In Autumn When The Leaves Fall...

The financial world is eagerly awaiting the new US labor market data to be released on Friday. If they are weaker than forecast again, hopes for falling yields are likely to be rekindled – much to the delight of the stock markets and precious metals. The bet that the Fed will cut interest rates by a quarter of a percent at its meeting on September 16 and 17 now stands at a whopping 89 percent. Some even hope for half a percent.

However, we have already discussed several times in previous Thoughts that interest rate cuts are even being discussed in times of persistent inflation. This makes it all the more clear that if the data turns out to be surprisingly strong, the euphoria could quickly evaporate and the markets could react negatively.

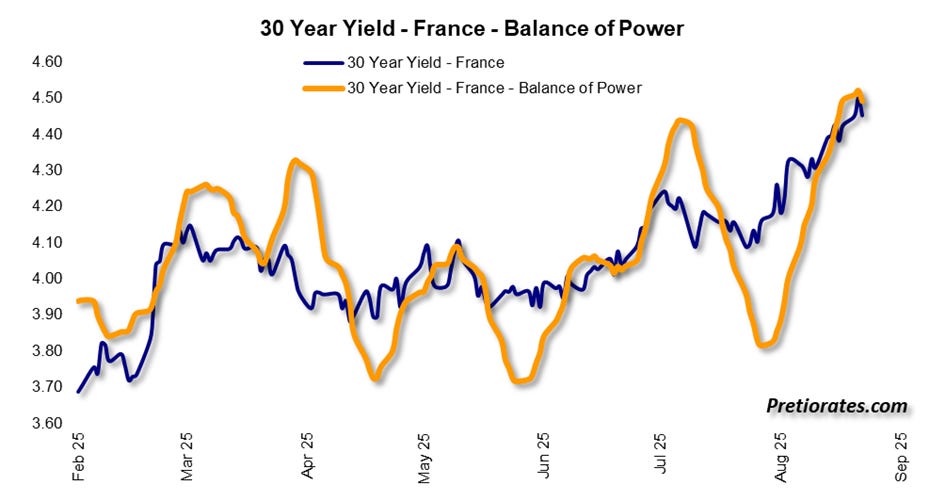

Beside, we are completely forgetting that there are also trouble spots in Europe that are causing investors headaches. This time, the focus is not on Greece or Italy, but on France and the UK. In Paris, Prime Minister François Bayrou is fighting for his political survival – he is likely to lose the vote of confidence on September 8. His austerity plans are too heavy, even though France has a frightening level of national debt. As a result, yields on French bonds rose to almost 4.5 percent. The balance of power indicator, which signals a calming of the situation, now gives us at least temporary hope.

(Click on image to enlarge)

The situation on the island is hardly any better. Yields on 30-year British gilts have climbed to almost 5.75 percent – a jump that signals that the air is thin here too. Once again, we can only hope that the markets will stabilize in the short term if the balance of power is correct this time too.

(Click on image to enlarge)

The picture is quite different on the other side of the Atlantic: on the US Treasury market, yields on 20-year bonds could be set for another upward trend, according to the cycles. This would be a clear warning signal for the stock market.

(Click on image to enlarge)

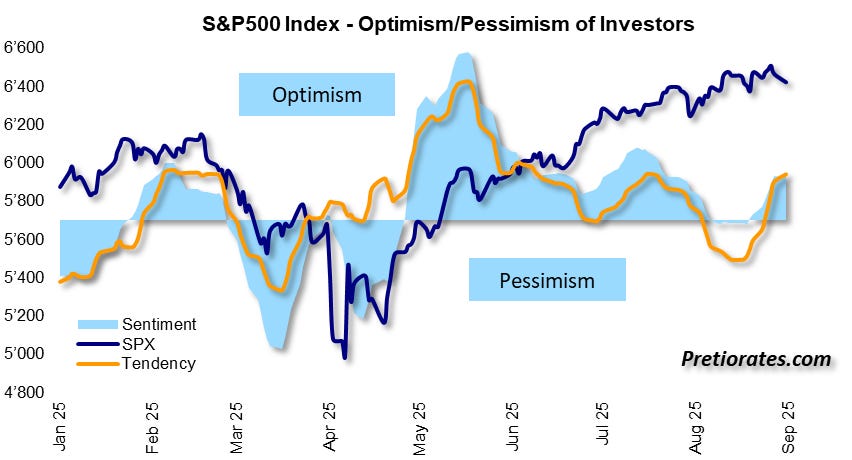

This is not yet reflected in the S&P 500; on the contrary, sentiment has brightened recently, and optimistic markets are known to be surprisingly resilient.

(Click on image to enlarge)

However, so-called smart investors have recently been distributing their equity investments. For the first time since June, they are retreating.

(Click on image to enlarge)

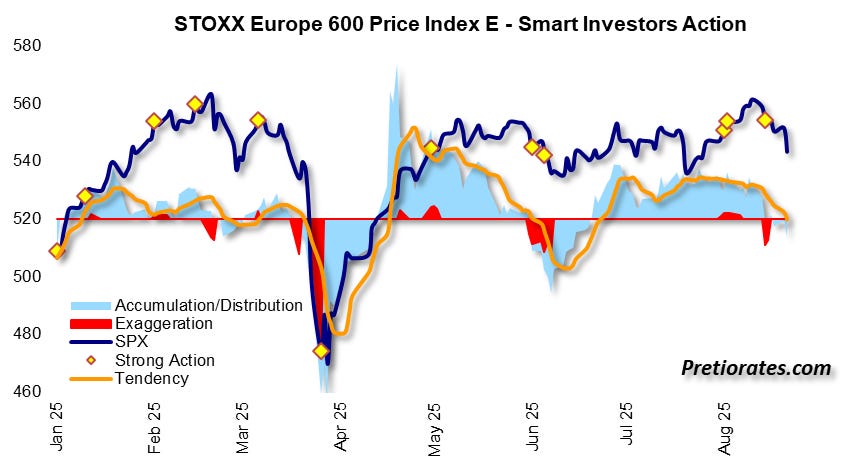

And the distribution tendencies of the professionals are visible globally – in Europe, too, smart investors are selling discreetly in the background.

(Click on image to enlarge)

The European Stoxx 600 Index has been unable to keep pace with Wall Street since May because investors were in a rather pessimistic mood. Recently, however, the general public has been showing more confidence again.

(Click on image to enlarge)

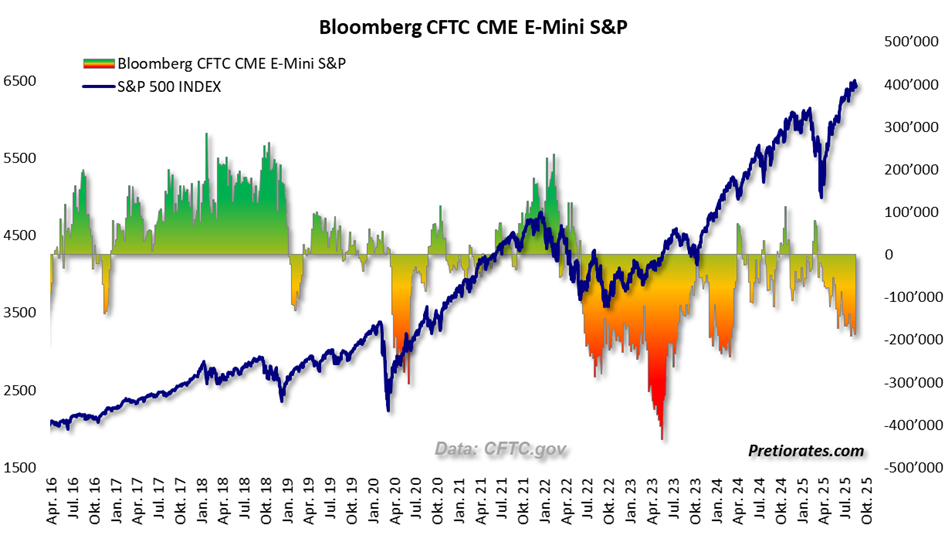

On the futures market, short positions in the S&P 500 are increasing noticeably. Whether as naked short bets or as hedging, the signal is clear.

(Click on image to enlarge)

However, there is little sign of fear of a correction. On the contrary, speculative investors have once again built up strong short positions in the volatility index (VIX) and are brimming with confidence. Experience shows that this is precisely the moment when the next correction is usually not long in coming.

(Click on image to enlarge)

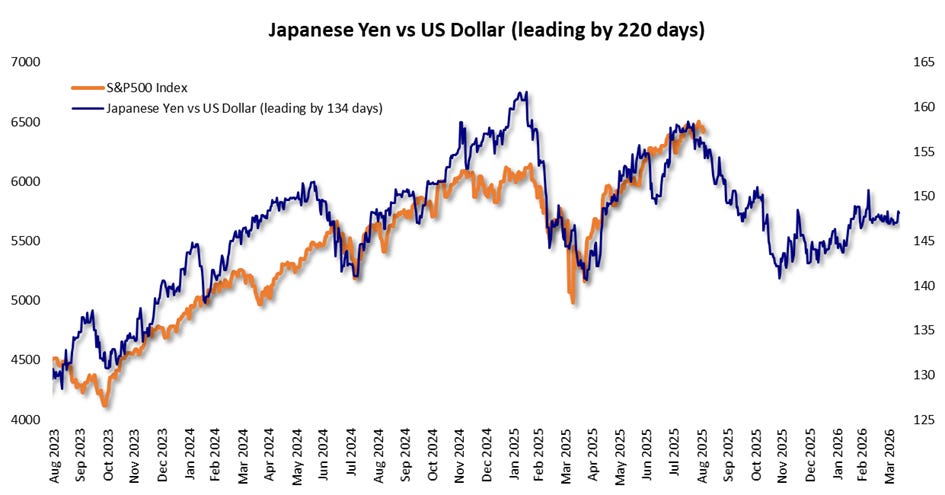

And then there is the Japanese yen. With its time lag of around 220 days, it is considered a fairly reliable leading indicator for Wall Street. Carry trades in the Japanese yen are an important factor for Wall Street. If this proves to be true again this time, then we are in for a rather bumpy start to the fall.

(Click on image to enlarge)

More By This Author:

Decoding The Nonsense: Trying To Find Logic In Trump’s Puzzle

Jackson Hole, Market Hold Their Breath

Gold, Stagflation And Tariffs – What Irony

Disclaimer: The information & opinions published by Pretiorates.com or "Pretiorates Thoughts" are for information purposes only and do not constitute investment advice. They are solely ...

more