Jackson Hole, Market Hold Their Breath

Tomorrow marks the start of the annual gathering of central bankers in Jackson Hole, Wyoming. For three days, they will discuss the big issues in monetary policy. But the real highlight is scheduled for Friday, when Fed Chair Jerome Powell will take the floor. Nervousness is already palpable on the financial markets, with investors hitting the brakes and adopting a wait-and-see approach. This comes as no surprise: Powell is caught between stubborn inflation and massive pressure from the White House, where President Donald Trump is vehemently calling for lower interest rates.

The latest data does not make the situation any easier. While the consumer price index (CPI) was in line with expectations last week, the producer price index (PPI) shot up by 0.9% within a month. This is anything but a sign that inflation is under control. For Fed members who have to decide on interest rates in the coming weeks, this presents a dilemma: if they cut rates – as the markets and the president are demanding – they risk fueling inflation even further. You know our assessment: the Fed will probably deliver less than many hope.

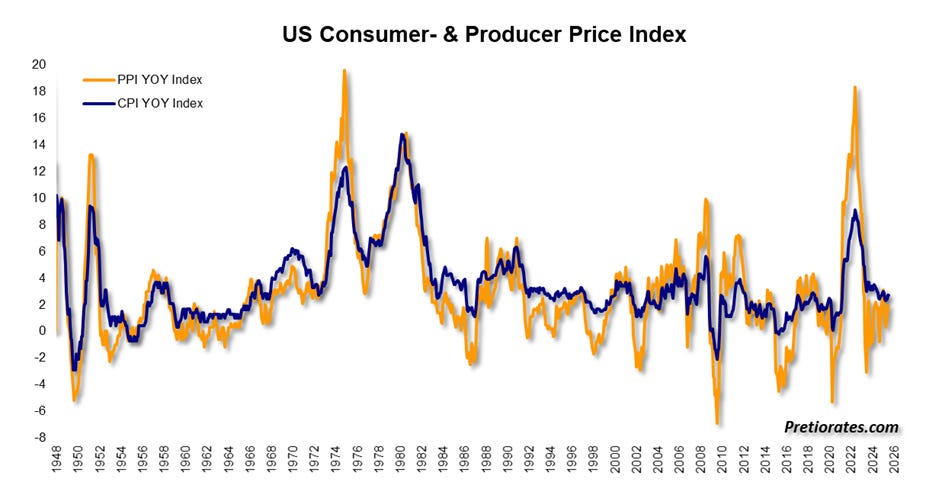

The producer price index is often seen as a precursor to the CPI. That sounds logical: it takes a certain amount of time from purchasing raw materials to selling the end product. But the reality is more complex. For one thing, both indices also include services, which account for a whopping 83% of economic output in the US. Second, price changes in energy, raw materials, and food usually have an impact at the same time, regardless of whether they are reflected in the CPI or PPI. Exchange rate effects and global supply shocks also have a synchronous impact.

A look at the charts confirms this: there has been no clear lag between the PPI and CPI over the last 80 years.

(Click on image to enlarge)

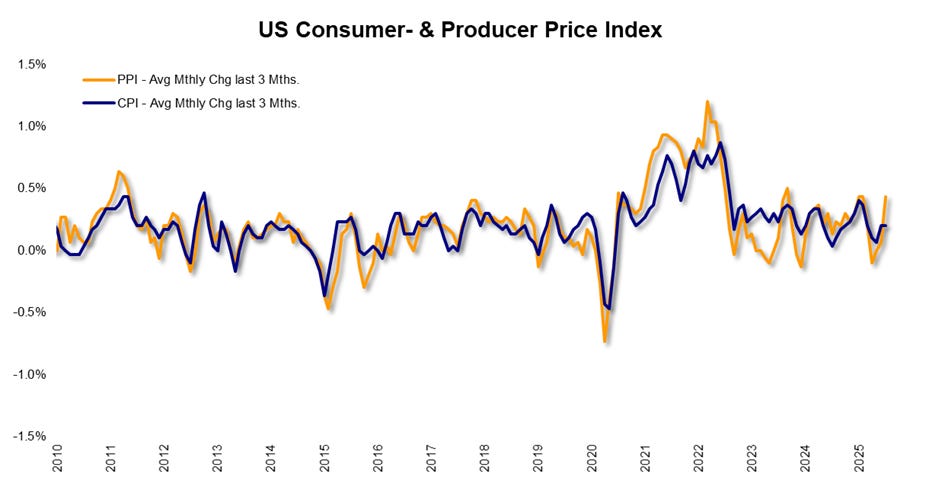

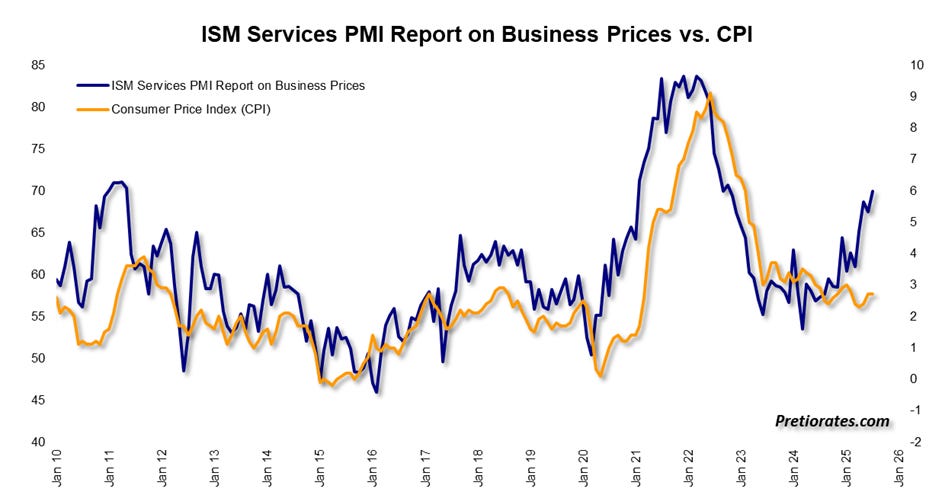

Even on closer inspection, with a shorter time span over the last 15 years, no lag can be detected. At most, the PPI shows slightly stronger swings, especially since the turbulent pandemic years. And the latest jump in the PPI does not yet look like an alarm signal in this chart.

(Click on image to enlarge)

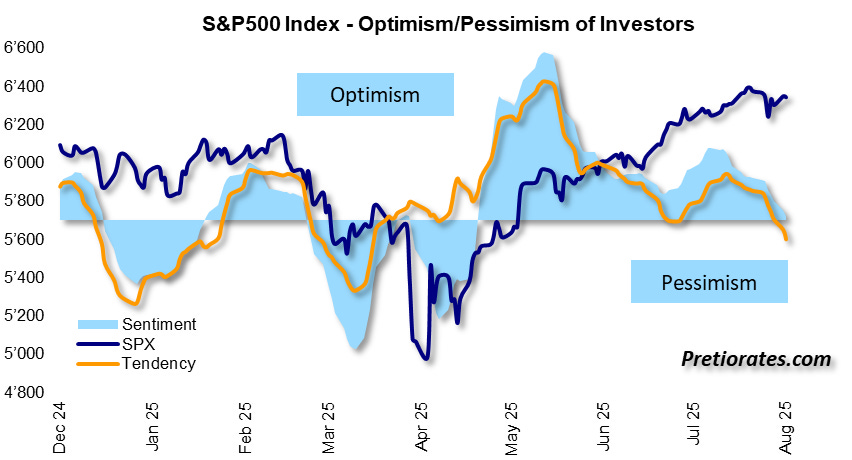

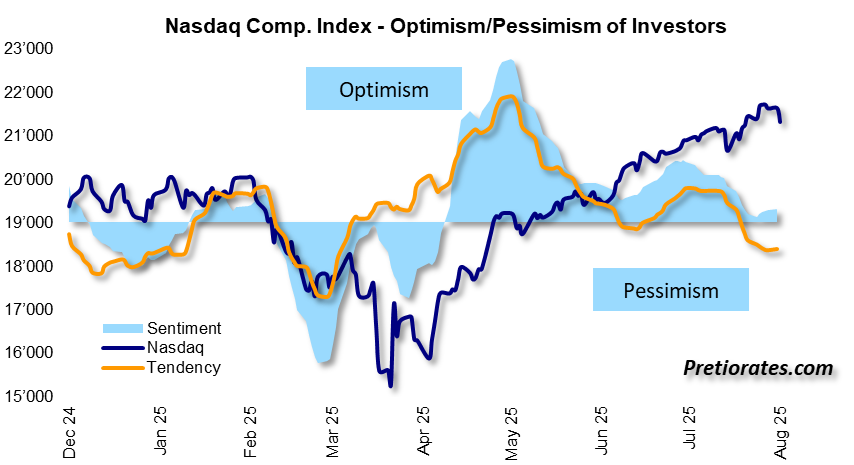

Wall Street therefore remained calm. Despite the fact that market sentiment has long since slipped back into pessimistic territory – meaning that bad news weighs heavily and good news is hardly rewarded.

(Click on image to enlarge)

The fact that this sentiment is also reflected on the Nasdaq has been impossible to ignore recently.

(Click on image to enlarge)

It is interesting to note that the service sector in particular is gaining momentum – exactly the opposite of what one would expect at this stage of the economic cycle. Tariffs are not a factor here, but the ISM Services PMI report shows it in black and white: prices are rising. And because this sector is so important for the US, it correlates strongly with the CPI. A closer look reveals that the ISM report acts almost like a harbinger – and it does not bode well for inflation prospects.

(Click on image to enlarge)

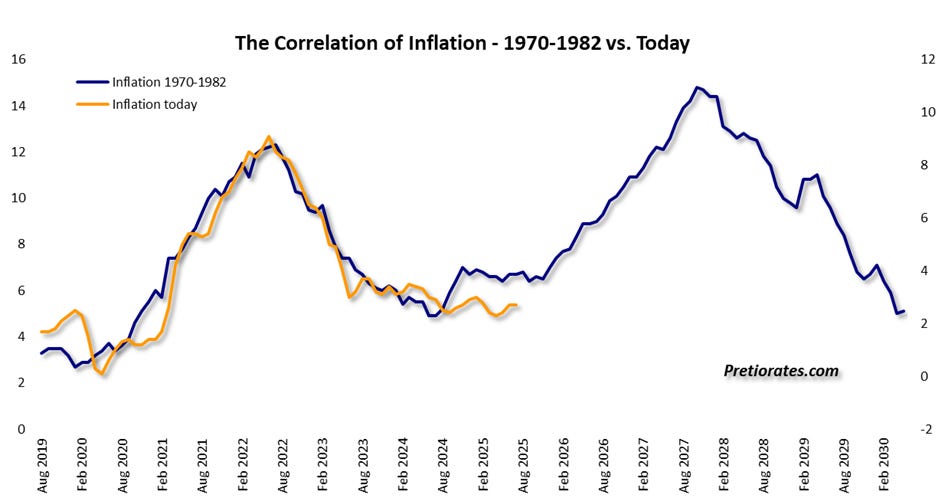

Many economists feel vindicated: a second wave of inflation could be on the horizon. The pattern of the 1970s is reminiscent. So can Powell really cut interest rates in this environment? It's possible, perhaps as early as September. But first, the inflation data for August will be released. If the CPI and/or PPI surprise on the upside again, the chances of an interest rate cut will naturally shrink dramatically.

(Click on image to enlarge)

It is no coincidence that Jackson Hole is receiving so much attention. Time and again, historic decisions have been made there: Ben Bernanke announced the path to QE2 in 2010. Mario Draghi broke with European austerity policy in 2014. Janet Yellen caused market turmoil with cautious hints of rising interest rates. And Powell himself surprised everyone in 2020 with “average inflation targeting” – a fundamental change of course for the Fed.

No wonder, then, that the markets are treading water these days. Too much can happen – and perhaps there will be a surprise this time too. Until then, the motto is: stay calm and wait and see. We will analyze the situation again next week.

More By This Author:

Gold, Stagflation And Tariffs – What IronyA Trillion Reasons To Be Cautious?

Jay, Stay Strong – Even When Thunder Rumbles Above

Disclaimer: The information & opinions published by Pretiorates.com or "Pretiorates Thoughts" are for information purposes only and do not constitute investment advice. They are solely ...

more