Decoding The Nonsense: Trying To Find Logic In Trump’s Puzzle

Image Source: Pixabay

After the central bank meeting in Jackson Hole, investors are not really any wiser. Yes, an interest rate cut in September is considered a virtual certainty – and the markets responded with loud applause. But no sooner had the applause died down than Donald Trump pushed his way back into the limelight. And, as so often, he is making headlines with surprises that, at first glance, make little sense to many.

Let's call these surprises puzzle pieces this time. In this edition of Pretiorates' Thoughts 95, we are therefore foregoing the usual charts and instead attempting to form an overall picture from these puzzle pieces. The result remains a hypothesis – Trump's actual plan could look very different. However, he has already put some of these pieces on the table.

We have compiled a list of some of the measures and statements with which President Trump has surprised the world since taking office. This list is neither chronological nor complete:

1. A weaker dollar: Trump is openly calling for devaluation. This is good for exports, but problematic for debt financing, as foreign investors may then show less appetite for US Treasuries.

2. Expansionist rhetoric: Whether in Canada, Panama, or Gaza, Trump's hints in this direction have caused frowns around the world.

3. Attack on the Fed's independence: Loud calls for interest rate cuts, the possible dismissal of Governor Lisa Cook, and Harvard professor Stephen Miran being brought into play as her successor.

4. Summit in Alaska: Meeting with Putin, followed by talks with European leaders. Nothing changed in the war situation in Ukraine. Was Ukraine even the main topic? In any case, there was no press conference.

5. Intel deal: With an investment package of just under $9 billion, the US government acquired a 10% stake in chip manufacturer Intel – essentially a drastic intervention in the free market economy.

6. Executive order on sovereign wealth funds: On February 3, 2025, Trump signed the green light for a US sovereign wealth fund.

7. Liberation Day: In April, he imposed high import tariffs on numerous countries – Trump shocked the world with high tariffs in April – and caused the US Treasury market to falter.

8. The Genius Act: On July 18, 2025, he standardized stablecoins – a move with major consequences for cryptos and US Treasuries.

9. The Big Beautiful Bill: Instead of curbing debt, Trump is sending the US into even higher spheres of debt with this law.

In addition to facts and financial history, we also looked at analyses from Zerohedge.com, InternationalMan.com, and numerous other analysts and expert opinions. This results in a scenario: the pieces of the puzzle could actually be part of a larger strategy – a realignment of the global financial and trading system. A «reset» that the markets have not yet seriously priced in. If this maneuver succeeds, the US could achieve the impossible: genuine restructuring.

The approach copies earlier agreements and is therefore not new. Do we remember President Nixon when he abolished the gold standard for the US dollar in August 1971? We remember this as the «Bretton Woods Agreement». What hardly anyone remembers, however, is that on the same day, he imposed a 10% import duty on all imported goods. In doing so, he forced other countries to support the new monetary agreement known as the «Smithsonian Agreement». However, this failed within a few years.

The strategy was repeated in the 1980s. This time, Japan was the «China of today». It was the «Plaza Accord». The US dollar was devalued again at that time. In order for this to be realized, President Reagan needed the support of the world's most important finance ministers, who met at the Plaza Hotel in New York in September 1985. In order for the Plaza Accord to actually be implemented, it also required the approval of then-Fed Chairman Paul Volcker, who worked closely with Treasury Secretary James Baker. It was a great success for the US: exports recovered, the trade deficit stabilized, and the stock market boomed—until a new policy relativized what had been achieved.

Today, the script is called the «Mar-a-Lago Concept» – with Stephen Miran, Harvard professor and Trump's nominee for the Fed, as co-architect. The key points:

· a weaker US dollar,

· the repatriation and revaluation of gold,

· a US sovereign wealth fund modeled on the Norwegian, Saudi, or Chinese models,

· US corporations should reinvest profits domestically, bring back supply chains, and create jobs.

For this to succeed, Trump needs the Fed on his side. There is friction with Powell, and Governor Lisa Cook could leave. Instead, Stephen Miran will be appointed to the Federal Open Market Committee (FOMC). And he could possibly succeed Powell in 2026. With him, Trump would have the monetary policy backing to interlink interest rates, balance sheet policy, and liquidity with his reset strategy.

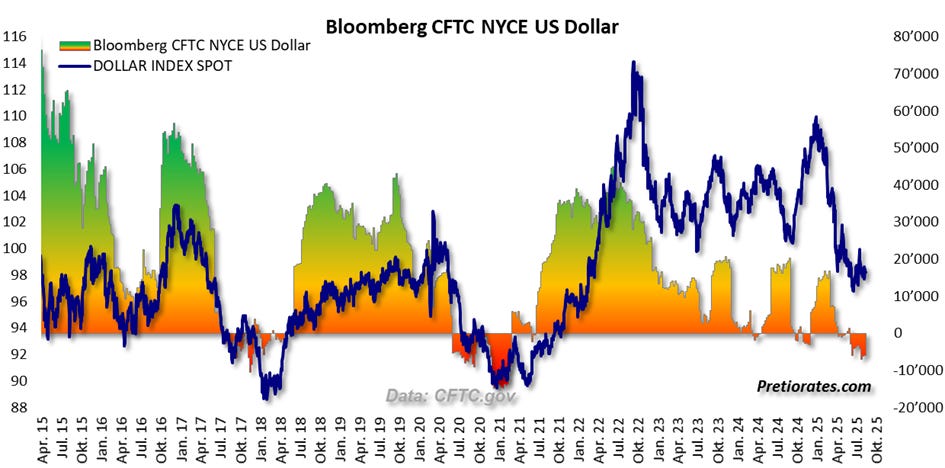

President Trump insists that the US as a manufacturing location must become stronger again. Hence the import tariffs and «only» the focus on the trade deficit. The weaker US dollar, which is helping in this regard, is already a reality. And the latest COT data from the futures exchange shows that non-commercials, i.e., large investors, are again speculating on a weaker US dollar with their short positions.

After Bretton Woods, gold exploded, and after the Plaza Accord, it rose by 15% in just six months. Interestingly, the US has been one of the largest gold importers again for months. Perhaps not only because of fears of import tariffs...

We know that Donald Trump already spoke of a sovereign wealth fund during his presidential campaign last year. In fact, one of his first actions as US President-elect on February 3 was to sign an executive order with the aim of establishing a US sovereign wealth fund.

This sovereign wealth fund is the linchpin. Intel was just the beginning. There is talk of investments in US Steel, Lockheed Martin, rare earth mines, and strategic raw materials companies. At Nvidia, the figure of 15% of export revenues going directly to the state is circulating.

In the US itself, there are huge untapped assets: land, gold, copper, oil in the ANWR field in Alaska, minerals, and other raw materials. The approval process for their use often takes decades. We wrote about this in the issue Pretiorates' Thoughts 74. Everyone is aware of the dependence on China for rare earth metals and almost all other raw materials.

If the state itself were involved through the fund, things like approvals could move faster – and it would benefit directly. Scott Bessent, Trump's finance minister, announced plans to monetize the «asset side of the US balance sheet» for the people over the next twelve months. Commerce Secretary Howard Lutnik spoke of a treasure trove worth around USD 500 trillion. Even a return of a quarter of a percent would generate USD 1.25 trillion per year. One question remains: would this sovereign wealth fund also be allowed to provide financing for investments abroad, e.g., in Canada, Greenland, or Panama?

Additional help comes from the Genius Act of July 18, 2025. Stablecoins may only be backed directly or indirectly via money market securities by US Treasuries. The stablecoin market is likely to continue to grow very strongly, creating huge new demand for government bonds. It is less susceptible to fluctuations than typical cryptos and is therefore also interesting for international payments. At the same time, users can bypass the SWIFT system – a silent counterattack against the de-dollarization that Biden had accelerated with his sanctions.

A clever move: While CBDCs are still being discussed in Europe and other regions, Trump is providing a private-sector alternative – with tailwinds for the US Treasury market. The buyers or sellers are known to the government, but it is not possible to control individual transactions. A key argument against CBDC. Trump is thus keeping his promise not to introduce a CBDC. While Europe and the ECB are tinkering with digital central bank currencies, their acceptance is likely to decline.

These are still hypotheses. But if the pieces fit together, we are seeing an attempt to initiate the biggest currency reset in 50 years. With a weak currency, gold at its core, a sovereign wealth fund, and a reorientation of industrial policy, the US could not only alleviate its debt burden but also reinvent itself. The only thing that is certain is that the price of gold is likely to continue to shine. And if nothing happens, the US Treasury market is likely to collapse under its own weight sooner or later. The result would probably be the much-vaunted hyperinflation, and a country without its own manufacturing sector would find it difficult to rebuild.

And so our conclusion remains: these are thoughts, not certainties. Perhaps every reader is of the opinion that this is nothing new, that it is all already known. But it is important to understand the context. The overall picture and its effects have not yet been priced into the markets. If the hypothesis becomes reality, some assets are likely to be repriced.

More By This Author:

Jackson Hole, Market Hold Their Breath

Gold, Stagflation And Tariffs – What Irony

A Trillion Reasons To Be Cautious?

Disclaimer: The information & opinions published by Pretiorates.com or "Pretiorates Thoughts" are for information purposes only and do not constitute investment advice. They are solely ...

more