Gold, Stagflation And Tariffs – What Irony

Image Source: Pixabay

The consumer price index (CPI) came in as expected. Only the core CPI, which excludes volatile components such as food and energy, rose to 3.1 percent in July compared to the previous year. In June, it stood at 2.9 percent, while expectations were at 3.0 percent. This is a clear sign that the US Federal Reserve is still far from its inflation target of 2 percent.

Last week's labor market data made it clear that growth is stagnating. And what happens when inflation remains high while growth slows? Stagflation. A nightmare for the economy. The stock market has not (yet?) reacted to this threatening development, but continues to float on the drug called “hopium”. Even precious metals do not seem to be taking the growing danger seriously – which is surprising. After all, stagflation would actually be the best-case scenario for gold and other precious metals!

There is currently much speculation on social media about the narrowing triangle in the gold chart. In fact, the price could fall to the lower side, which would turn the consolidation into a slight correction. Fear of this could cause investors to wait and see which side the gold price ultimately breaks out on.

(Click on image to enlarge)

Source: Bloomberg.com

So another trigger is needed – an event that could cause the breakout in one direction or the other. Market sentiment will then determine how strong the breakout will be. Positive input will be met with loud applause, while negative input could be better absorbed. And, of course, the opposite is also true.

As always, the gold market is divided. Different rules apply in Shanghai and the Western hemisphere. In Shanghai, the current mood in the gold market is rather “slightly positive,”…

(Click on image to enlarge)

…while in the West it is described as “extremely positive.” This means that negative input should still be easily digested, while positive momentum would likely lead to a stronger breakout.

(Click on image to enlarge)

The situation also looks constructive in the silver market. Rising prices first require positive sentiment so that buyers have confidence in a potential increase in value. And it is precisely this sentiment that has recently resurfaced.

(Click on image to enlarge)

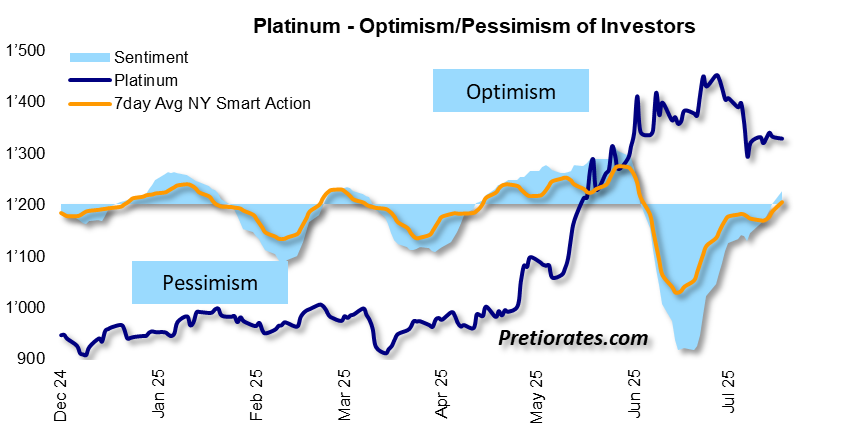

Since mid-June, sentiment in the platinum market has been strongly negative, but has now worked its way back into positive territory. This is also a bullish indication.

(Click on image to enlarge)

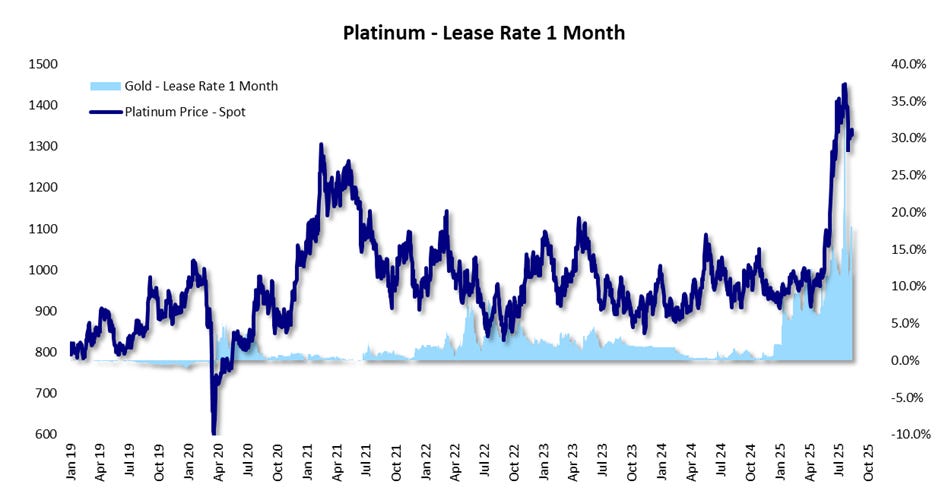

Another exciting aspect is the leasing rates, i.e. the costs for the temporary loan of physical precious metals. These reflect bottlenecks in physical trading. However, as long as the paper market dominates, they have only a relatively minor impact on price formation. The leasing rate for gold is currently close to zero, while that for silver has fallen back to 1.9% and that for palladium has risen slightly to 3%. However, the development of platinum is particularly exciting: after rising to an incredible 36% in mid-June, the leasing rate has since calmed down, but recently rose again to 18.1%.

(Click on image to enlarge)

It is also interesting to note that the large short positions in the futures market, which have dominated the market for years, have been almost completely unwound. Market participants seem to be gradually coming to the conclusion that the correction in the palladium market, which has been ongoing since 2022, could soon come to an end.

(Click on image to enlarge)

Precious metals investors can now only speculate as to what the next trigger for a major market movement might be. Should the gold price fall below the important support level, a new buying opportunity could arise. In the long term, however, gold remains a favorite, mainly due to the growing threat of stagflation and ongoing gold purchases by central banks. Even President Trump recently confirmed this development indirectly: while he imposed unjustified import tariffs of 39% on Switzerland, gold imports, especially bars of 1kg and 100 ounces for the COMEX, are exempt from this regulation.

(Click on image to enlarge)

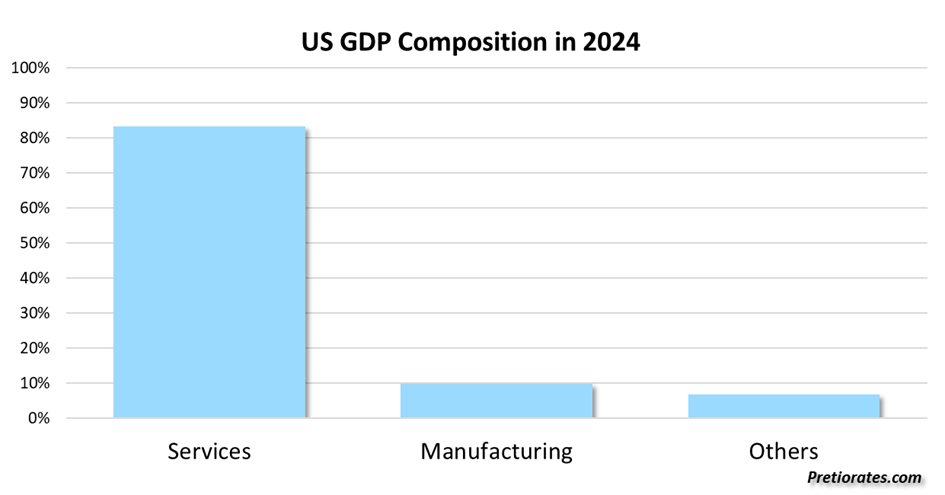

These tariffs are actually unjustified, as the US has a significant current account deficit with Switzerland when you take into account the services exported from the US to Switzerland, which has 50 times fewer inhabitants. It is also interesting to note that services account for around 83% of US GDP, while manufacturing, which is responsible for the trade balance and is used as a benchmark by US President Trump, accounts for only around 10%.

(Click on image to enlarge)

Switzerland exported a lot of physical gold to the US, which ultimately accounted for a large part of the trade deficit. And it is again ironic that the country is subject to high US import tariffs because it supplies the US with physical gold. Trump may be a friend or foe to many, but he is not doing himself any favors with this naive calculation – unless he looks beyond the horizon of his presidency. Because if the US Treasury market really does run into serious trouble, which virtually all market participants agree it will, then the (still) small share of manufacturing in GDP will definitely become more important.

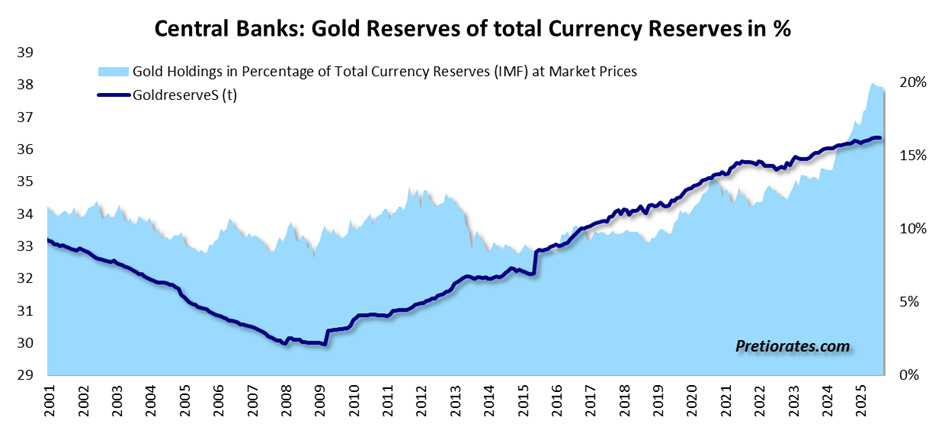

One crucial point that every gold investor should celebrate, however, is that the percentage of gold in central bank total curency reserves has doubled to around 20% over the past six years. And there is hardly any reason why this trend should stop, but many reasons why it will continue. Just in May, the European Central Bank warned of the sharp rise in gold prices. And on August 1, 2025, the FED published an article on the subject of revaluations of gold reserves. It's ironic, again, that this happened on the same day Switzerland was hit with tariffs, plunging the gold futures market in the US into chaos. And that it also happened on Switzerland's national holiday is probably a coincidence…

(Click on image to enlarge)

More By This Author:

A Trillion Reasons To Be Cautious?

Jay, Stay Strong – Even When Thunder Rumbles Above

From Liberation To Levitation – But Gravity Is Patient

Disclaimer: The information & opinions published by Pretiorates.com or "Pretiorates Thoughts" are for information purposes only and do not constitute investment advice. They are solely ...

more