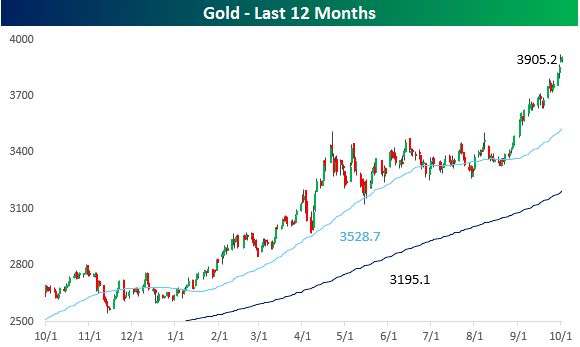

The rally in gold just keeps chugging along. This morning, prices are once again attempting to close above $3,900 for the first time, on pace for the sixth straight day of gains and the ninth daily gain in the last ten. Investors have been looking in awe at charts like Nvidia (NVDA), Western Digital (WDC), and other hyper-growth stocks, but gold is screaming, “what about me?” as its chart has also gone vertical. As of this morning, the price is more than 10% above its 50-day moving average (DMA) and 22% above the 200-DMA.

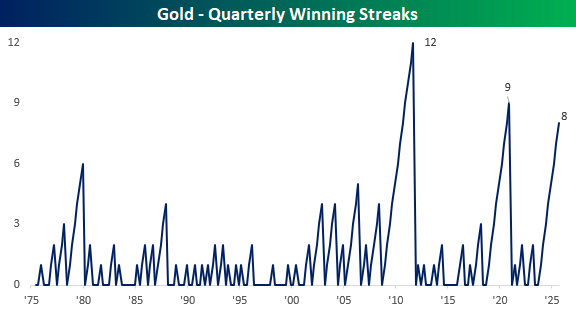

On a quarterly basis, gold is also reaching rare air. Its Q3 gain of 16.1% was the eighth straight, which ranks as the third-longest quarterly winning streak since at least the early 1970s. The longest was 12 quarters ending fourteen years ago in Q3 2011, while the second longest ended at nine in Q4 2020.

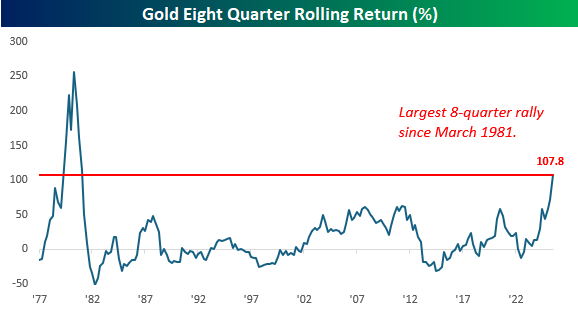

Besides the 16% gain last quarter, gold has also had three other double-digit percentage quarterly gains during the current streak. In total, gold’s price has more than doubled in the last eight quarters, and as shown in the chart below, it has been the largest eight-quarter gain since Q1 1981. Most people have literally never seen anything like it!

More By This Author:

Tuesday, The New MondayHome Sale Strength

Investors Buying Apple As Consumers Buy The iPhone

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more